Economy

Asking prices for homes increased 9% in the third quarter, but the rate is falling

Wanted home prices in the third quarter rose 9% nationwide compared to the same period last year.

This is according to two separate reports from real estate websites Myhome.ie and Daft.ie and compares to a rate of 13% in the second quarter of the year, indicating a moderate rate of increase.

“The latest signals from the sales market are that the worst of the Covid-19 pressure is over,” said Ronan Lyons, economist at Trinity College Dublin and author of the Daft.ie analysis.

The MyHome.ie report had the highest claim rates in Dublin at 7.3% in the July-September period compared to the same three months in 2020.

However, Daft.ie analysis places the price growth rate in the capital at 4.9%.

MyHome.ie calculated that the inflation rate outside Dublin was around 10.1% during this period.

That’s compared to Daft.ie’s estimate, which puts the increase for the quarter outside major cities at 12.9% year over year.

Despite the differences in the findings of the two reports, both agree that the rate of residential property price inflation continues to be driven by a chronic shortage of supply and rising demand.

« The market remains supply-deprived, with homebuyers aggressively raising prices, » said Kunal McCwell, chief economist at Davey and author of the MyHome.ie report.

“This behavior is evident in transactions that settle well above asking prices. For a limited group of 450 properties sold during the summer, we calculated that the transaction price was 6.5% above the asking price, compared to a premium of 2.7% in Q2 2021. «

The MyHome.ie report said there are currently 13,500 properties for sale on its site, up slightly from 12,700 in the second quarter but still well below the 20,000 pre-pandemic.

Daft.ie found that on September 1, the total number of properties available for purchase was just under 12,700, a slight increase from levels recorded earlier in the year, but still one of the lowest numbers recorded since the advent of advertising properties for sale online.

It said the total nationwide availability of homes for sale on that date was a third lower than the same date a year ago and just over half the amount for sale in September 2019.

“Inflation has eased a bit, and there has been a modest improvement in the number of homes available for purchase at any one time,” Lyons said.

“However, while the Covid-induced surge in market conditions may pass, the underlying issues remain.”

“Inventory for sale remains well below pre-Covid-19 levels, while many parts of the country are still seeing prices at least 10% higher than they were a year ago.”

« Additional supply remains the key to resolving Ireland’s chronic housing shortage, and with the pandemic under control, housing remains a critical problem – both economically and politically – that policymakers must address. »

According to Daft.ie, the median listing price for a home nationally between July and September was €287,704, 22% less than the Celtic Tiger.

In Dublin, the average asking price in the third quarter was 399,323 euros, up 4.9% from the same period last year – the slowest rate of inflation in a year.

This compares to €230,585 in Limerick, but there is an inflation of 8.4%.

In Cork City, the average cost of a home was €307,464 during this period, an increase of 5.8%, while in Galway the rate of increase was 3.1%.

Daft.ie found that the fastest price hikes were in Mayo and Leitrim.

MyHome.ie found that the average asking price for new sales nationally is now €308,000, while in Dublin it is €414,000 and elsewhere across the country at €260,000.

In light of the latest data, McQuayle said, Davey raised his forecast for real estate price inflation at the end of this year to 10% from 8%.

The drop in the supply of new homes on the market was astonishing if not surprising, said the Institute of Professional Auctions and Appraisers (IPAV).

“Given supply constraints and very strong demand, it is likely that prices achieved for homes in many areas have in fact exceeded asking prices, the latter being captured by the Daft.ie report,” said Pat Daft, CEO of IPAV.

« Our study of actual prices achieved by auctioneers in the first six months of 2021 over the last six months of 2020 finds an acceleration in house price increases especially in the country. »

However, he said, agents across the country are now reporting more used properties coming to the market.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Le prochain événement de « réduction de moitié » du Bitcoin aura lieu Actualités scientifiques et technologiques

Les réductions de moitié précédentes ont généré d'importants gains en cours de route, mais les analystes préviennent que cela ne signifie pas automatiquement que la même chose se produira cette fois-ci.

par Dan Cairns, journaliste

Samedi 20 avril 2024 à 03h45, heure du Royaume-Uni

Un événement rare de réduction de moitié du Bitcoin s’est produit, selon la société d’analyse de crypto-monnaie CoinGecko.

Cela réduit le nombre de nouveaux Bitcoin Entrer sur le marché en réduisant de 50 % les récompenses reçues par les mineurs de Bitcoin.

La conférence a lieu environ tous les quatre ans et vise à limiter l'offre à 21 millions d'ici 2140.

Cela signifie que seuls 450 Bitcoins seront désormais créés chaque jour.

Des réductions de moitié ont également eu lieu en 2012, 2016 et 2020 – le mécanisme a été écrit dans le code de Bitcoin lors de sa création initiale.

Le prix de la crypto-monnaie est resté stable à 63 747 $ (51 531 £) après la réduction de moitié, les analystes affirmant que l'événement attendu avait déjà été intégré dans le prix.

Les investisseurs espèrent qu’une forte augmentation n’est pas si loin, après que la précédente réduction de moitié ait finalement conduit à des gains importants.

Le prix lors de la réduction de moitié en mai 2020 était d'environ 8 600 dollars, mais un an plus tard, il est passé à plus de 56 000 dollars.

Andrew O'Neill, expert en crypto-monnaie chez S&P Global, s'est dit « quelque peu sceptique quant aux leçons qui peuvent être tirées en termes de prévision des prix des réductions de moitié précédentes ».

« Ce n'est qu'un facteur parmi tant d'autres qui peuvent influencer les prix », a déclaré O'Neill.

Bitcoin Il a atteint un nouveau sommet de 73 803 $ (59 661 £) en mars. Après une hausse de 175 % au cours des 12 derniers mois.

Sa légitimité a également été renforcée en janvier lorsque les ETF contenant du Bitcoin ont été autorisés à être négociés sur une bourse américaine.

En savoir plus:

Pourquoi Bitcoin a-t-il subi une forte baisse par rapport à des niveaux records ?

C’est l’informaticien, et non le mystérieux inventeur du Bitcoin, qui fait la loi

Le secteur financier traditionnel considère traditionnellement le Bitcoin comme étant extrêmement risqué et vulnérable aux fluctuations de prix importantes et imprévisibles.

Le gouverneur de la Banque d’Angleterre, Andrew Bailey, a mis en garde à ce sujet en 2021 Monnaies numériques Il n’a aucune « valeur intrinsèque » et les investisseurs doivent être « prêts à perdre tout leur argent ».

Il a également déclaré aux députés en janvier que les crypto-monnaies sont « largement inefficaces » et « ne décollent toujours pas en tant que service financier essentiel ».

Plus de 19,5 millions de Bitcoins ont été extraits jusqu’à présent, ce qui n’en laisse que 1,5 million exploitables au cours des 116 prochaines années.

La réduction de moitié se produit tous les 210 000 « blocs », ce qui se produit généralement tous les quatre ans environ.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Propriété de Mount Juliet en vente pour 45 millions d'euros en tant qu'hôtel et complexe de golf – The Irish Times

:quality(70):focal(683x341:693x351)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/OQLZ3WLOR46YUKFNSBHLSDHAXA.jpg)

Tetrarch Capital est sur le point de réaliser un retour sur investissement significatif dans la propriété Mount Juliet à Kilkenny. Après avoir déboursé 15 millions d'euros pour s'assurer la propriété de l'hôtel cinq étoiles et du golf resort en 2014, la société et l'homme d'affaires Emmett O'Neill, copropriétaire de Mount Juliet, l'ont mis en vente au prix indicatif de 45 millions d'euros. .

Dans une lettre envoyée vendredi soir aux membres de Mount Juliet, le directeur de Mount Juliet, Damien Gaffney, a déclaré que les consultants en immobilier commercial JLL Ireland avaient été nommés pour « explorer le marché et gérer la vente ».

Commentant la gestion par Tetrarch de l'hôtel de 125 chambres, du restaurant étoilé Michelin Lady Helen, du parcours Jack Nicklaus Signature Design et du domaine plus vaste de 500 acres, il a déclaré que la société avait « investi très financièrement » dans le complexe et qu'elle était « très fière ». . Il a supervisé une transformation si majeure.

M. Gaffney a déclaré que les propriétaires actuels sont « ravis d’organiser deux Irish Open consécutifs en 2021 et 2022 sur notre parcours de golf emblématique Jack Nicklaus pour la première fois depuis le milieu des années 1990 – respectant la promesse que nous avons faite aux membres lors de notre acquisition. le domaine à l’été 2014. »

M. Gaffney a conclu la lettre en disant que même si le processus de vente commencerait immédiatement, « toutes les activités et opérations liées au golf se poursuivront comme d'habitude et les emplois de tous nos employés resteront sûrs et inchangés ».

Le moment de la vente pourrait être opportun car elle intervient dans la mesure où les revenus de la station ont presque doublé pour atteindre 17,6 millions d'euros en 2022, dernière année pour laquelle des comptes consolidés ont été déposés. L'opérateur de la propriété, MJBE Investments 1 Ltd, a renoué avec les bénéfices d'exploitation issus de ces revenus pour enregistrer un bénéfice d'exploitation de 699 520 €, l'organisation de l'Irish Open jouant un rôle important pour attirer des affaires.

Ce bénéfice d'exploitation fait suite à une modeste perte d'exploitation de 10 302 € en 2021, lorsque le site avait également accueilli l'Irish Open 2021.

[ Mount Juliet narrows pretax losses amid Covid closures ]

Les comptes montrent que l'encours des prêts bancaires à fin 2022 s'élevait au total à 13,65 millions d'euros, alors qu'il restait un encours supplémentaire de 24,2 millions d'euros au titre d'un prêt d'actionnaire.

En plus de souligner le retour à la rentabilité et l'organisation de l'Irish Open, les propriétaires de Mount Juliet pourraient également espérer capitaliser sur la publicité positive entourant la récente décision de la BCE d'accueillir une réunion de son conseil d'administration composé de 26 membres. Conseil là-bas en mai.

Contactée pour commentaires, une porte-parole des propriétaires de Mount Juliet a confirmé qu'ils avaient chargé JLL d'envisager de vendre la propriété pour un prix indicatif de 45 millions d'euros. La porte-parole a déclaré que la décision avait été prise après « un certain nombre de communications indésirables récentes » concernant la propriété.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Un homme qui n'a pas droit à un allègement fiscal pour la location d'une maison qu'il a quittée à cause de harcèlement raciste – The Irish Times

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/OAM557WQURAFZEKSBP6MYXLHWI.jpg)

La Cour suprême a statué contre un Pakistanais qui tentait de faire valoir son droit à un allègement fiscal pour la location de la maison que lui et sa famille avaient quittée en raison d'allégations de harcèlement raciste de la part de certains résidents locaux.

Cependant, Adnan Ahmed Siddiqui a obtenu partiellement gain de cause devant le tribunal, le juge Oisin Quinn étant d'accord avec lui sur le fait que le commissaire aux appels fiscaux (TAC) avait commis une erreur dans la façon dont il avait considéré un paiement de 85 000 € de son ancien employeur.

Le juge a déclaré que le paiement avait été effectué alors que Siddiqui était en congé de stress et qu'il faisait partie d'un accord de règlement en mars 2014 visant à retirer sa plainte auprès du Tribunal pour l'égalité pour discrimination raciale présumée.

Le Tax Appeals Commissioner (TAC) a demandé au tribunal de déterminer s'il avait raison de confirmer la décision du Commissioner of Revenue sur trois questions juridiques en vertu de la Tax Consolidation Act 1997.

Dans sa décision, le juge a déclaré que Siddiqui, qui vit et travaille en Irlande depuis 2000, a affirmé qu'il devrait être autorisé à déduire le loyer qu'il a payé pour sa nouvelle résidence des revenus locatifs qu'il a reçus des locataires qui ont emménagé dans son ancien logement. Le juge a déclaré que ses allégations de « graves incidents de harcèlement » étaient étayées par des documents fournis à la police.

Dans un discours prononcé à Dublin 14, M. Siddiqi a déclaré que sa décision en 2014 était nécessaire en raison de l'incapacité présumée de la police à lutter contre le harcèlement. Le loyer de sa nouvelle maison était plus élevé que les revenus locatifs qu'il recevait de son ancienne maison et, comme il ne voulait pas déménager, il affirmait qu'il existait un lien entre les deux paiements, de sorte que son impôt à payer devrait être réduit à zéro entre 2014 et 2017, a indiqué le juge.

Le juge Quinn était convaincu que le TAC avait raison dans ses conclusions concernant les impôts sur les revenus locatifs.

Même s’il était « profondément insatisfaisant » que M. Siddiqui et sa famille aient été expulsés en raison de harcèlement raciste, cela ne change rien à la question juridique. « Le code des impôts n’a pas de justice », a déclaré le juge, et « le coût de l’installation d’un toit n’est pas une dépense déductible ».

Par ailleurs, le Revenu a déduit 21 872 € d'impôts sur le montant à titre gracieux de 84 903 €, que M. Siddiqui a reçu en plus de sa quittance statutaire. La juge a déclaré qu'elle avait traité l'affaire comme étant liée à la cessation de son emploi de comptable financier dans une société de location de voitures, car l'accord de règlement pertinent décrivait expressément cela comme une indemnité de départ.

M. Siddiqui, qui se représente lui-même, a déclaré qu'il s'agissait essentiellement d'un règlement de sa plainte en cours devant le Tribunal pour l'égalité et d'une éventuelle plainte pour préjudice à sa santé mentale résultant de la discrimination alléguée. Le juge a déclaré que les sommes versées pour régler ces réclamations ne seraient pas imposables.

Le ministère des Finances a confirmé que TAC avait raison de considérer que le paiement était imposable et a souligné l'accord de règlement qui stipulait que M. Siddiqui devait recevoir une somme nette de 65 000 €, ce qu'il a fait. Elle a déclaré que l'accord lui-même proposait ce type de traitement fiscal et que Siddiqui avait conclu cet accord en bénéficiant des conseils juridiques d'avocats experts en droit du travail.

Le juge Quinn n'était pas d'accord, estimant que le ministère des Finances était tenu de procéder à une analyse objective de la « matrice de vérité » entourant le paiement. Il a déclaré que la correspondance de 2018 et 2019 aurait dû être considérée comme pertinente car elle indiquait le contexte du règlement.

Il a souligné que le règlement aboutissait au retrait de la demande d’égalité et prévoyait le paiement de 10 000 euros plus taxe sur la valeur ajoutée pour les frais juridiques de M. Siddiqui. Le juge a estimé qu'une fois versée l'indemnité légale de licenciement, on aurait dû se poser une « vraie question » de savoir pourquoi 85 000 € supplémentaires avaient été accordés à un salarié avec un salaire annuel de 57 000 € qui n'avait travaillé dans l'entreprise que trois fois. années. .

Le juge a déclaré que le « contexte factuel global » associé aux dispositions statutaires de l’article 192A de la loi de 1997 exigeait que l’affirmation de M. Siddiqi selon laquelle le montant avait été payé en règlement d’une réclamation soit examinée plus en détail.

Il a soutenu que le TAC avait eu tort dans son interprétation de l'entente de règlement et dans sa conclusion que le montant n'était pas celui offert pour régler la réclamation.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

-

entertainment2 ans ago

Découvrez les tendances homme de l’été 2022

-

Top News2 ans ago

Festival international du film de Melbourne 2022

-

Tech1 an ago

Voici comment Microsoft espère injecter ChatGPT dans toutes vos applications et bots via Azure • The Register

-

science2 ans ago

Les météorites qui composent la Terre se sont peut-être formées dans le système solaire externe

-

science3 ans ago

Écoutez le « son » d’un vaisseau spatial survolant Vénus

-

Tech2 ans ago

F-Zero X arrive sur Nintendo Switch Online avec le multijoueur en ligne • Eurogamer.net

-

entertainment1 an ago

Seven révèle son premier aperçu du 1% Club

-

entertainment1 an ago

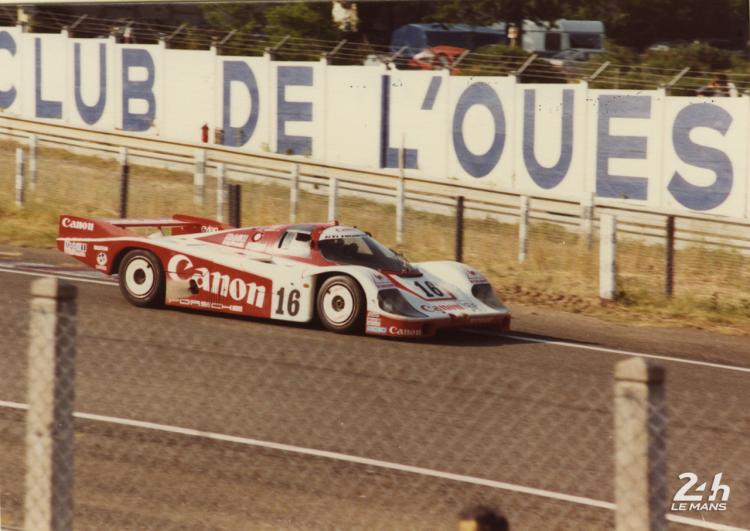

Centenaire des 24 Heures – La musique live fournit une bande-son pour la course