Economy

Consumer expert warns that KBC customers with a €2,000 a year mortgage are worse off with the Bank of Ireland

typical KBC A Bank of Ireland mortgage borrower will be left worse off at more than €2,000 a year if his loan is sold Bank of Ireland And they go for a new interest rate fix After that, a consumer advocate told competition regulators as they checked the sale.

The sale of KBC’s Irish mortgages is currently being evaluated by the Competition and Consumer Commission (CCPC), which has sought to make representations about the implications of the deal.

« KBC’s exit from the Irish mortgage market will seriously reduce competition and lead to higher mortgage rates, » said Brendan Burgess, founder of consumer finance website Askaboutmoney, in his report.

If the deal goes ahead, Burgess said, it should be on the condition that the international investment bank operates KBC’s assets in full swing or the bank commits not to offer cash back mortgages and offer the same lending rates to existing and new clients.

Otherwise, KBC’s existing clients will be paying much higher rates on their mortgages, he said.

The sale won’t cause immediate changes in customers’ mortgage rates, but he said they will face higher interest in the future, including when their current two-, three- and five-year mortgage periods expire.

He cited the example of a typical KBC client who has a loan of less than 80% for his 300,000-euro mortgage whose fixed rate is set to expire today. They can fix again for three years at 2.3 pieces with KBC.

But he said they face an additional interest payment of 0.7 percent if their loan is with the investment bank, adding €2,100 extra interest each year.

Customers will have the option of switching to another provider, if they qualify for the new mortgage approval, but this is more complex and will also require legal work to secure the home loan for the new lender.

The planned acquisition by the Bank of Ireland of KBC Bank Ireland’s €9 billion assets is under scrutiny by the competition watchdog.

The so-called ‘Phase Two’ achievement of the CCPC, which could take more than four months to complete, is an unexpected hurdle in consolidating the Irish banking system as foreign-owned KBC and Ulster Bank exit the market.

If you leave KBC, Burgess said, it is better to have the mortgage book taken over by an active lender (such as BoI) rather than a trust.

KBC is being sold at the same time as Ulster exits the market and will leave only three retail banks in Ireland, an unusual level of concentration in most sectors of the economy and double that given the state’s bank equity stakes.

While non-bank lenders like Avant, Dilosk and Finance Ireland offer some competition in mortgages, their overall market share is less than 10%.

Belgian-owned bank KBC Ireland announced in April that it intends to leave the Irish market and is entering into a Memorandum of Understanding to sell its influential consumer banking business to Bank of Ireland.

AIB has entered into a deal to acquire Ulster Bank’s €4.2 billion business and corporate loan book, while TSB is negotiating terms for more than €7.6 billion in Ulster Bank’s mortgage, SME loan and asset financing business. NatWest can take a stake in PTSB as part of the arrangement.

These deals will also require CCPC approval.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Éteindre une seule chose dans votre voiture peut « doubler la durée de vie » de votre moteur, explique le mécanicien

Un expert en conduite automobile possédant des décennies d'expérience a révélé une astuce simple qui pourrait doubler la durée de vie du moteur de votre voiture.

Avec près de 50 ans d'expérience en tant que mécanicien, Scotty Kilmer a appris une chose ou deux sur le fonctionnement des voitures et est impatient de transmettre sa sagesse. Ce technicien automobile chevronné partage un trait commun qui peut nuire aux performances d'un véhicule.

Dans une vidéo sur sa populaire chaîne YouTube, Kilmer a conseillé aux conducteurs de désactiver le démarrage/arrêt automatique de leur voiture, ce qu'utilisent de nombreuses voitures modernes.

Lire la suite : Les automobilistes irlandais paient toujours plus pour le carburant que l’été dernier, malgré quatre mois de baisse des prix

Bien que ces fonctionnalités aient gagné en popularité ces dernières années en raison de leur capacité à réduire les émissions tout en augmentant l'économie de carburant, Kilmer n'en est pas si sûr, expliquant que la technologie pourrait simplement entraîner une usure plus rapide du moteur.

Il a déclaré: « [Turning it off] C'est une chose intelligente à faire. La technologie marche/arrêt est la chose la plus stupide qui ait été introduite depuis des années. 97 % de l'usure se produit lorsque vous démarrez votre voiture, alors souhaitez-vous continuer à la démarrer et à l'éteindre ? Pas si vous voulez que votre voiture dure plus longtemps.

Heureusement, la fonction stop/start peut être facilement désactivée à l'aide d'un interrupteur à bascule que l'on trouve généralement sur le tableau de bord, souvent marqué de la lettre A entourée d'une flèche circulaire. Une petite lumière indique généralement lorsque le paramètre est désactivé.

Les conseils du mécanicien ont choqué les utilisateurs des réseaux sociaux, car de nombreux propriétaires de voitures ont afflué vers les commentaires pour le remercier de ses conseils.

L'un d'eux a commenté : « Je conduisais récemment une voiture de location dotée de cette fonctionnalité, et après avoir réalisé que la voiture ne s'arrêtait pas à chaque feu rouge, j'ai réalisé ce qui se passait. Je pensais que c'était… pire pour le moteur que de simplement tourner au ralenti. »

Un autre a déclaré : « J’ai déjà testé une voiture avec cette fonction et j’ai trouvé cela ennuyeux. »

Rejoignez le service d'actualités de l'Irish Mirror sur WhatsApp. Cliquez sur ce lien Recevez les dernières nouvelles et les derniers titres directement sur votre téléphone. Nous proposons également aux membres de notre communauté des offres spéciales, des promotions et des publicités de notre part et de celles de nos partenaires. Si vous n'aimez pas notre communauté, vous pouvez la consulter à tout moment. Si vous êtes curieux, vous pouvez lire notre site internet Avis de confidentialité.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Excédent budgétaire prévu de 8,6 milliards d’euros malgré une « perte de dynamique économique » – Irish Times

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/FAS6WGTVVNEWNLBVB36VW5U5VA.JPG)

Le gouvernement espère réaliser un excédent budgétaire de 8,6 milliards d'euros cette année et des excédents cumulés de 38 milliards d'euros au cours des quatre prochaines années grâce à des recettes inattendues de l'impôt sur les sociétés.

Les dernières prévisions contenues dans la mise à jour du programme de stabilisation du gouvernement, soumise annuellement à la Commission européenne, s'accompagnent d'un avertissement concernant une perte de dynamique économique au cours des derniers mois, alors que l'inflation et les taux d'intérêt continuent de peser sur les dépenses de consommation et les investissements.

L'excédent budgétaire attendu de 8,6 milliards d'euros équivaut à 2,8 pour cent du revenu national et fait suite à un excédent de 8,3 milliards d'euros l'année dernière.

Le ministre des Finances, Michael McGrath, a déclaré qu'une grande partie de la générosité du budget était due aux recettes fiscales potentiellement volatiles des entreprises du secteur multinational. Il a souligné qu'en supprimant ces recettes, on enregistrerait un déficit de 2,7 milliards d'euros cette année et de 1,8 milliard d'euros l'année prochaine.

Les recettes annuelles de l’impôt sur les sociétés sont passées de 4 milliards d’euros à 24 milliards d’euros en une décennie. Cependant, McGrath a averti que l’ère de la surperformance en matière d’impôt sur les sociétés « touche désormais à sa fin ».

« On ne peut pas compter sur ces recettes : nous avons constaté un ralentissement significatif de l’impôt sur les sociétés au cours de l’année écoulée, mettant en évidence la volatilité de cette source de revenus », a-t-il déclaré.

La solide position fiscale du gouvernement, qui reflète également la croissance annuelle des recettes de l'impôt sur le revenu et de la TVA, verra 6 milliards d'euros de ressources budgétaires transférées vers un nouveau fonds de richesse et un plus petit fonds pour les infrastructures et le climat, créé pour servir de réserves tampons. Contre les contractions futures.

Les nouvelles projections permettront également de nouvelles dépenses et mesures fiscales agressives dans le budget 2025, le dernier avant les élections. Cependant, le ministre McGrath et le ministre des Dépenses publiques Paschal Donohoe ont refusé de dire si le budget respecterait la règle de dépenses de 5 pour cent que le gouvernement s'est imposée, qui vise à limiter les augmentations annuelles des dépenses à un plafond de 5 pour cent.

Le gouvernement a violé cette règle dans chacun de ses deux derniers budgets. M. Donohoe a souligné que que les dépenses augmentent l'année prochaine de 5, 5,5 ou 6 pour cent, « cette décision concerne des centaines de millions » alors que le gouvernement économisait 6 milliards d'euros « pour assurer un avenir meilleur à ce pays ».

« Pour évaluer la prudence et le soin apportés à la stratégie budgétaire, 6 milliards d'euros par an constituent un élément crucial », a-t-il déclaré.

Le document du gouvernement SPU prévoit que l'économie nationale connaîtra une croissance modeste de 1,9% cette année, en baisse par rapport aux prévisions précédentes de 2,2%, et de 2,4% en 2025.

Le rapport prévient que l'économie irlandaise a été confrontée à plusieurs vents contraires ces dernières années, avec une perte de dynamique évidente dans les données des derniers trimestres.

Un troisième terminal à l’aéroport de Dublin : nécessité urgente ou tarte en l’air ?

« Cela est dû en grande partie à deux facteurs contraires, à savoir les récents taux d'inflation élevés, qui ont affecté les salaires réels et les dépenses de consommation, et le resserrement monétaire, qui a fait grimper le coût du capital », a-t-il ajouté.

Cependant, le ministre des Finances Michael McGrath a insisté sur le fait que l'économie restait dans une « forme raisonnablement bonne », avec une baisse des prix de l'énergie et une baisse de l'inflation qui en découlerait susceptible de soutenir « une amélioration des salaires réels et du pouvoir d'achat des ménages ».

Il a noté que le taux d'inflation global de cette année devrait désormais être de 2,1 pour cent, inférieur aux prévisions du jour du budget de 2,9 pour cent.

[ €6bn has been removed from the budget day pot. Politically, this could get interesting ]

« Le point économique le plus brillant est sans aucun doute le marché du travail, qui est resté résilient tout au long de cette période de forte inflation et de taux d'intérêt élevés », a-t-il déclaré, notant qu'il y a désormais plus de 2,7 millions de personnes ayant un emploi.

Les prévisions macroéconomiques qui sous-tendent le SPU ont été approuvées par le Conseil des Finances le 2 avril, une obligation légale en vertu de la réglementation européenne.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Une femme a perdu 2,7 millions d'euros sur 3 millions d'euros pour un peu plus de 1 300 euros – The Irish Times

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/7FHEWBJYGBFKZAB3JBGKTDKSJ4.JPG)

Les dettes d'une femme d'environ 3 millions d'euros ont fait l'objet d'une annulation de 2,7 millions d'euros en échange d'un paiement de 1 316 euros aux créanciers et elle conservera son domicile familial selon les termes d'un accord d'insolvabilité personnelle (PIA) approuvé par la Haute Cour.

Un arrangement similaire a été approuvé séparément pour le mari de la femme qui avait des dettes de 2,66 millions d'euros, provenant pour la plupart des mêmes prêts, qui ont été annulées pour un paiement de 1 316 euros.

Les arrangements de verrouillage ont été approuvés par le juge Alexander Owens pour Thomas Johnson et son épouse Valerie, tous deux âgés de 60 ans et retraités, avec une adresse à Drumrey Road, Dunshoughlin, comté de Meath. Le tribunal a appris que Johnson travaillait à temps plein comme soignante de sa mère.

En ce qui concerne la demande déposée lundi par l'avocat Keith Farry pour le praticien de l'insolvabilité personnelle Nicholas O'Dwyer pour les deux candidats, le juge a été convaincu que les arrangements répondaient aux critères de consentement en vertu des lois sur l'insolvabilité personnelle.

Dans des documents judiciaires, les dettes totales de Johnson s'élevaient à 2 984 millions d'euros, dont environ 2,2 millions d'euros, sous forme de prêts personnels, étaient dus à Everyday Finance, qui faisait partie de plusieurs créanciers chirographaires qui ont voté contre le plan de mise en œuvre du projet proposé au Parlement. assemblée des créanciers. . Les dettes totales de Johnson, liées pour la plupart aux mêmes prêts, s'élevaient à 2 976 millions d'euros.

Le PIA proposé était soutenu par Mars Capital Ireland DAC, un créancier garanti qui doit environ 618 000 € sur une hypothèque garantie sur la maison du couple à Dunshoughlin. La valeur marchande actuelle de ce bien est de 275 mille euros, ce qui représente un déficit d'environ 343 mille euros.

Aux termes de l'accord de mise en œuvre du projet, Johnson paiera 1 316 euros aux créanciers en échange de l'annulation de 2,66 millions d'euros de dette.

Johnson a déclaré dans une déclaration sous serment qu’une somme totale de 200 000 euros devait être payée dans les six mois suivant l’approbation par le tribunal de l’organisme de mise en œuvre du projet. Elle a déclaré que cela serait payé grâce au produit de la vente de la maison de sa mère à Sutton, Dublin. Selon des documents judiciaires, sa mère emménagera dans la maison de sa fille.

Le solde de l'hypothèque résidentielle de Dunshaughlin, dans le cadre du PIA, sera réduit à 275 000 € et le taux d'intérêt sera réduit de 4,15 pour cent à un taux fixe de 3 pour cent. Les remboursements hypothécaires de 665 € seront payés pendant six mois de PIA et par la suite pour la durée hypothécaire prolongée de 11 ans. Le solde impayé de 343 109 € sera alors amorti.

La Mercedes Vito de Mme Johnson a été exclue du PIA parce qu'elle devait être sous la garde de sa mère. La Nissan de son mari a également été exclue de son PIA en raison de l'emplacement de leur domicile.

Le revenu net de Mme Johnson était estimé à 1 851 € par mois et celui de son mari à 1 243 €. Après déduction des frais fixés, des frais de subsistance raisonnables et des versements hypothécaires, une contribution mensuelle de 21,60 € et de 10,99 € est mise à la disposition de l'organisme de mise en œuvre du projet.

Dans un affidavit, M. O'Dwyer a déclaré que le PIA fait partie d'un accord imbriqué qui permet une distribution plus importante aux créanciers que ce ne serait le cas dans le cadre d'une procédure de faillite. On estimait que ces arrangements offraient des chances raisonnables d'être exécutés et offraient de meilleurs résultats pour les deux débiteurs que la faillite. Comme l'exige la loi, plus de la moitié d'une certaine catégorie de créanciers ont soutenu l'accord, a-t-il déclaré.

S'abonner à Alertes push Et recevez les meilleures nouvelles, analyses et commentaires directement sur votre téléphone

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

-

entertainment2 ans ago

Découvrez les tendances homme de l’été 2022

-

Top News2 ans ago

Festival international du film de Melbourne 2022

-

Tech1 an ago

Voici comment Microsoft espère injecter ChatGPT dans toutes vos applications et bots via Azure • The Register

-

science2 ans ago

Les météorites qui composent la Terre se sont peut-être formées dans le système solaire externe

-

science3 ans ago

Écoutez le « son » d’un vaisseau spatial survolant Vénus

-

Tech2 ans ago

F-Zero X arrive sur Nintendo Switch Online avec le multijoueur en ligne • Eurogamer.net

-

entertainment1 an ago

Seven révèle son premier aperçu du 1% Club

-

entertainment1 an ago

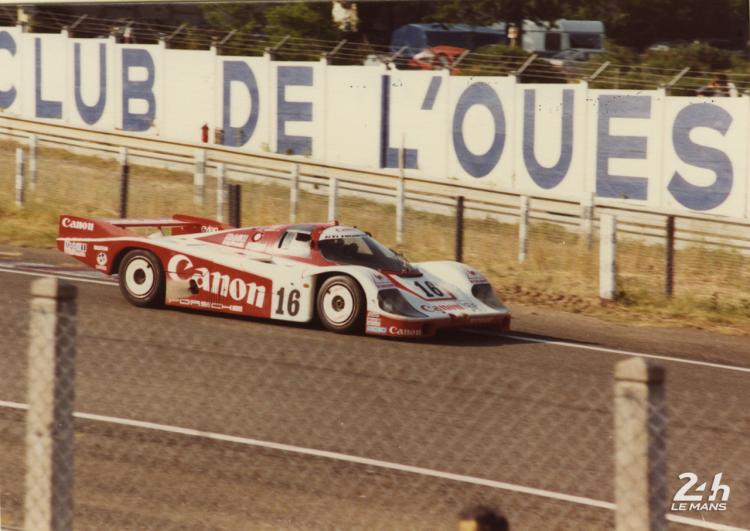

Centenaire des 24 Heures – La musique live fournit une bande-son pour la course