Economy

Evergrande warns of rising default risk

Cash-strapped China Evergrande Real Estate Group said it has hired advisors to examine its financial options and warned of the risks of default amid plunging property sales, sending stock and bond prices lower.

The real estate giant was scrambling to raise the money it needed to pay lenders and suppliers.

Regulators and financial markets worry that any crisis could spread to the Chinese banking system and potentially lead to wider social unrest.

In the latest development, Evergrande said two of its subsidiaries failed to meet guarantee obligations of 934 million yuan ($145 million) in wealth management products issued by third parties.

It said in a statement to the Hong Kong Stock Exchange that this could “lead to a cross default,” which “would have a material negative impact on the group’s business, prospects, financial condition and results of operations,” without providing further details. on products.

The company’s shares fell to a six-year low in Hong Kong today and the Shanghai Stock Exchange suspended trading of its listed bonds amid sharp fluctuations in their prices.

Evergrande said it has appointed Houlihan Lokey and Admiralty Harbor Capital as its joint financial advisors, the clearest indication yet that it is looking at restructuring options, analysts say.

The two companies will assess the Group’s capital structure, assess liquidity, and explore solutions to mitigate current liquidity pressures and reach the optimal solution for all stakeholders as soon as possible.

Evergrande said last night that speculation online about bankruptcy and restructuring was « completely untrue ».

This came despite growing market expectations that Evergrande may need to restructure, after China ruled in August that various lawsuits against the developer would be handled centrally in Guangzhou.

Evergrande said it is talking to potential investors to sell some of its assets, but has not made « significant progress » so far.

Read more

Evergrande – China’s fragile housing giant

The company said earlier this month that it was in talks to sell certain assets, including stakes in two Hong Kong-listed units Evergrande New Energy Vehicle and Evergrande Property Services.

Pressures on Evergrande – which has 1.97 trillion yuan ($305 billion) in liabilities – have intensified in recent weeks as concerns about its ability to repay investors spark protests that are sure to rock Beijing.

The company blamed « continued negative media reports » for eroding investor confidence, leading to a further decline in sales in September.

Shares of the company are down more than 10% this morning to their lowest levels since December 2014. Shares of the publicly listed electronic company are down more than 23% and those of its property management unit are down 8%.

Moves in the company’s highly liquid internal bonds have been volatile, with one bond traded on the Shanghai Stock Exchange rising nearly 23% and bringing trading to a halt, while another bond in Shenzhen is down nearly 12%.

Angry investors gathered near Evergrande’s headquarters in the southern Chinese city of Shenzhen yesterday to demand the company repay loans and financial products.

Fund managers and analysts say the developer’s struggle to sell assets quickly and avoid defaulting on huge liabilities increases the risk of contagion to other privately owned developers.

In a statement, it said it was facing « unprecedented difficulties » but would make every effort to resume work and protect the legitimate rights and interests of its customers.

The company’s debt has been repeatedly reduced by rating agencies targeting the developer due to its massive debt restructuring struggles.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Un employé d'un restaurant de restauration rapide de Cork reçoit une indemnisation après un licenciement abusif

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Le programme de conduite autonome de Tesla est une déception perpétuelle en termes de revenus

(Bloomberg) – L’écart entre ce que dit Elon Musk à propos de la commercialisation de la technologie de conduite autonome et ce que Tesla dira plus tard dans les documents réglementaires n’a jamais été aussi large.

Tesla a publié mercredi son rapport trimestriel 10-Q qui fournit un aperçu plus détaillé de la santé financière de l'entreprise. Pendant plusieurs années consécutives, Tesla a fourni des mises à jour régulières de ces données sur le montant des revenus qu'elle a reçus des clients et qui n'ont pas encore été entièrement reconnus. Une partie de ces revenus différés est liée à un produit en préparation : la conduite entièrement autonome, ou FSD, en abrégé.

Les revenus reportés des véhicules de Tesla s'élevaient à 3,5 milliards de dollars au 31 mars, soit peu de changement par rapport à la fin de l'année dernière. Sur ce montant, Tesla s'attend à reconnaître 848 millions de dollars au cours des 12 prochains mois, ce qui signifie qu'une grande partie des obligations de performance associées à ce qu'elle facture aux clients pour le FSD ne seront toujours pas satisfaisantes dans un an.

La société ne donne pas de détails sur ses performances médiocres, même si le titre du programme est connu pour être un abus de langage. FSD est un système d'aide à la conduite qui ne rend pas les voitures de l'entreprise autonomes ; Cela nécessite que les conducteurs vigilants gardent les mains sur le volant.

Dans ces documents, Tesla a également indiqué le montant des revenus différés réellement comptabilisés – et la société basée à Austin n’a toujours pas répondu à ses attentes. Il a reconnu 494 millions de dollars de revenus différés au cours des 12 derniers mois, soit moins que les 679 millions de dollars prévus il y a un an.

Ces chiffres ont pris encore plus d’importance à la lumière du ralentissement de l’activité automobile de Tesla et de l’accent mis par Musk sur le FSD. Le PDG a mis en place une exigence à la fin du premier trimestre, selon laquelle les employés devaient installer et démontrer un FSD à chaque client en Amérique du Nord avant de livrer le véhicule.

En fait, lors de la conférence téléphonique sur les résultats du premier trimestre de Tesla mardi, Musk a tracé une nouvelle ligne dans le sable : « Si quelqu'un ne pense pas que Tesla va résoudre le problème de l'autonomie, alors je pense qu'il ne devrait pas investir dans le secteur. entreprise. » « Nous le ferons, et nous le ferons », a déclaré l’exécutif.

Alors que Tesla a bénéficié au premier trimestre de la hausse des revenus FSD par rapport à l'année dernière, en raison de la sortie d'une fonctionnalité en Amérique du Nord appelée Autopark, les revenus totaux ont chuté de 8,7 % à 21,3 milliards de dollars. Il s'agit de la première baisse d'une année sur l'autre de l'entreprise en quatre ans et de la plus forte baisse en pourcentage depuis 2012.

Musk a donné le coup d'envoi de l'appel aux résultats de Tesla en qualifiant la dernière version de FSD de « profonde » et s'améliorant rapidement. La société a réduit le prix d’achat de la fonctionnalité ou d’abonnement pour l’utiliser sur une base mensuelle et propose également des essais gratuits. Le PDG a déclaré que la société avait eu des discussions avec un grand constructeur automobile au sujet d'une licence FSD.

« Encore une fois, je recommanderais fortement à tous ceux qui, je pense, envisagent des actions Tesla, de vraiment conduire FSD », a déclaré Musk à la fin de l'appel. « Il est impossible de comprendre l’entreprise si on ne la comprend pas. »

D'autres histoires comme celle-ci sont disponibles sur bloomberg.com

©2024 Bloomberg LP

Ouvrez un monde d'avantages ! Des newsletters utiles au suivi des stocks en temps réel, en passant par les dernières nouvelles et un fil d'actualité personnalisé, tout est là, en un seul clic ! Connecte-toi maintenant!

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Le tribunal accorde une injonction interdisant temporairement à un homme de travailler avec une entreprise rivale – The Irish Times

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/7FHEWBJYGBFKZAB3JBGKTDKSJ4.JPG)

La Cour suprême a accordé une injonction interdisant à un ancien cadre supérieur travaillant pour un fabricant de composants de dispositifs médicaux d'accepter un emploi chez une entreprise rivale en attendant l'audience sur un litige portant sur la question de savoir si son emploi est soumis à une clause de non-concurrence.

Niall Cullen était chef de produit chez Creganna Ltd, une société irlandaise basée à Galway, avant de se voir proposer un poste de direction chez son rival Lake Region Medical en janvier dernier.

Creganna opère au sein de l'unité commerciale TE Medical d'une société mondiale connue sous le nom de TE Connectivity, elle-même détenue par la société suisse Tyco Electronics Group SA.

TE Connectivity est l'une des principales sociétés d'externalisation de dispositifs médicaux au monde, spécialisée dans la conception et la fabrication de dispositifs d'administration et d'accès mini-invasifs pour une gamme de traitements médicaux.

En janvier dernier, M. Cullen, qui était chef de produit senior chez Creganna et a joué un rôle clé dans le maintien des relations avec les principaux décideurs d'un certain nombre d'entreprises clientes mondiales, a remis son préavis expirant le 29 avril.

Crejana a appris qu'il occuperait un poste de direction chez Lake Region Medical, qui fait partie du groupe Integar qui est également l'un des principaux fabricants mondiaux de dispositifs médicaux.

Une action a été déposée devant la Cour suprême visant à l'empêcher de prendre un emploi après le 29 avril car, a déclaré Crejana, cela constituerait une violation d'une clause de non-concurrence de son contrat qui lui interdit de travailler pour un concurrent dans les 12 mois. de la résiliation de son contrat. emploi.

Crejana affirme que la clause de non-concurrence était nécessaire pour protéger son intérêt légitime à garder confidentielles ses informations commerciales hautement sensibles, qui, selon lui, seraient toujours en danger s'il prenait son poste chez Lake Region Medical.

Cullen et la société Lake Region, qui est également poursuivie, affirment que la clause de non-concurrence est invalide et inapplicable parce qu'elle est déraisonnable et trop large pour être justifiée.

Le juge Oisin Quinn s'est dit convaincu que Crejana avait démontré qu'il y avait une question sérieuse à résoudre, à savoir que si M. Cullen acceptait le nouvel emploi, cela constituerait une rupture de contrat exécutoire en raison d'une violation de la clause de non-concurrence. dans son contrat. contrat de travail.

Il était convaincu que Creganna avait soulevé une question sérieuse au procès quant à la validité de la clause de non-concurrence.

Il était également convaincu que, puisque Crejana était prête à s'engager à continuer de payer M. Cullen jusqu'au procès de la réclamation, qui devait désormais avoir lieu en juillet prochain, le maintien du statu quo présentait le moins de risques d'injustice. En attente d'une décision sur l'affaire ou sur une autre affaire.

Le juge a également rejeté l'affirmation de M. Cullen selon laquelle Crejana était coupable de retard dans la présentation de la demande d'injonction.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

-

entertainment2 ans ago

Découvrez les tendances homme de l’été 2022

-

Top News2 ans ago

Festival international du film de Melbourne 2022

-

Tech1 an ago

Voici comment Microsoft espère injecter ChatGPT dans toutes vos applications et bots via Azure • The Register

-

science2 ans ago

Les météorites qui composent la Terre se sont peut-être formées dans le système solaire externe

-

science3 ans ago

Écoutez le « son » d’un vaisseau spatial survolant Vénus

-

Tech2 ans ago

F-Zero X arrive sur Nintendo Switch Online avec le multijoueur en ligne • Eurogamer.net

-

entertainment1 an ago

Seven révèle son premier aperçu du 1% Club

-

entertainment1 an ago

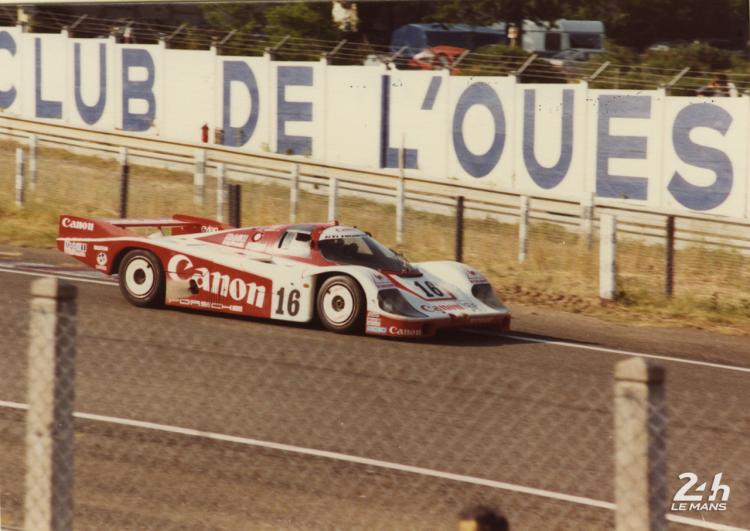

Centenaire des 24 Heures – La musique live fournit une bande-son pour la course