Economy

Facebook’s parent company Meta participates in continuing to survey 200 billion euros

Shares in Facebook’s parent company Meta Platforms tumbled on Friday, with shares set to enter a bear market after months of volatility caused by disclosures of irregularities and disappointing quarterly results.

Selling has been around 20% since its record closed on September 7, wiping out nearly $230 billion (€200 billion) from market value.

Meta stock came under pressure this week as investors grappled with the uncertainty surrounding the Omicron variable and the possibility that the US central bank would end its pandemic support program sooner than expected. It fell more than 2% in one stage on Friday.

Meta shares have been hurt in recent months by negative comments about Facebook’s business model from Frances Hogan, according to David Trainer, who covers investment research firm Meta New Constructs. Ms Haugen appeared before the US House of Representatives Technology Subcommittee earlier this week, after she accused the social media giant of putting the « profit on the safety » of its users in October.

Growing concerns about the impact of Apple’s data collection rules and supply chain challenges also contributed to the decline and drove Meta’s biggest drop in nearly a year in October.

Meta shares are down more than 8% for the week ending Friday, with the stock heading for its worst weekly drop since June 2020.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Les cours des actions de Trump Media chutent à mesure que la société émet davantage d'actions

Les cours des actions de Trump Media ont chuté, faisant baisser sa valeur nette alors que se déroulait le procès de l'argent secret.

L’offre de nouvelles actions peut-elle sauver une entreprise en difficulté parce qu’elle perd rapidement de l’argent ?

Le cours de l'action Trump Media and Technology Group, propriété de Donald Trump, a chuté de 18 % aujourd'hui, lundi, après que la société a annoncé la vente de millions d'actions. CNN mentionné.

L'ancien président, qui fait actuellement l'objet d'un procès pénal, détient 57 % des actions de la société et devrait en recevoir davantage. Cela représente la majeure partie de sa valeur nette.

Les actions de la société du candidat républicain à la présidentielle sont en baisse depuis un certain temps à la Bourse du Nasdaq. Il a clôturé à 26,61 dollars par action, en baisse de 18 % par rapport à la clôture de vendredi et de 66 % par rapport à son sommet du 26 mars de 79,38 dollars.

L'émission d'actions ne signifie pas qu'elles seront facilement disponibles sur le marché. Les actions ne peuvent pas être officiellement émises avant qu'une déclaration d'enregistrement émise par la Securities and Exchange Commission ne prenne effet.

La majorité des actions vendues appartiennent à Trump, mais il ne peut vendre aucune action de Trump Media avant l'expiration de la période de blocage de six mois ou jusqu'à ce qu'il obtienne une dérogation du conseil d'administration de la société.

Trump fait actuellement face à 34 accusations criminelles, alléguant qu'il a exagéré ses antécédents commerciaux pour influencer l'élection présidentielle de 2016 en payant la star du porno Stormy Daniels dans une affaire de fonds secrets.

Le procès a débuté lundi et devrait durer une semaine ou plus.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Les postes vacants ont diminué de 30 % et une augmentation significative des embauches est attendue

Un nouvel observateur du recrutement d'un grand cabinet de recrutement constate un début d'année 2024 « prudent » sur le marché de l'emploi professionnel.

Il y a eu une baisse « significative » de 14 % des offres d'emploi, les embauches ayant été hésitantes au cours des trois premiers mois de l'année.

Le rapport révèle également que les employeurs font pression sur leurs employés pour qu’ils travaillent davantage « sur place », selon le Quarterly Employment Monitor de la société irlandaise Morgan McKinley.

Soulignant le déclin des opportunités d’emploi, le rapport affirme que cette contraction « reflète une incertitude économique plus large et un changement dans les attentes en matière d’emploi au début de l’année ».

Depuis la fin de l'année dernière, le nombre de demandeurs d'emploi professionnels a diminué de plus de 2% au cours des premiers mois de l'année. La baisse annuelle de leur nombre a été énorme, dépassant 31 %.

Le rapport note une approche plus « conservatrice » de la part des demandeurs d'emploi professionnels en matière de changement d'emploi sans offre garantie.

Mais il existe des évolutions positives qui « stimulent » le marché du travail et de nouveaux emplois devraient apparaître grâce aux investissements de l’IDA dans les services financiers, les sciences de la vie, l’industrie manufacturière et la technologie.

Les salaires sont restés stables, mais la pénurie de compétences fait grimper les salaires des géomètres, des fiscalistes, des spécialistes des retraites et des experts en cybersécurité.

« Une tendance notable dans tous les secteurs est la demande croissante de travail sur site », indique le rapport.

Elle dit que cela affecte particulièrement les professionnels de la technologie qui étaient habitués à des arrangements plus flexibles avant la pandémie.

« En outre, la crise actuelle de la résidence en Irlande continue d’entraver le recrutement et l’intégration de talents externes, compliquant encore davantage le paysage de l’emploi », indique le rapport.

Trike Kevans, directeur des IDE mondiaux chez Morgan McKinley Irlande, a déclaré que le secteur technologique avait connu une augmentation significative de la demande d'emplois permanents en raison du démarrage de projets de transformation numérique à long terme, notamment à Dublin.

« Cette demande devrait s'étendre aux emplois contractuels à mesure que les phases initiales du projet seront achevées », a-t-elle déclaré.

Cependant, elle a déclaré que le jour où le marché des entrepreneurs a connu des fluctuations, initialement en baisse en raison des mesures de réduction des coûts, mais montrant des signes de reprise à la fin du premier trimestre de l'année.

Elle a déclaré que le secteur irlandais des services financiers recrute régulièrement, avec une augmentation des postes tels que les analystes de la conformité réglementaire et les responsables de la gestion des données en raison des nouvelles réglementations.

Elle a déclaré que de nouvelles réglementations, telles que le régime de retraite à inscription automatique qui devrait entrer en vigueur en janvier 2025, remodèlent les exigences en matière de compétences.

« À Dublin, la demande de professionnels de la comptabilité et de la finance reste forte, en particulier pour les directeurs fiscaux et les comptables nouvellement qualifiés des quatre grands cabinets », a-t-elle déclaré.

« Cependant, les marchés régionaux ont connu une légère baisse des embauches, en partie due au fait que les professionnels ont choisi de conserver leur poste actuel, attirés par de meilleurs salaires et de meilleures perspectives d'emploi sur les lieux de travail. »

Elle a déclaré que le recrutement en général restait un défi en raison de la pénurie persistante de talents, exacerbée par la migration de comptables qualifiés vers des pays comme l'Australie. Cela a exacerbé la pénurie de talents dans le secteur.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Une entreprise de maisons de retraite qui a pris des millions à des investisseurs chinois a été officiellement fermée

La Haute Cour a rendu une ordonnance formelle de liquidation d'une société créée pour acquérir une propriété de Co Wicklow et la transformer en établissement de soins/maison de soins.

Le juge Brian Kerrigan a confirmé lundi la nomination du praticien de l'insolvabilité Declan de Lacey de Clonmannon House Retirement Village Limited, enregistré à Dublin, qui a acquis Clonmannon House et les terrains environnants à Ashford, dans le comté de Wicklow.

M. DeLacy a été nommé à titre intérimaire par le tribunal à la fin de la semaine dernière, après que la société a été jugée insolvable et incapable de payer ses dettes à leur échéance.

Il n'y a eu aucune opposition de la part de la société ni d'aucune autre partie à la demande de confirmation de la nomination de M. De Lacey.

L'affaire a été demandée par Mme Ye Yuan, basée à Pékin, qui affirme avoir accordé un prêt d'un million d'euros à l'entreprise dans le cadre du programme gouvernemental pour les investisseurs migrants.

Ce programme, annulé l'année dernière, permettait à ceux qui avaient investi au moins 1 million d'euros en Irlande d'obtenir des visas pour résider ici.

Lundi, devant la Haute Cour, Arthur Cunningham BL, agissant en tant qu'avocat du liquidateur de Peter Boyle & Co, a déclaré que même si son client n'était sur place que temporairement depuis jeudi dernier, il avait pris certaines mesures concernant l'accord. une entreprise.

L'avocat a déclaré que De Lacey avait été en contact avec l'unique directrice de la société, Mme Candance La Flor, qui avait accepté de coopérer avec le liquidateur.

La liquidation était complexe, a déclaré l'avocat, ajoutant qu'un accord avait été conclu pour que la société puisse soumissionner pour acheter Clonmannon House d'ici la fin du mois.

L'avocat a indiqué qu'environ 1,9 million d'euros avaient été payés pour acheter le bien, avec une somme de plus de 100 000 euros due au vendeur.

Cependant, l'avocat a déclaré que même si la société ne semblait pas disposer des fonds nécessaires pour finaliser l'achat, des plans étaient en cours pour fournir un financement qui permettrait de réaliser la vente.

L'avocat a également déclaré que M. De Lacy étudiait également certaines questions fiscales, notamment les droits de timbre, qui pourraient survenir lors de l'achat de la propriété.

En réponse aux aveux de l'avocat du juge, la société a affirmé espérer vendre le bien pour environ 4 millions d'euros.

Le juge Kerrigan s'est dit satisfait de confirmer la nomination de M. De Lacey en tant que liquidateur et a ordonné que Mme La Flor fasse un état des lieux.

L'affaire devrait revenir devant le tribunal plus tard ce mois-ci.

Représenté par Sally O'Neill BL, mandatée par l'avocat Aisling Murphy du cabinet O'Shea Barry Solicitors, le pétitionnaire a demandé la nomination d'un liquidateur après que la société n'a pas réussi à lui payer la somme de 1,17 million d'euros devenue exigible en août dernier.

Mme O'Neill a déclaré que son client s'était inquiété après qu'un autre investisseur ait entamé une procédure judiciaire, alléguant que la société n'avait pas remboursé à l'investisseur 1,3 million d'euros.

Mme La Flor a déposé un affidavit dans cette procédure qui incluait des éléments que Mme Yuan dit être faux, a déclaré l'avocat.

Le tribunal a entendu que des inquiétudes existaient également quant au respect par l'entreprise du droit irlandais des sociétés.

La procédure a été engagée en janvier dernier lorsque Mme Lee Sun, représentée par Sean O'Sullivan BL, mandatée par les avocats de Rafferty Jamesons, a obtenu une ordonnance de gel temporaire interdisant à la société d'encaisser, de dissiper ou de disposer de toute autre manière de toute somme d'argent qu'elle reçoit dans le cadre de toute vente ou aliénation des actifs ou des actions du défendeur.

Mme Sun, basée à Clontarf, qui a investi dans l'entreprise en 2019, a demandé l'ordonnance en raison d'inquiétudes concernant son investissement et de craintes de ne pas recevoir les 1,3 millions d'euros auxquels elle dit avoir droit de la part de l'entreprise.

La société a nié toutes les allégations d'actes répréhensibles dans cette procédure.

L'action reviendra devant le tribunal plus tard ce mois-ci.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

-

entertainment2 ans ago

Découvrez les tendances homme de l’été 2022

-

Top News2 ans ago

Festival international du film de Melbourne 2022

-

Tech1 an ago

Voici comment Microsoft espère injecter ChatGPT dans toutes vos applications et bots via Azure • The Register

-

science2 ans ago

Les météorites qui composent la Terre se sont peut-être formées dans le système solaire externe

-

science3 ans ago

Écoutez le « son » d’un vaisseau spatial survolant Vénus

-

Tech2 ans ago

F-Zero X arrive sur Nintendo Switch Online avec le multijoueur en ligne • Eurogamer.net

-

entertainment1 an ago

Seven révèle son premier aperçu du 1% Club

-

entertainment1 an ago

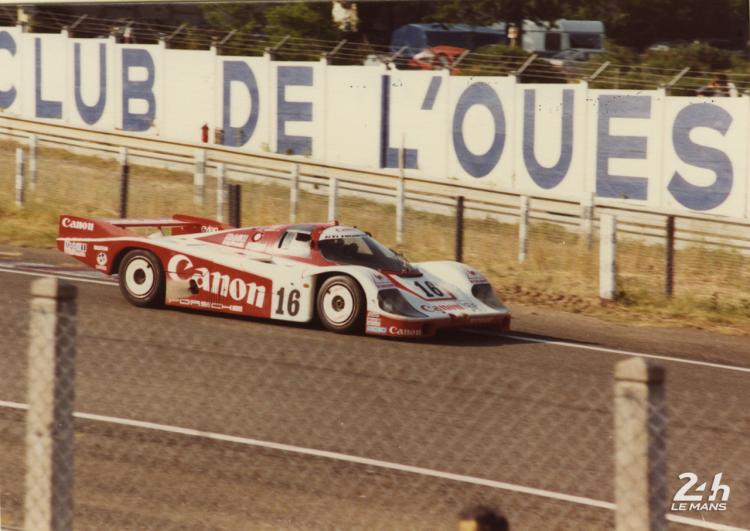

Centenaire des 24 Heures – La musique live fournit une bande-son pour la course