Economy

Firms warn of ‘unprecedented’ cost pressures as inflation fears grow | Business News

A business group warned of the impact of the « unprecedented » rise in inflation on its members, but said that companies are concerned about another rise in interest rates, fearing that it will lead to a recovery from the emerging Corona virus.

The British Chambers of Commerce (BCC) said there was already strong evidence of an economic slowdown in the last quarter of 2021 ahead of the Bank of England. raise interest rates In December to combat rising inflation expectations.

Borrowing cost has been adjusted from Corona virus disease Crunch low from 0.1% to 0.25%, despite the elephant in the room, and energy costs, being out of the bank’s control.

Then, policymakers also raised their expectations for inflation, warning that it is set to hit 6% this year, led by a sharp increase in energy bills after wholesale gas costs rose at unprecedented rates in the latter half of 2021.

unless Government talks with energy suppliers Putting in place a plan to cushion the increase, the industry has warned households and businesses that their bills will skyrocket.

Energy UK has estimated that domestic customers will incur a 56% increase from April, when the price cap – which currently halts billing – is adjusted again.

Companies are already beginning to deal with sharp increases on top of a host of other cost increases, from raw materials to wages.

The survey showed that one in four of the 5,500 companies questioned were concerned about rising interest rates. A record three in five expect their prices to rise in the next three months.

Supply chain disruption has also been an ongoing topic in many sectors.

BCC Head of Economics, Soren Theroux, said: “Our latest survey indicates that the UK’s economic recovery slowed in the last quarter of 2021 as rising headwinds increasingly limited leading indicators of activity.

“The continued weakness in cash flow is worrisome as it leaves companies more vulnerable to the economic impact of Omicron, rising inflation and other potential restrictions.

“Rising raw material costs, higher energy prices, and the reversal of the value-added tax cut for the hospitality sector are likely to push inflation over 6% by April.

« The marked rise in concerns about rate hikes underscores the need for the BoE to proceed cautiously on rate increases to avoid undermining confidence and an already fragile recovery. »

« With companies now having to grapple with the impact of Omicron and further changes to the rules for the import and export of goods to the EU, there are significant hurdles for companies in the coming months, » added Sivon Haviland, director general of the organisation.

The BCC survey was released hours after the inflation issue took hold of PMQs in the House of Commons.

Boris Johnson tells MPs it will « undoubtedly be a difficult period » after Labor deputy leader Angela Rayner ran Sir Keir Starmer infected with Covid – He accused the government of negligence.

« The prices of daily commodities are rising dramatically out of control, the hard-earned savings will be damaged and workers’ wages will not go that far, » she said.

Rayner said « serious solutions » were needed to prevent people from « falling into poverty or debt » as a result of inflation.

Johnson also denied that he called inflation fears « unfounded » – Even though Sky News made him say exactly that on camera.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Excédent budgétaire prévu de 8,6 milliards d’euros malgré une « perte de dynamique économique » – Irish Times

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/FAS6WGTVVNEWNLBVB36VW5U5VA.JPG)

Le gouvernement espère réaliser un excédent budgétaire de 8,6 milliards d'euros cette année et des excédents cumulés de 38 milliards d'euros au cours des quatre prochaines années grâce à des recettes inattendues de l'impôt sur les sociétés.

Les dernières prévisions contenues dans la mise à jour du programme de stabilisation du gouvernement, soumise annuellement à la Commission européenne, s'accompagnent d'un avertissement concernant une perte de dynamique économique au cours des derniers mois, alors que l'inflation et les taux d'intérêt continuent de peser sur les dépenses de consommation et les investissements.

L'excédent budgétaire attendu de 8,6 milliards d'euros équivaut à 2,8 pour cent du revenu national et fait suite à un excédent de 8,3 milliards d'euros l'année dernière.

Le ministre des Finances, Michael McGrath, a déclaré qu'une grande partie de la générosité du budget était due aux recettes fiscales potentiellement volatiles des entreprises du secteur multinational. Il a souligné qu'en supprimant ces recettes, on enregistrerait un déficit de 2,7 milliards d'euros cette année et de 1,8 milliard d'euros l'année prochaine.

Les recettes annuelles de l’impôt sur les sociétés sont passées de 4 milliards d’euros à 24 milliards d’euros en une décennie. Cependant, McGrath a averti que l’ère de la surperformance en matière d’impôt sur les sociétés « touche désormais à sa fin ».

« On ne peut pas compter sur ces recettes : nous avons constaté un ralentissement significatif de l’impôt sur les sociétés au cours de l’année écoulée, mettant en évidence la volatilité de cette source de revenus », a-t-il déclaré.

La solide position fiscale du gouvernement, qui reflète également la croissance annuelle des recettes de l'impôt sur le revenu et de la TVA, verra 6 milliards d'euros de ressources budgétaires transférées vers un nouveau fonds de richesse et un plus petit fonds pour les infrastructures et le climat, créé pour servir de réserves tampons. Contre les contractions futures.

Les nouvelles projections permettront également de nouvelles dépenses et mesures fiscales agressives dans le budget 2025, le dernier avant les élections. Cependant, le ministre McGrath et le ministre des Dépenses publiques Paschal Donohoe ont refusé de dire si le budget respecterait la règle de dépenses de 5 pour cent que le gouvernement s'est imposée, qui vise à limiter les augmentations annuelles des dépenses à un plafond de 5 pour cent.

Le gouvernement a violé cette règle dans chacun de ses deux derniers budgets. M. Donohoe a souligné que que les dépenses augmentent l'année prochaine de 5, 5,5 ou 6 pour cent, « cette décision concerne des centaines de millions » alors que le gouvernement économisait 6 milliards d'euros « pour assurer un avenir meilleur à ce pays ».

« Pour évaluer la prudence et le soin apportés à la stratégie budgétaire, 6 milliards d'euros par an constituent un élément crucial », a-t-il déclaré.

Le document du gouvernement SPU prévoit que l'économie nationale connaîtra une croissance modeste de 1,9% cette année, en baisse par rapport aux prévisions précédentes de 2,2%, et de 2,4% en 2025.

Le rapport prévient que l'économie irlandaise a été confrontée à plusieurs vents contraires ces dernières années, avec une perte de dynamique évidente dans les données des derniers trimestres.

Un troisième terminal à l’aéroport de Dublin : nécessité urgente ou tarte en l’air ?

« Cela est dû en grande partie à deux facteurs contraires, à savoir les récents taux d'inflation élevés, qui ont affecté les salaires réels et les dépenses de consommation, et le resserrement monétaire, qui a fait grimper le coût du capital », a-t-il ajouté.

Cependant, le ministre des Finances Michael McGrath a insisté sur le fait que l'économie restait dans une « forme raisonnablement bonne », avec une baisse des prix de l'énergie et une baisse de l'inflation qui en découlerait susceptible de soutenir « une amélioration des salaires réels et du pouvoir d'achat des ménages ».

Il a noté que le taux d'inflation global de cette année devrait désormais être de 2,1 pour cent, inférieur aux prévisions du jour du budget de 2,9 pour cent.

[ €6bn has been removed from the budget day pot. Politically, this could get interesting ]

« Le point économique le plus brillant est sans aucun doute le marché du travail, qui est resté résilient tout au long de cette période de forte inflation et de taux d'intérêt élevés », a-t-il déclaré, notant qu'il y a désormais plus de 2,7 millions de personnes ayant un emploi.

Les prévisions macroéconomiques qui sous-tendent le SPU ont été approuvées par le Conseil des Finances le 2 avril, une obligation légale en vertu de la réglementation européenne.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Une femme a perdu 2,7 millions d'euros sur 3 millions d'euros pour un peu plus de 1 300 euros – The Irish Times

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/7FHEWBJYGBFKZAB3JBGKTDKSJ4.JPG)

Les dettes d'une femme d'environ 3 millions d'euros ont fait l'objet d'une annulation de 2,7 millions d'euros en échange d'un paiement de 1 316 euros aux créanciers et elle conservera son domicile familial selon les termes d'un accord d'insolvabilité personnelle (PIA) approuvé par la Haute Cour.

Un arrangement similaire a été approuvé séparément pour le mari de la femme qui avait des dettes de 2,66 millions d'euros, provenant pour la plupart des mêmes prêts, qui ont été annulées pour un paiement de 1 316 euros.

Les arrangements de verrouillage ont été approuvés par le juge Alexander Owens pour Thomas Johnson et son épouse Valerie, tous deux âgés de 60 ans et retraités, avec une adresse à Drumrey Road, Dunshoughlin, comté de Meath. Le tribunal a appris que Johnson travaillait à temps plein comme soignante de sa mère.

En ce qui concerne la demande déposée lundi par l'avocat Keith Farry pour le praticien de l'insolvabilité personnelle Nicholas O'Dwyer pour les deux candidats, le juge a été convaincu que les arrangements répondaient aux critères de consentement en vertu des lois sur l'insolvabilité personnelle.

Dans des documents judiciaires, les dettes totales de Johnson s'élevaient à 2 984 millions d'euros, dont environ 2,2 millions d'euros, sous forme de prêts personnels, étaient dus à Everyday Finance, qui faisait partie de plusieurs créanciers chirographaires qui ont voté contre le plan de mise en œuvre du projet proposé au Parlement. assemblée des créanciers. . Les dettes totales de Johnson, liées pour la plupart aux mêmes prêts, s'élevaient à 2 976 millions d'euros.

Le PIA proposé était soutenu par Mars Capital Ireland DAC, un créancier garanti qui doit environ 618 000 € sur une hypothèque garantie sur la maison du couple à Dunshoughlin. La valeur marchande actuelle de ce bien est de 275 mille euros, ce qui représente un déficit d'environ 343 mille euros.

Aux termes de l'accord de mise en œuvre du projet, Johnson paiera 1 316 euros aux créanciers en échange de l'annulation de 2,66 millions d'euros de dette.

Johnson a déclaré dans une déclaration sous serment qu’une somme totale de 200 000 euros devait être payée dans les six mois suivant l’approbation par le tribunal de l’organisme de mise en œuvre du projet. Elle a déclaré que cela serait payé grâce au produit de la vente de la maison de sa mère à Sutton, Dublin. Selon des documents judiciaires, sa mère emménagera dans la maison de sa fille.

Le solde de l'hypothèque résidentielle de Dunshaughlin, dans le cadre du PIA, sera réduit à 275 000 € et le taux d'intérêt sera réduit de 4,15 pour cent à un taux fixe de 3 pour cent. Les remboursements hypothécaires de 665 € seront payés pendant six mois de PIA et par la suite pour la durée hypothécaire prolongée de 11 ans. Le solde impayé de 343 109 € sera alors amorti.

La Mercedes Vito de Mme Johnson a été exclue du PIA parce qu'elle devait être sous la garde de sa mère. La Nissan de son mari a également été exclue de son PIA en raison de l'emplacement de leur domicile.

Le revenu net de Mme Johnson était estimé à 1 851 € par mois et celui de son mari à 1 243 €. Après déduction des frais fixés, des frais de subsistance raisonnables et des versements hypothécaires, une contribution mensuelle de 21,60 € et de 10,99 € est mise à la disposition de l'organisme de mise en œuvre du projet.

Dans un affidavit, M. O'Dwyer a déclaré que le PIA fait partie d'un accord imbriqué qui permet une distribution plus importante aux créanciers que ce ne serait le cas dans le cadre d'une procédure de faillite. On estimait que ces arrangements offraient des chances raisonnables d'être exécutés et offraient de meilleurs résultats pour les deux débiteurs que la faillite. Comme l'exige la loi, plus de la moitié d'une certaine catégorie de créanciers ont soutenu l'accord, a-t-il déclaré.

S'abonner à Alertes push Et recevez les meilleures nouvelles, analyses et commentaires directement sur votre téléphone

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Un projet de transition massive vers les véhicules électriques dans toute l’UE se heurte à des problèmes, préviennent les auditeurs

Ils affirment que la production de batteries de voitures électriques en Europe coûte trop cher pour réaliser des ventes de masse.

Une batterie fabriquée dans l’UE coûte actuellement 15 000 € et les matières premières proviennent de pays extérieurs à l’Union.

Cela incitera l’Union européenne à tenter d’augmenter ses ventes, soit en s’appuyant sur des voitures importées de Chine moins chères, soit en injectant d’énormes subventions sur le marché de l’Union européenne.

Ils affirment également que les infrastructures publiques de recharge des véhicules électriques sont très médiocres dans une grande partie de l’Europe, la majorité des points de recharge étant concentrés dans seulement trois pays.

Les auditeurs avertissent que de grands espoirs reposent sur le développement des biocarburants comme alternative à l'essence et au diesel.

Ils affirment que le biocarburant est une option douteuse sur le plan environnemental, qu’il n’est pas disponible en quantité suffisante et que son prix n’est pas compétitif.

« Nous sommes confrontés à une bataille difficile », a déclaré Annemie Turtelbaum, de la Cour des comptes européenne.

Les émissions dues aux transports représentent un quart des émissions totales dans l’Union européenne, dont la moitié provient des voitures particulières.

Dans le cadre du Green Deal de l’UE, l’objectif est que toutes les voitures neuves vendues utilisent une technologie à zéro émission de carbone à partir de 2035.

Les ventes de voitures conventionnelles ne seraient pas interdites mais une pénalité carbone serait introduite, ce qui ajouterait des milliers d'euros au prix.

Cependant, l'EPA a déclaré que les politiques actuelles visant à encourager les automobilistes à utiliser des véhicules électriques ne fonctionnent pas assez vite ni dans la mesure nécessaire.

« Pour conquérir le marché de masse, les prix doivent être réduits de moitié », a déclaré Turtelbaum.

L’autre problème est que même si les voitures essence et diesel modernes émettent moins d’émissions de carbone que les modèles plus anciens, tout gain est annulé à mesure que les voitures deviennent plus grandes et plus lourdes.

« Les émissions des voitures conventionnelles – qui représentent encore près des trois quarts des nouvelles immatriculations de véhicules – n’ont pas diminué de manière significative depuis 12 ans », a déclaré Nikolaos Milionis, membre de la Commission économique pour l’Afrique.

« Alors que les moteurs sont devenus plus efficaces, cela a été contré par des voitures plus lourdes, en moyenne 10 % plus lourdes, et des moteurs plus puissants nécessaires pour transporter ce poids, en moyenne 25 % plus puissants. »

Les auditeurs ont constaté que les voitures hybrides rechargeables produisent plus d’émissions que ce qui est indiqué.

« L'écart entre les émissions mesurées en laboratoire et celles sur route est en moyenne de 250% », ont-ils précisé.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

-

entertainment2 ans ago

Découvrez les tendances homme de l’été 2022

-

Top News2 ans ago

Festival international du film de Melbourne 2022

-

Tech1 an ago

Voici comment Microsoft espère injecter ChatGPT dans toutes vos applications et bots via Azure • The Register

-

science2 ans ago

Les météorites qui composent la Terre se sont peut-être formées dans le système solaire externe

-

science3 ans ago

Écoutez le « son » d’un vaisseau spatial survolant Vénus

-

Tech2 ans ago

F-Zero X arrive sur Nintendo Switch Online avec le multijoueur en ligne • Eurogamer.net

-

entertainment1 an ago

Seven révèle son premier aperçu du 1% Club

-

entertainment1 an ago

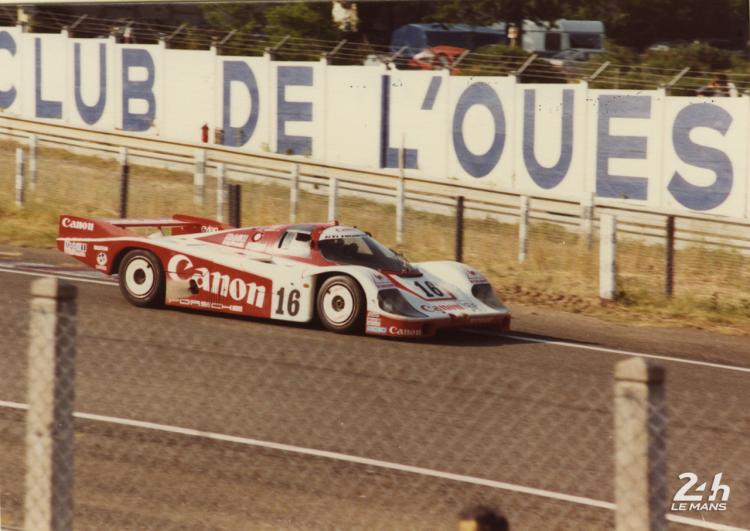

Centenaire des 24 Heures – La musique live fournit une bande-son pour la course