Economy

Former Anglo Irish Bank CEO, Shaun Fitzpatrick dies

A family spokesperson has confirmed the death of former CEO and Chairman of Anglo Irish Bank Seán FitzPatrick.

Mr. FitzPatrick, or « Seanie » as he was known to his friends and acquaintances, was 73 years old. He died yesterday after a short illness.

The former banker became known for the role he played in the rapid expansion and subsequent collapse of the Anglo Irish Bank, following the collapse of the ownership over a decade ago.

Chartered Accountant, in 1986 Mr. Fitzpatrick was appointed Chief Executive Officer of what was then the City of Dublin Bank which later became Anglo Irish Bank.

At that time, the bank was small, with few employees, while it was worth about 5 million euros.

But over the next two decades, he led the lender’s transformation from a small business to the third largest bank in the country, with a balance sheet estimated in the billions.

He did this by building what was a small commercial bank into a large lender to property developers who were operating in Ireland, the United Kingdom, and elsewhere.

Anglo’s growth, championed by Mr. Fitzpatrick, coincided with the rise of the Celtic Tiger economy, which was in turn driven by a real estate bubble fueled in part by credit loans by the bank.

The expansion made the bank very profitable and in 2004, his last year as CEO, Mr. Fitzpatrick earned €2.7 million.

The following January, he was replaced by David Drum and moved to the position of President.

Over the next four years, under the leadership of both men, Anglo’s loan book tripled to €72 billion.

In June 2007, Mr. Fitzpatrick criticized what he described as the « corporate McCarthyistic » culture surrounding business in Ireland.

That year, the bank’s annual profit peaked at €1.2 billion Anglo shares also gained more than 17 euros, valuing the bank at 13 billion euros.

But over the next year, the collapse of real estate and banks began to unfold and the dissolution of the Celtic Tiger, exposing the many holes in the balance sheets of Anglo Bank and other major Irish banks, and creating stress on liquidity.

On March 17, 2008, the bank’s share price fell nearly 15% following announcements in the United States the day before regarding the emergency sale of Bear Stearns.

Soon the situation became more serious, and by September 2008 the government decided to introduce a 400 billion euro scheme that would guarantee the country’s main banks, including the Anglo Irish.

In an interview with broadcaster Marianne Finucane on RTÉ days later, Mr. Fitzpatrick declined the opportunity to apologize.

« The cause of our problems is global, » he said.

« So I can’t say sorry with any sincerity and decency. But I can say thank you, » he added.

But in December 2008 Mr. Fitzpatrick resigned as president amid an investigation by the financial regulator into the temporary transfer of his multi-million euro loans between Anglo and Irish Nationwide over eight years.

The effect of the transactions was that his loans did not appear in Anglo’s annual report.

He also left the boards of Aer Lingus and Smurfit Kappa where he worked as a director.

The state began recapitalizing the Anglo Irish Bank, but it was eventually nationalized in January 2009.

In the 15 months to the end of December 2009, Anglo recorded a pre-tax loss of 12.7 billion euros as a result of having to write off 15 billion euros of bad loans.

Loans totaling 34.4 billion euros were later transferred to the National Asset Management Agency, which bought it for 13.4 billion euros.

Anglo eventually merged with the Irish Nationwide to become the Irish Bank Resolution Corporation, which is still in liquidation today.

The Comptroller and Auditor General estimated the total cost of the two banks’ collapse to the taxpayer at 36 billion euros.

In February 2009, it turned out that in an effort to prop up the bank’s share price, Anglo loaned 450 million euros to a group of 10 clients, known as Maple 10, to purchase a 10% portion of a much larger stake established by entrepreneur Sean Coen in the bank via CFDs.

Garday and members of the Office of the Director of Corporate Enforcement raided Anglo’s offices in February 2009.

Then in March 2010, Mr. Fitzpatrick was arrested by members of Garda’s fraud squad and questioned at Bray Garda Station, near his home in Greystones in Co Wicklow, before being released without charge.

That same month, Angelo initiated legal proceedings against him in an attempt to recover €70m of unpaid loans.

Later that year, Fitzpatrick was declared bankrupt with a debt of 147 million euros.

In December of the same year, Taoiseach Brian Cowen quit, in part because it emerged he had played a round of golf with Mr. Fitzpatrick a few months before the bank guarantee was issued in 2008.

A year later, Mr. Fitzpatrick was arrested a second time by Garday as part of an investigation into financial wrongdoing. He was again released without charge.

Seven months later he was arrested for the third time, this time on 16 counts of crimes related to his role in the Maple 10 case.

However, he denied the charges and in April 2014 he was acquitted of all of them.

That year, Mr. Fitzpatrick was pardoned from bankruptcy.

In November 2016, he again went to trial, this time charged with 27 counts under the Companies Act 1990 related to allegations that he misled bank auditors over a five-year period by failing to disclose loans worth tens of millions of euros.

22 counts of making misleading, false or deceptive statements and five counts of providing false information. Mr. Fitzpatrick again pleaded not guilty to the charges.

But the Corporate Law Enforcement Director’s Office case was mired in problems and during the trial it was found that potentially valuable documents had been shredded and witnesses trained.

In 2017, after the longest criminal trial in the state’s history, Judge John Aylmer issued a directive acquitting Mr. Fitzpatrick, criticizing the ODCE for its handling of the investigation.

Two years later, Mr. Fitzpatrick was expelled from Ireland’s CPA and fined €25,000.

Mr. Fitzpatrick is survived by his wife Catriona and three children David, Jonathan and Sarah.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

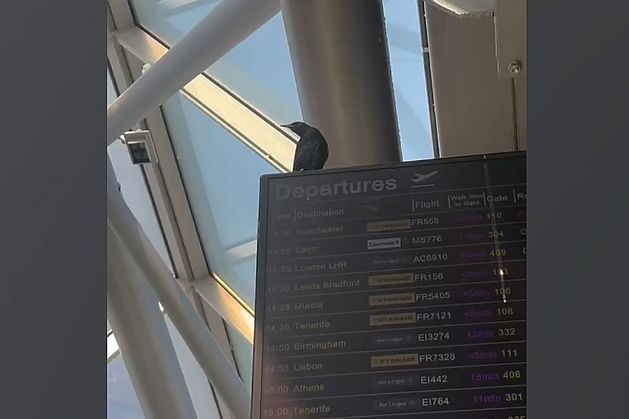

Un oiseau piégé dans le terminal de l'aéroport de Dublin « erre dans la confusion pendant plus de 40 jours » car son élimination « n'est pas une tâche facile »

Un militant des droits des animaux a déclaré que l’oiseau « errait confusément, à la recherche de restes de nourriture pendant plus de 40 jours.

« Nous notons des inquiétudes concernant l'oiseau vivant actuellement dans le terminal 1 de l'aéroport de Dublin », avait précédemment déclaré l'aéroport de Dublin sur Twitter.

« Aider un petit (et très rapide !) oiseau à sortir d'un bâtiment aussi immense et bondé n'est pas une tâche facile. Mais l'équipe de l'aéroport se saisit du dossier et, en consultation avec des experts de la faune et des oiseaux, mène une opération qui aura l'oiseau reprendra son chemin en toute sécurité très bientôt.

« En attendant, le public peut être assuré que l'oiseau reçoit suffisamment de nourriture et de boisson et qu'il est en bonne santé. Le retour en toute sécurité de l'oiseau dans la nature est une priorité absolue et nous remercions le public d'avoir confié son sauvetage au public. professionnels. »

Le militant Caoimhe Laird Phelan lance un appel pour sauver l'oiseau, une espèce d'étourneau sansonnet, qui serait là depuis plus de 40 jours.

« C'est la saison de reproduction, c'est le printemps, ils devraient voler d'arbre en arbre pour collecter du matériel de nidification afin de pouvoir avoir des bébés, sans errer confusément dans la station à la recherche de restes », a-t-elle déclaré.

« Être piégé à l’intérieur sans nulle part où s’échapper est très stressant pour un oiseau sauvage. Il est déjà dans un état de panique alors qu’il vole constamment vers les fenêtres du ciel pour trouver une issue.

Les étourneaux seraient piégés dans le terminal 1 de l'aéroport de Dublin depuis le 8 mars.

« Il ne sait pas que le hall des arrivées dans lequel il se trouve est au troisième étage et que pour sortir du bâtiment, il devra descendre deux volées d'escaliers pour atteindre une porte à la porte d'embarquement.

« C'est quelque chose qu'il n'a jamais pu comprendre car ces portes sont ouvertes par intermittence dans le seul but de permettre aux passagers de monter à bord de l'avion.

« Les aéroports ne sont pas leur habitat naturel et ne produisent pas de vers ni d’insectes à manger. Les étourneaux ne trouveront pas la nourriture et l’eau dont ils ont besoin.

«J'étais en voyage vendredi dernier et j'ai remarqué un étourneau maigre faisant des cercles autour du terminal 1. J'ai demandé à quelques membres du personnel, et personne ne semblait trop dérangé par sa présence ou par le début des secours.

«J'avais le sentiment qu'il était là depuis un moment, alors j'ai filmé quelques clips et réalisé une vidéo racontant son histoire et je l'ai mise en ligne.

« Cela a pris de l'ampleur et j'ai appris qu'il y avait été aperçu pour la première fois le 8 mars. À partir d'aujourd'hui, cela signifie qu'il est là depuis 42 jours », a-t-elle déclaré.

Caoimhi espère que l'aéroport de Dublin « assumera la responsabilité de mettre en place des procédures appropriées lorsque la faune est piégée entre ses murs ».

Kildare Wildlife Rescue a déclaré avoir reçu plusieurs demandes de renseignements concernant l'oiseau piégé.

« Nous avons reçu plusieurs rapports de personnes ayant vu une vidéo de cet étourneau en ligne », a-t-elle déclaré.

« L'aéroport n'a pas été en contact avec nous, mais même s'il l'était, nous ne pouvons malheureusement pas faire grand-chose pour aider dans cette situation.

« Puisque les étourneaux peuvent voler dans un grand espace ouvert avec de hauts plafonds, il ne serait pas possible de les attraper avec un filet.

« Le conseil habituel pour les oiseaux piégés dans les bâtiments est d’éteindre toutes les lumières et d’ouvrir toutes les fenêtres/sorties. Cela doit être fait pendant la journée afin que l’oiseau ne s’envole pas dans l’obscurité.

«Nous ne pouvons que supposer que l'aéroport ne sera pas en mesure de suivre ces conseils pour des raisons de sécurité et de logistique.

« Comme il est là depuis des semaines, nous pouvons au moins être assurés qu'il trouve de la nourriture et de l'eau quelque part – soit il est intentionnellement nourri par le personnel ou les voyageurs, soit il est capable de trouver de la nourriture et de l'eau par lui-même.

«Nous contactons nous-mêmes l'aéroport de Dublin et serions heureux de leur parler plus en détail et d'envisager des options potentielles s'ils nous répondent.

« La situation est loin d'être idéale ; « Nous espérons que tôt ou tard, il pourra s'en sortir », a-t-il ajouté.

Gillian Baird de la DSPCA a ajouté qu'il pourrait être difficile de faire sortir l'oiseau de l'aéroport.

« Le problème avec les étourneaux est qu'ils ont tendance à trouver leur chemin, quelle que soit la direction qu'ils prennent », a-t-elle déclaré. « À l'heure actuelle, ce qui se serait passé, c'est que l'oiseau aurait pu construire un nid et pondre des œufs », a-t-elle déclaré.

« Certains poussins pourraient bientôt éclore, c'est donc très difficile.

« Ce que nous disons à quelqu'un qui a un oiseau coincé dans son bâtiment, c'est d'éteindre toutes les lumières, d'ouvrir les portes, de mettre des graines à l'extérieur et de laisser l'oiseau tranquille.

« Mais ce que je vois, c'est que l'oiseau est piégé dans un bâtiment aéroportuaire doté de nombreux plafonniers. Il serait donc impossible d'éteindre les lumières car c'est une zone très fréquentée. L'oiseau ne sera jamais laissé seul. »

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Le propriétaire irlandais indépendant Mediahuis est en pourparlers pour racheter Journal.ie – The Irish Times

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/LMA2PTBA7JJEAWS6264HMSESLM.jpg)

L'éditeur irlandais indépendant Mediahuis Ireland est en pourparlers pour acquérir le fournisseur d'informations en ligne The Journal ainsi que sa publication sportive et podcast sœur. the42.ieSelon des sources.

La valeur de l’accord potentiel serait de l’ordre de « quelques millions à un chiffre ».

« Mediahuis note des spéculations concernant une éventuelle acquisition », a déclaré une porte-parole de l'éditeur. « Comme toujours, Mediahuis ne souhaite pas commenter de telles spéculations, sinon pour dire que nous continuerons à étudier et à évaluer toutes les opportunités qui se présenteront. »

Journal Media a été fondée en 2010 par les frères Brian et Eamonn Fallon. Les efforts pour obtenir les commentaires de la famille de Fallon ont échoué.

La vente est gérée en interne par Journal Media, la société à l'origine des deux publications. Il semblerait que Business Post, contrôlé par Kilcullen Kapital Partners et l'homme d'affaires de Galway Enda Okoinen, ait fait l'objet d'une offre sous-évaluée pour l'entreprise.

Le42.ie Elle fonctionne sur abonnement, tandis que la revue est ouverte aux contributions des lecteurs. Journal Media a fermé un site d'information sur la culture populaire. DailyEdge.ieen 2019 et au-delà Forums.ie Business News Service l’année suivante. La récente fermeture a été imputée aux mesures de réduction des coûts prises par l’entreprise pendant la pandémie.

Journal Media ne dépose pas d'états financiers séparés auprès du Bureau d'enregistrement des sociétés. Au lieu de cela, les chiffres consolidés sont transmis à la société mère ultime, DML Capital Unlimited.

Eamonn et Brian Fallon ont marqué une première fois le paysage numérique irlandais en créant Putain.ie Le site immobilier en 1997, alors qu'ils avaient respectivement 20 et 15 ans. Ils ont fusionné cette entreprise avec leur société sœur Annonces.ieAvec Schibsted Media Group basé en Norvège DoneDeal.fr En 2015.

La coentreprise qui en résulte, Distilled Ltd, est détenue à 50 pour cent par la famille Fallon, qui détient ses actions via DMG, et à 50 pour cent par Adevinta, une filiale de Schibsted.

Mediahuis Group, basé en Belgique, a acquis Independent News & Media (INM), alors cotée en bourse, en 2019 et l'a ensuite rebaptisé Mediahuis Ireland.

Outre l'Irish Independent, Mediahuis Ireland publie le Sunday Independent, le Sunday World, le Belfast Telegraph, le Sunday Life et neuf titres régionaux.

Le groupe mère est également présent en Belgique, aux Pays-Bas, au Luxembourg et en Allemagne.

Mediahuis Ireland a confirmé la semaine dernière avoir réduit ses effectifs de 50 personnes dans sa division d'édition, ce total incluant un certain nombre de licenciements obligatoires. L’entreprise employait près de 550 personnes début 2024, avant d’annoncer qu’elle cherchait à réduire les effectifs dans sa division d’édition en Irlande.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Comment une fausse publicité pour une célébrité gagnant de l'argent grâce au Bitcoin a coûté près de 10 000 € à un lecteur – The Irish Times

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/TEIYANDAA5GCHPE2TRSWWKJXZQ.jpg)

Fin février, une lectrice que nous appellerons Joan était sur Facebook et est tombée sur un article qui semblait provenir d'une source d'information irlandaise réputée, soulignant comment une personnalité de la télévision irlandaise réputée avait réussi à gagner une grosse somme d'argent après quelques années. des plaisanteries. Investir dans la crypto-monnaie.

L’article regorgeait de citations d’autres célébrités irlandaises qui ont également gagné beaucoup d’argent grâce aux crypto-monnaies.

Vous savez probablement où cela va, n'est-ce pas ?

Mais Joan n'a pas fait ça.

« Il y avait un lien dans le contenu, j'ai cliqué sur le lien et je me suis inscrit pour prendre un appel », a-t-elle écrit. « En moins de cinq minutes, un homme m'a appelé, m'a posé quelques questions sur mon âge et, comme j'avais la cinquantaine, m'a proposé une réduction pour effectuer un dépôt. »

Il lui a dit que la caution était normalement de 250 €, mais il l'avait enregistrée pour 200 €. Je pensais à des jours heureux.

« Je lui ai donné les coordonnées de ma carte de crédit pour effectuer le paiement. Il m'a dit que la plateforme fonctionnait sur l'intelligence artificielle et que je n'avais rien d'autre à faire que de voir mon investissement croître. Il m'a ensuite dit qu'on me désignerait un gestionnaire de compte qui le ferait. contactez-moi le lendemain pour me préparer au trading.

Effectivement, l’appel est arrivé et le « gestionnaire d’investissement » – un homme appelé Max – a demandé à Joan de télécharger une application où elle pouvait voir que 200 € étaient désormais 208 €.

«Max m'a dit qu'il travaillait avec une commission de 10 pour cent de mes bénéfices et qu'il toucherait sa commission à la mi-avril», dit-elle.

« Il m'a demandé combien d'argent je voulais gagner, et je lui ai dit que quelques milliers d'euros seraient bien. Il m'a dit que je ne gagnerais pas ce genre d'argent avec un dépôt de 200 €, alors il m'a donné quelques chiffres de bénéfices si je le faisais. pourrait déposer plus d’argent. Il m’a dit que la valeur du Bitcoin était à son plus haut niveau jamais vu et que le bénéfice « logement » arriverait à la mi-avril 2024, et que plus vous investissez, plus vous pourriez rapporter de bénéfices. lui où se trouvait le siège de cette entreprise et il a déclaré : « Max et moi avions l'habitude de nous parler tous les deux ou trois jours au téléphone, principalement pour me tenir au courant de mes revenus », a écrit Joan.

Puis, deux semaines après le premier contact, Max a envoyé à Joan un message sur Telegram disant : « Son service de conformité a besoin d'une pièce d'identité de ma part pour des raisons de conformité. Je lui ai donc envoyé des photos de mon permis de conduire, recto et verso, et il m'a demandé de lui envoyer des photos de mon permis de conduire. lui aussi des photos. Une photo de moi tenant mon permis de conduire.

Fin mars, Joan avait investi 8 500 €.

« J'ai demandé à Max ce qu'il adviendrait de mon solde de revenus à la mi-avril, et il m'a répondu que je pouvais retirer une partie ou la totalité de mon argent, auquel cas je ne paierais aucun impôt. Il a répondu : « Si je laissais une partie ou la totalité de mon argent. mon argent là-bas, je devrais payer des impôts, mais je ne paierais des impôts que sur mes revenus.

«Il m'a dit que j'obtiendrais une attestation fiscale pour les impôts payés en Suisse et que le taux d'imposition y est compris entre 15 et 20 pour cent. Ce type, Max, m'a envoyé une très belle lettre de Pâques pour moi et ma famille. Parfois, il me demandait si ! J’étais obligé de retirer de l’argent, alors j’ai dit « non » et j’étais heureux de continuer à faire croître mes investissements.

« Je réalise maintenant qu'il me posait cette question parce que si je voulais retirer une partie de mon argent, il m'aurait dit qu'il y aurait des impôts à payer et il m'aurait demandé de lui remettre plus d'argent pour ce retrait. »

Fin mars, elle a parlé à une amie de ses investissements.

« Elle soupçonnait vraiment que j'étais victime d'une arnaque, et lorsque j'ai recherché l'entreprise sur Google, tous les avis disaient qu'il s'agissait d'une arnaque. J'étais vraiment nerveux à l'époque à l'idée d'avoir pu me faire arnaquer. »

« J'ai donc testé Max Man en demandant le retrait de mes fonds le jeudi 4 avril 2024. Il m'a envoyé un 'formulaire de retrait' précisant que je devrais payer un impôt et une commission de 1 800 € pour un retrait de 9 000 €. . Je lui ai dit que je n'avais plus d'argent pour payer la taxe/commission. J'ai dit que j'aimerais retirer mon dépôt, auquel cas je n'aurais pas à payer d'impôts. Je lui ai alors dit que je voulais clôturer mes dépôts (c'est ainsi qu'il désigne mon argent sur le marché des changes) et il m'a dit que je faisais une très grosse erreur et que je perdrais tous mes bénéfices. Je lui ai dit que j'étais en crise financière et que j'avais besoin de l'argent de mon dépôt, qui s'élevait désormais à 8 500 euros.

Max lui a dit qu'elle devrait attendre une semaine pour obtenir l'argent et Joan a remercié Max pour son aide.

« Le lundi 8 avril, j'ai ouvert l'application Telegram pour envoyer à Max un message concernant la récupération de mon argent et j'ai découvert que Max avait supprimé toutes nos discussions Telegram et que la connexion à mon compte d'investissement avait également disparu. »

La triste vérité est que son argent a probablement disparu pour de bon, car elle a clairement été victime d’une arnaque à l’investissement.

Nous avons envoyé les détails à Niamh Davenport de FraudSmart, l'unité de cybercriminalité de la Fédération irlandaise des banques et des paiements.

« Les escroqueries liées aux investissements, y compris les escroqueries liées aux cryptomonnaies, sont en augmentation et deviennent de plus en plus sophistiquées et sophistiquées », dit-elle. « Les fraudeurs se cachent derrière des sites Web qui peuvent sembler légitimes et utilisent les médias sociaux et la publicité en ligne pour cibler leurs victimes en leur promettant des rendements élevés, les incitant souvent à partager des informations personnelles et financières.

« Une fois que la victime accepte de payer et que les fonds arrivent sur le compte de l’escroc, le criminel transfère rapidement les fonds vers plusieurs autres comptes, souvent à l’étranger, où ils sont ensuite encaissés. »

Elle a souligné que quiconque pense avoir été victime d'une fraude doit le signaler le plus rapidement possible à sa banque et à An Garda Síochána. Chaque cas de fraude signalé fait l'objet d'une enquête approfondie et les banques et institutions financières feront de leur mieux pour aider les clients à récupérer leur argent, si possible.

Davenport ajoute que comme les fraudeurs ciblent de plus en plus directement les consommateurs, « il est important que nous sachions tous comment nous protéger. En particulier, le public doit se méfier des publicités en ligne et sur les plateformes de médias sociaux, même s'il s'agit de publicités payantes ou soutenues. en utilisant des marques ou des noms de marque familiers Arrêtez de réfléchir et contactez l'entreprise de manière indépendante pour vérifier les détails.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

-

entertainment2 ans ago

Découvrez les tendances homme de l’été 2022

-

Top News2 ans ago

Festival international du film de Melbourne 2022

-

Tech1 an ago

Voici comment Microsoft espère injecter ChatGPT dans toutes vos applications et bots via Azure • The Register

-

science2 ans ago

Les météorites qui composent la Terre se sont peut-être formées dans le système solaire externe

-

science3 ans ago

Écoutez le « son » d’un vaisseau spatial survolant Vénus

-

Tech2 ans ago

F-Zero X arrive sur Nintendo Switch Online avec le multijoueur en ligne • Eurogamer.net

-

entertainment1 an ago

Seven révèle son premier aperçu du 1% Club

-

entertainment1 an ago

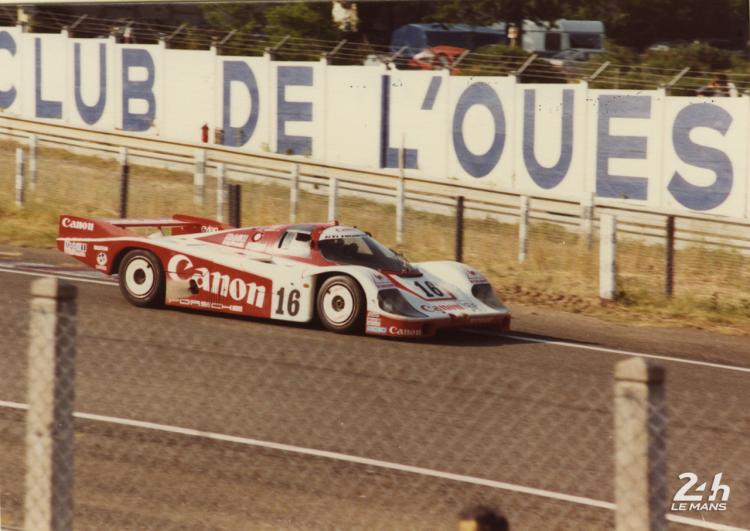

Centenaire des 24 Heures – La musique live fournit une bande-son pour la course