Economy

Global tax rate could push Ireland to raise an additional €12.4 billion

Ireland could collect an additional €12.4 billion in corporate tax under the proposed global minimum rate of 15%.

That’s according to figures released today by the European Union Tax Observatory, an independent think tank based in Paris that receives funding from the European Union.

Based on OECD tax figures for 2016 and 2017, the observatory estimates that the rule change would have increased Ireland’s corporate tax by 7.7 billion euros, or 91%, in 2016 and 12.4 billion euros, or 137% in 2017.

Luxembourg would have seen its corporate tax increase by 108% in 2016 and 182% in 2017.

The average increase in the EU would have been 15% in 2016 and 18% in 2017.

The OECD average will be an increase of 7% in 2016 and 12% in 2017.

The Observatory report found that the EU-27 will see combined corporate tax revenue increase by a quarter, or €83 billion.

The United States could benefit 57 billion euros annually.

Developing countries will benefit less with an increase of 6 billion euros for China, 4 billion euros for South Africa and 1.5 billion euros for Brazil.

The report concludes that developing and low-income countries will benefit less since most multinational corporations are based in high-income countries.

If « deductions », which are tax breaks for spending on payroll and investing in factory sites and other assets in countries, were applied, the potential revenue in the EU27 would drop to around €64 billion.

Over ten years, as the « deductions » depreciate, the potential incremental revenue could be reduced by 14%.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Découvrez l'intérieur de la nouvelle maison de Mary Kennedy à Dublin

La maison de Mary Kennedy dégage une énergie chaleureuse et accueillante. L'odeur du gâteau au citron fraîchement sorti du four remplit la cuisine, une demande plutôt sophistiquée de son petit-fils Buddy pour son cinquième anniversaire.

Des œuvres d'art et des photos Polaroid de ses petits-enfants bien-aimés (ils sont quatre et un autre ensemble les rejoindra cet été) sont fièrement exposées, tandis que des jouets jonchent le sol, preuve d'un week-end de Pâques chargé en famille.

Dans le nouveau numéro de RSVP à l'appel principalMary partage sa nouvelle demeure, parle de ses éléments non négociables lors du déménagement et de la façon dont elle a fait évoluer son style d'intérieur.

« Ça a été amusant. C'est un plan d'étage ouvert, c'est lumineux, c'est neuf. Cela fait plus d'un an que j'ai emménagé. J'ai réduit les locaux parce que ma maison était devenue trop grande. C'était une décision importante à prendre », mais là Il y avait quelques éléments sur lesquels j'ai insisté dans la nouvelle maison : l'un d'eux était un jardin orienté au sud, et j'ai dû avoir quatre chambres parce que ma fille vit à Limerick et qu'elle avait besoin d'un endroit où rester.

« C'est aussi dans la même paroisse, donc j'ai toujours les mêmes amis et quelques nouveaux, ce qui est vraiment important. Même église, mêmes supermarchés, même centre communautaire, toutes ces choses sont toujours les mêmes, ce qui est vraiment sympa. Je ne le fais pas. je sais si je pouvais « En quittant la région, vous êtes en quelque sorte propriétaire de vos racines. »

Lisez l'interview complète de Mary et découvrez-en davantage dans le nouveau numéro de RSVP Home, disponible dès maintenant.

Photographie de Philipp Lauterbach

Coiffure et maquillage : Lauren Edgerton @lorringerton / @makemeblush.ie

Conception : Gilly, Drogheda. @magénérationvêtementsstore Tél : 041-9818695

Le salon de Maryam

Cet ensemble de meubles a plus de 40 ans et est toujours aussi solide

Le nouveau jardin de Mary a une magnifique cour

Mary a préparé un gâteau au citron pour le 5e anniversaire de son petit-fils Paddy – son préféré

Cuisine ouverte avec salle à manger

Ce buffet était un cadeau de mariage offert aux parents de Mary en 1953.

RSVP, avril 2024

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Connor Pope entre dans le nouvel entrepôt de livraison d'IKEA à Dublin – The Irish Times

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/SBD53DZR6NG4BPGPWLHOWKLSQQ.jpg)

La référence officielle pour les entrepôts géants d'Irlande sont désormais les stades GAA, avec un nouvel entrepôt de livraison Ikea à l'extérieur de Rathcoole, dans le comté de Dublin, qui pèse sur deux impressionnants Croke Parks.

Il est bien sûr de petite taille par rapport au centre de distribution Amazon voisin, qui est plus proche de cinq Croke Parks, mais il est énorme par toute autre mesure imaginable.

À partir de là, jusqu'à un demi-million de colis composés de meubles plats, de sacs de congélation bon marché, d'un éclairage tamisé, de coussins plus moelleux et le reste seront expédiés à travers l'Irlande plus rapidement que jamais dans les mois à venir.

Cependant, ce n'est pas une ruche d'activité lorsque vous visitez l'Irish Times. Au contraire, c’est un calme mortel et il n’y a pratiquement aucun pécheur dans cet endroit. Elle est comme la Mary Celeste du monde des emballages plats.

[ New Ikea distribution centre to cut delivery times to three days ]

Les quelque 120 employés qui déplacent normalement les articles des étagères encombrantes vers les baies de distribution ont tous été envoyés en pause pour s'assurer que nous ne tombons pas entre les mains du voyou Billy, explique Jacob Bertilson, responsable de la satisfaction client chez IKEA Irlande. Des livres pendant que nous sommes en tournée de presse.

Lors de l'ouverture officielle, lui et un groupe de cadres supérieurs d'IKEA ont été rejoints par certains des quelque 200 employés qui travailleront dans l'entrepôt, avec l'ambassadrice suédoise Lena van der Weyden également présente pour célébrer ce grand jour pour le commerce de détail suédois. géant.

L'entrepôt s'étend sur plus de 27 000 mètres carrés et abrite actuellement environ 9 000 des quelque 11 000 produits, petits et grands, qu'IKEA stocke en Irlande. Désormais opérationnel, le géant suédois promet aux e-acheteurs leur commande sous trois jours, avec des frais de livraison allant de dix à 50 € selon le montant de la commande.

D'une certaine manière, l'entrepôt ressemble à la zone d'un magasin IKEA avec tous ses meubles emballés à plat, mais ici, les étagères s'élèvent beaucoup plus haut dans le ciel.

L'autre différence majeure est que les produits ici ne sont pas retirés par les consommateurs et amenés à l'extérieur pour des jeux de voiture de Tetris joués par des acheteurs nerveux qui font de leur mieux pour ranger tous leurs achats emballés dans des chaussures.

C'est plus calme ici, et les produits sont retirés des étagères par un personnel dédié conduisant des chariots élévateurs et déposés dans des points d'emballage informatisés où ils sont assemblés et envoyés à travers l'Irlande dans la nouvelle flotte de véhicules électriques (VE) d'IKEA. .

Au cours des 12 prochains mois, IKEA affirme qu'elle livrera environ un demi-million de commandes, le nouveau centre de distribution remplaçant une unité précédemment utilisée à Peterborough, avec des délais de livraison réduits à trois jours.

L'entrepôt est doté d'une classe énergétique de bâtiment (Ber) de A2 et d'un nombre enviable de points de recharge pour véhicules électriques pour aider Ikea à passer à des services exclusifs de livraison à domicile zéro émission.

Désormais, les clients disposant des codes électroniques Dublin recevront leurs commandes à emporter dans des véhicules zéro émission, et IKEA s'engage à garantir que toutes les livraisons aux clients à travers l'Irlande se feront exclusivement dans des véhicules zéro émission d'ici août 2025.

Marsha Smith, vice-présidente exécutive d'IKEA Irlande, sourit en parlant du passé, du présent et du futur.

Elle dit que le détaillant cherche depuis de nombreuses années à ouvrir un centre de distribution en Irlande. « Heureusement, nous avons connu un grand succès ici ces dernières années, ce qui signifie que nous avons pu investir dans cette unité. »

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/5PZ4ZVMMMVA4NGOQZCVFUWALR4.jpg)

Elle souligne que cela ne signifie pas qu'il s'agit de rideaux pour le magasin lui-même, car elle dit qu'il y a quand même eu une « visite incroyable » au magasin de Ballymun.

Elle dit qu'à mesure que les gens s'habituent à ses offres en ligne, les gammes qu'ils achètent s'élargissent.

« Il y a quelques années, nous ne voyions pas de gens acheter des cuisines en ligne, et maintenant ils achètent l'ensemble complet ; mais si vous souhaitez simplement commander trois tasses, vous pouvez les faire livrer chez vous très rapidement.

Jan McCabe, PDG de Retail Excellence, était également présent à l'ouverture et a salué la croissance d'IKEA.

« IKEA est à l'avant-garde dans de nombreux secteurs et a réinventé la façon de faire du shopping. Je ne pense pas qu'il y ait une maison en Irlande qui n'ait pas un morceau d'IKEA. Pour moi, c'est un régal parce que je suis. un détaillant.

Pour d’autres qui n’en sont peut-être pas aussi amoureux, bien sûr, cela peut conduire directement à une thérapie de couple lorsqu’ils tombent sur l’ensemble plat.

Mais c'est une toute autre histoire.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Plus de 150 emplois prévus pour la réouverture des mines de Tara – The Irish Times

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/MLMC4U7P2GVR3GAKNAEKMG3G3E.jpg)

Environ 160 emplois devraient être supprimés à Tara Mines dans le cadre d'un accord proposé entre le propriétaire suédois de l'installation et les syndicats représentant les travailleurs de l'entreprise, qui verrait la réouverture progressive du site.

Les termes de l'accord, conclu tôt mercredi matin à la Commission des relations du travail, stipulent que toute perte d'emploi se fera sur une base volontaire. La production dans l’usine de Co Meath appartenant à Boliden a été arrêtée en juillet dernier, avec 650 travailleurs temporairement licenciés après ce que l’entreprise a qualifié de « pertes financières importantes et insoutenables » dans un contexte de chute des prix mondiaux du zinc.

Au moins 50 personnes auraient pris leur retraite ou pris une retraite anticipée au cours des neuf derniers mois.

L'accord récemment en cours devrait stipuler des conditions de cinq semaines de salaire pour chaque année de service, y compris les avantages légaux, pour les employés qui acceptent d'être licenciés. Il est également entendu qu'il apporte des garanties concernant le maintien des niveaux de salaires actuels et certaines garanties concernant le recours futur à la main-d'œuvre directe vis-à-vis de sous-traitants externes.

Au moins 160 employés contractuels travaillaient dans l'installation au moment de sa fermeture temporaire.

L'intention est désormais de commencer à rouvrir l'établissement à partir de juin, même si aucune date définitive n'a encore été fixée.

La société a cherché à apporter un large éventail de changements aux pratiques de travail à la mine en modifiant les horaires de travail et les horaires, et il est entendu que certains de ces changements ont été intégrés dans le nouvel accord.

Les termes de l'accord sont encore en cours de finalisation par les responsables du WRC mercredi matin mais devraient être signés par les deux parties. Il sera soumis aux superviseurs d'atelier de la mine au début de la semaine prochaine avant d'être voté par tous les différents membres du syndicat, mais il est entendu qu'il sera recommandé par les responsables de Siptu, Unite et Connect.

Dans une lettre envoyée au personnel mercredi matin et consultée par l'Irish Times, Poliden a déclaré que les propositions, si elles étaient acceptées, permettraient la réouverture de la mine et le retour progressif du personnel. Toutefois, il a déclaré que les propositions entraîneraient des changements dans l'exploitation de la mine, dont les détails devraient être partagés avec les employés dans les prochains jours.

Unite, Siptu et Boliden ont été contactés pour commentaires.

Plus tôt cette année, une guerre des mots a éclaté entre les représentants des travailleurs et Boliden après que la multinationale suédoise a proposé un plan de sauvetage qui, selon Unite, réduirait de manière permanente la main-d'œuvre de la mine de plus d'un tiers et modifierait considérablement les termes et conditions des travailleurs restants. .

« Les syndicats ont présenté des propositions réalistes qui auraient pu aboutir à des économies significatives tout en protégeant les emplois et le niveau de vie, mais elles ont été ignorées et l'entreprise adopte désormais une approche de « coupe et brûlage » en ce qui concerne les emplois, les salaires et les conditions de travail des travailleurs », a-t-il déclaré. dit. La secrétaire générale de l'ONU, Sharon Graham, a déclaré dans un communiqué. « Le comportement de Boliden est totalement inacceptable et à moins que l’entreprise ne change sa position, le gouvernement doit intervenir pour assurer l’avenir de la mine. »

Unite a accusé Bulliden de revenir sur les termes et conditions des travailleurs restants et a déclaré que le gouvernement devait intervenir pour garantir « de bons emplois et de bonnes compétences » à la mine Co. Meath à moins que l'entreprise ne retire ses propositions.

Tara Mines a par la suite signalé une baisse de 61 pour cent de ses revenus l'année dernière, en raison de la baisse des prix du zinc, de la baisse des qualités des métaux, de la faiblesse du dollar américain et de la baisse de la production due à la suspension des opérations.

Les syndicats avaient précédemment demandé une intervention gouvernementale majeure pour soutenir la mine face à ce qui était considéré comme des problèmes de coûts temporaires liés au prix international du zinc et à la hausse des prix de l'énergie à la mine en raison de la hausse des prix du pétrole et du gaz en 2016 suite à l'invasion russe de l'Ukraine. .

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

-

entertainment2 ans ago

Découvrez les tendances homme de l’été 2022

-

Top News2 ans ago

Festival international du film de Melbourne 2022

-

Tech1 an ago

Voici comment Microsoft espère injecter ChatGPT dans toutes vos applications et bots via Azure • The Register

-

science2 ans ago

Les météorites qui composent la Terre se sont peut-être formées dans le système solaire externe

-

science3 ans ago

Écoutez le « son » d’un vaisseau spatial survolant Vénus

-

Tech2 ans ago

F-Zero X arrive sur Nintendo Switch Online avec le multijoueur en ligne • Eurogamer.net

-

entertainment1 an ago

Seven révèle son premier aperçu du 1% Club

-

entertainment1 an ago

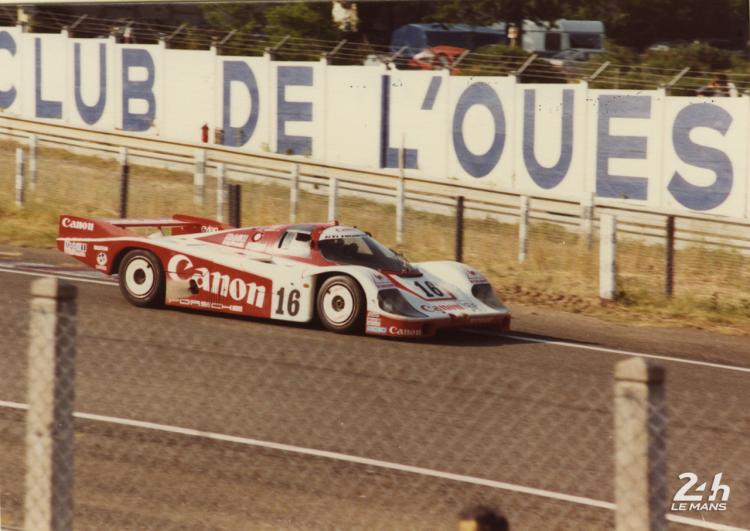

Centenaire des 24 Heures – La musique live fournit une bande-son pour la course