Economy

Has the pandemic permanently changed the ways we spend?

Covid-19 has undoubtedly changed many aspects of our lives, some of which we hope will return once the clouds have cleared from the pandemic.

However, there are some areas where our habits may have changed permanently and we are unlikely to ever fully return to the old ways.

One example of this is our relationship with our money and how we spend it.

Everything from online shopping to food delivery and an accelerating decline in cash use have been hallmarks of the pandemic.

And there were other indirect effects of Covid affecting our relationship with our hard-earned euro.

For example, things became more expensive due to inflation, and we had to be more patient as consumers because supply chain difficulties meant we had to wait longer for products to reach our doors.

Big Bang Change

Vladimir Lenin quote ‘There are decades when nothing happens; there are weeks when contracts happen’ ‘probably opportune because we look forward to life after Covid.

When we receded from the sanctity of our homes in March 2020, we had to adapt to new ways of doing things and instead of going out for our services, they came to us.

But some couldn’t and our spending simply dwindled.

The Central Bank concluded in a report on the impact of COVID-19 on consumer spending at the end of 2020.

The study found that total retail spending rose from 47% of card spending in 2019 to 55% a year later, with reallocation driven largely by changes in spending on groceries – supermarkets are one of the few outlets we can visit in closed case. .

In contrast, as has been well documented, hospitality and event venues suffered.

According to figures from the Central Statistics Office, household spending fell by 10 billion euros in 2020 with the biggest impact on spending in restaurants and hotels, which fell by 6.5 billion euros.

A savings boom giving way to a spending boom?

Much of the unspent money in deposit accounts ended up with the savings rate skyrocketing among many Irish consumers – who already have a tendency to put money on deposits.

According to the latest data from the Central Bank, the level of deposits in Ireland reached an all-time high of 136 billion euros at the end of October.

This has increased by 24 billion euros since the outbreak of the pandemic.

But there are signs that money chains have loosened up a bit throughout 2021 as consumers slowly begin to part with their Covid savings.

Central bank figures for November showed household deposits fell by 1.4 billion euros per month, the first time since the summer that withdrawals exceeded deposits.

The Bank of Ireland Savings and Investments Barometer in the run-up to Christmas recorded the largest quarterly drop in attitudes towards savings among households indicating that our savings methods were regressing somewhat.

Mortar clicks

With retail outlets reopening throughout 2021, consumers have returned in droves to main streets and malls, contributing to record tax collections.

VAT receipts in Treasury VAT returns for 2021 indicated a healthy recovery in consumption last year, with receipts totaling €15.4 billion, a nearly quarterly increase from 2020.

But the internet spending habit, which many took for the first time during the pandemic, has shown no signs of abating dramatically.

According to a CSO study on digital consumer behaviour, about four out of five consumers purchased goods or services online last year with people in the 16-44 age group likely to do so.

A consumer survey conducted by KPMG earlier in the year revealed that more than two-thirds of them said they are doing more online shopping than they did before the pandemic.

However, while more and more retailers are following this trend by making their products and services available online, much of the spending that goes through online channels still ends up leaving the country.

An analysis by payments app Revolut of Black Friday spending in December concluded that while nearly three-quarters of Black Friday spending was kept within the state, with the majority of spending done in person, the bulk of the spending was handled online. On foreign websites – about two-thirds of them actually.

This was an increase in 2020 when 39% of online shopping by Irish Revolut customers was done through local websites, and 61% was ordered from external sites.

Therefore, it may be a good idea to keep some old habits in place for now.

Despite the emergence of a highly transmissible omicron variant of Covid, consumers continued to shop in-store in the Christmas period as the last-minute rush to stores continued as a feature of the retail scene, despite public health warnings and advice to shop early to avoid disappointment arising from the difficulties supply chain.

According to spending data released by the Bank of Ireland in December, about two-thirds of people preferred Christmas shopping in person rather than online.

Revolut spending data indicated spending increased in December at outlets where last-minute purchases including gems, department stores and toy stores are usually made.

Cash is no longer king?

No matter where people spent them, they likely didn’t make their purchases with cash.

After raising the minimum at which consumers could « benefit » from their purchases from 30 euros to 50 euros at the start of the pandemic, contactless payments inevitably rose.

The preference for cards over cash appears to have continued with the latest data from the Association of Banks and Payments showing that contactless payments reached a new high between July and September with around 234 million payments totaling approximately €3.8 billion being completed.

That was an increase of about 100 million « clicks » during the last quarter of 2019 before the outbreak of the pandemic, and in monetary terms, it was an increase of more than 2 billion euros.

It was the highest level recorded since BPFI began collecting data in 2016.

Banks and retailers are also catalysing this shift, with the former generally charging higher fees for ATM withdrawals rather than eavesdropping, while the latter, in some circumstances, choosing not to accept cash.

It looks like the end of the road may be near for liquidity eventually, but the ECB is certainly not giving up on it yet with plans to completely redesign the euro in the coming years.

Patience is needed with rising costs

One of the indirect effects of the pandemic on our spending patterns has been the recent decline in the purchasing power of the euro.

Consumer price inflation—something that has been largely absent for most of the past decade—is back with some gusto as economies bounce back from lockdown.

To a large extent, if it is largely confined to the energy sector with the costs of transportation and household utilities rising significantly, but this has an indirect impact on other categories, some of which have not yet been achieved.

For example, food producers and manufacturers seem to absorb significant cost increases which are expected to eventually pass on to the final consumer at some point.

So far, consumer price inflation in the food and beverage sector has remained below 1% compared to more than 5% in the broader consumer goods basket.

Some of the cost increases we see in areas like construction are the result of delays in getting materials to their final destination – and supply chain disruptions being the phrase we’ve all come to be familiar with – and shortages translate into higher prices.

The ECB’s mantra is to be patient and it will pass, but how long will that take anyone’s guess, and will they have to take action in the meantime, which means a potential rate hike that will affect most borrowers?

Getting back to normal will take some time, but the ‘new normal’ will likely look very different than it did before.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Une femme a perdu 2,7 millions d'euros sur 3 millions d'euros pour un peu plus de 1 300 euros – The Irish Times

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/7FHEWBJYGBFKZAB3JBGKTDKSJ4.JPG)

Les dettes d'une femme d'environ 3 millions d'euros ont fait l'objet d'une annulation de 2,7 millions d'euros en échange d'un paiement de 1 316 euros aux créanciers et elle conservera son domicile familial selon les termes d'un accord d'insolvabilité personnelle (PIA) approuvé par la Haute Cour.

Un arrangement similaire a été approuvé séparément pour le mari de la femme qui avait des dettes de 2,66 millions d'euros, provenant pour la plupart des mêmes prêts, qui ont été annulées pour un paiement de 1 316 euros.

Les arrangements de verrouillage ont été approuvés par le juge Alexander Owens pour Thomas Johnson et son épouse Valerie, tous deux âgés de 60 ans et retraités, avec une adresse à Drumrey Road, Dunshoughlin, comté de Meath. Le tribunal a appris que Johnson travaillait à temps plein comme soignante de sa mère.

En ce qui concerne la demande déposée lundi par l'avocat Keith Farry pour le praticien de l'insolvabilité personnelle Nicholas O'Dwyer pour les deux candidats, le juge a été convaincu que les arrangements répondaient aux critères de consentement en vertu des lois sur l'insolvabilité personnelle.

Dans des documents judiciaires, les dettes totales de Johnson s'élevaient à 2 984 millions d'euros, dont environ 2,2 millions d'euros, sous forme de prêts personnels, étaient dus à Everyday Finance, qui faisait partie de plusieurs créanciers chirographaires qui ont voté contre le plan de mise en œuvre du projet proposé au Parlement. assemblée des créanciers. . Les dettes totales de Johnson, liées pour la plupart aux mêmes prêts, s'élevaient à 2 976 millions d'euros.

Le PIA proposé était soutenu par Mars Capital Ireland DAC, un créancier garanti qui doit environ 618 000 € sur une hypothèque garantie sur la maison du couple à Dunshoughlin. La valeur marchande actuelle de ce bien est de 275 mille euros, ce qui représente un déficit d'environ 343 mille euros.

Aux termes de l'accord de mise en œuvre du projet, Johnson paiera 1 316 euros aux créanciers en échange de l'annulation de 2,66 millions d'euros de dette.

Johnson a déclaré dans une déclaration sous serment qu’une somme totale de 200 000 euros devait être payée dans les six mois suivant l’approbation par le tribunal de l’organisme de mise en œuvre du projet. Elle a déclaré que cela serait payé grâce au produit de la vente de la maison de sa mère à Sutton, Dublin. Selon des documents judiciaires, sa mère emménagera dans la maison de sa fille.

Le solde de l'hypothèque résidentielle de Dunshaughlin, dans le cadre du PIA, sera réduit à 275 000 € et le taux d'intérêt sera réduit de 4,15 pour cent à un taux fixe de 3 pour cent. Les remboursements hypothécaires de 665 € seront payés pendant six mois de PIA et par la suite pour la durée hypothécaire prolongée de 11 ans. Le solde impayé de 343 109 € sera alors amorti.

La Mercedes Vito de Mme Johnson a été exclue du PIA parce qu'elle devait être sous la garde de sa mère. La Nissan de son mari a également été exclue de son PIA en raison de l'emplacement de leur domicile.

Le revenu net de Mme Johnson était estimé à 1 851 € par mois et celui de son mari à 1 243 €. Après déduction des frais fixés, des frais de subsistance raisonnables et des versements hypothécaires, une contribution mensuelle de 21,60 € et de 10,99 € est mise à la disposition de l'organisme de mise en œuvre du projet.

Dans un affidavit, M. O'Dwyer a déclaré que le PIA fait partie d'un accord imbriqué qui permet une distribution plus importante aux créanciers que ce ne serait le cas dans le cadre d'une procédure de faillite. On estimait que ces arrangements offraient des chances raisonnables d'être exécutés et offraient de meilleurs résultats pour les deux débiteurs que la faillite. Comme l'exige la loi, plus de la moitié d'une certaine catégorie de créanciers ont soutenu l'accord, a-t-il déclaré.

S'abonner à Alertes push Et recevez les meilleures nouvelles, analyses et commentaires directement sur votre téléphone

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Un projet de transition massive vers les véhicules électriques dans toute l’UE se heurte à des problèmes, préviennent les auditeurs

Ils affirment que la production de batteries de voitures électriques en Europe coûte trop cher pour réaliser des ventes de masse.

Une batterie fabriquée dans l’UE coûte actuellement 15 000 € et les matières premières proviennent de pays extérieurs à l’Union.

Cela incitera l’Union européenne à tenter d’augmenter ses ventes, soit en s’appuyant sur des voitures importées de Chine moins chères, soit en injectant d’énormes subventions sur le marché de l’Union européenne.

Ils affirment également que les infrastructures publiques de recharge des véhicules électriques sont très médiocres dans une grande partie de l’Europe, la majorité des points de recharge étant concentrés dans seulement trois pays.

Les auditeurs avertissent que de grands espoirs reposent sur le développement des biocarburants comme alternative à l'essence et au diesel.

Ils affirment que le biocarburant est une option douteuse sur le plan environnemental, qu’il n’est pas disponible en quantité suffisante et que son prix n’est pas compétitif.

« Nous sommes confrontés à une bataille difficile », a déclaré Annemie Turtelbaum, de la Cour des comptes européenne.

Les émissions dues aux transports représentent un quart des émissions totales dans l’Union européenne, dont la moitié provient des voitures particulières.

Dans le cadre du Green Deal de l’UE, l’objectif est que toutes les voitures neuves vendues utilisent une technologie à zéro émission de carbone à partir de 2035.

Les ventes de voitures conventionnelles ne seraient pas interdites mais une pénalité carbone serait introduite, ce qui ajouterait des milliers d'euros au prix.

Cependant, l'EPA a déclaré que les politiques actuelles visant à encourager les automobilistes à utiliser des véhicules électriques ne fonctionnent pas assez vite ni dans la mesure nécessaire.

« Pour conquérir le marché de masse, les prix doivent être réduits de moitié », a déclaré Turtelbaum.

L’autre problème est que même si les voitures essence et diesel modernes émettent moins d’émissions de carbone que les modèles plus anciens, tout gain est annulé à mesure que les voitures deviennent plus grandes et plus lourdes.

« Les émissions des voitures conventionnelles – qui représentent encore près des trois quarts des nouvelles immatriculations de véhicules – n’ont pas diminué de manière significative depuis 12 ans », a déclaré Nikolaos Milionis, membre de la Commission économique pour l’Afrique.

« Alors que les moteurs sont devenus plus efficaces, cela a été contré par des voitures plus lourdes, en moyenne 10 % plus lourdes, et des moteurs plus puissants nécessaires pour transporter ce poids, en moyenne 25 % plus puissants. »

Les auditeurs ont constaté que les voitures hybrides rechargeables produisent plus d’émissions que ce qui est indiqué.

« L'écart entre les émissions mesurées en laboratoire et celles sur route est en moyenne de 250% », ont-ils précisé.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

L'application de rencontres gay Grindr a été poursuivie pour avoir prétendument partagé la séropositivité de ses utilisateurs avec des tiers | Nouvelles du Royaume-Uni

Un cabinet d'avocats affirme que des centaines d'utilisateurs de Grindr ont signé une plainte alléguant que des informations hautement privées, y compris leur statut sérologique, avaient été partagées avec des tiers sans leur consentement.

Lundi 22 avril 2024 à 18h01, Royaume-Uni

Des centaines d'utilisateurs de l'application de rencontres gay Grindr ont affirmé que l'entreprise partageait leurs informations privées, y compris leur séropositivité, avec des tiers, a déclaré lundi un cabinet d'avocats.

Austin Hayes a déclaré avoir déposé un recours collectif en matière de protection des données devant la Haute Cour de Londres et a affirmé que des milliers d'utilisateurs de Grindr au Royaume-Uni pourraient avoir été concernés.

La société allègue que les informations hautement sensibles des utilisateurs, notamment leur statut sérologique et la date du dernier test VIH, ont été fournies à des tiers à des fins commerciales.

Environ 670 personnes ont signé le procès pour abus qui auraient eu lieu entre 2018 et 2020, et des milliers d’autres devraient se joindre à l’affaire, a-t-elle déclaré.

« Grindr doit à la communauté LGBTQ+ d'indemniser ceux dont les données ont été compromises et ont subi une détresse en conséquence, et d'assurer la sécurité de tous ses utilisateurs lors de l'utilisation de l'application », a déclaré Chaya Hanumanji, directrice générale d'Austin Hayes, dans un communiqué. . Où qu’ils se trouvent, sans crainte que leurs données soient partagées avec des tiers. »

Un porte-parole de Grindr a déclaré : « Nous nous engageons à protéger les données de nos utilisateurs et à respecter toutes les réglementations applicables en matière de confidentialité des données, y compris au Royaume-Uni.

Grindr n'a jamais partagé les informations de santé signalées par les utilisateurs à des « fins commerciales » et n'a jamais monétisé ces informations.

« Nous avons l’intention de répondre avec force à cette allégation, qui semble reposer sur une mauvaise interprétation de pratiques datant de plus de quatre ans, avant début 2020. »

En savoir plus sur Sky News :

Huw Edwards démissionne de la BBC

Warwick Davis s'excuse pour son inquiétude après avoir publié sur les réseaux sociaux

Ce n'est pas la première fois que les pratiques de protection des données de Grindr sont examinées de près.

En 2021, c'était Amende de 5,5 millions de livres sterling Par les autorités norvégiennes concernant leur traitement des données personnelles des utilisateurs.

L'Autorité de protection des données (DPA) du pays a constaté qu'elle avait violé les règles du RGPD en partageant des données, notamment la localisation GPS, les informations de profil utilisateur et même le fait que les utilisateurs sont sur Grindr, ce qui pourrait révéler leur orientation sexuelle et mérite donc une protection particulière.

Grindr a également été réprimandé en 2022 par l’Information Commissioners Office (ICO) du Royaume-Uni pour ne pas avoir « fourni des informations de confidentialité efficaces et transparentes aux personnes concernées au Royaume-Uni concernant le traitement de leurs données personnelles ».

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

-

entertainment2 ans ago

Découvrez les tendances homme de l’été 2022

-

Top News2 ans ago

Festival international du film de Melbourne 2022

-

Tech1 an ago

Voici comment Microsoft espère injecter ChatGPT dans toutes vos applications et bots via Azure • The Register

-

science2 ans ago

Les météorites qui composent la Terre se sont peut-être formées dans le système solaire externe

-

science3 ans ago

Écoutez le « son » d’un vaisseau spatial survolant Vénus

-

Tech2 ans ago

F-Zero X arrive sur Nintendo Switch Online avec le multijoueur en ligne • Eurogamer.net

-

entertainment1 an ago

Seven révèle son premier aperçu du 1% Club

-

entertainment1 an ago

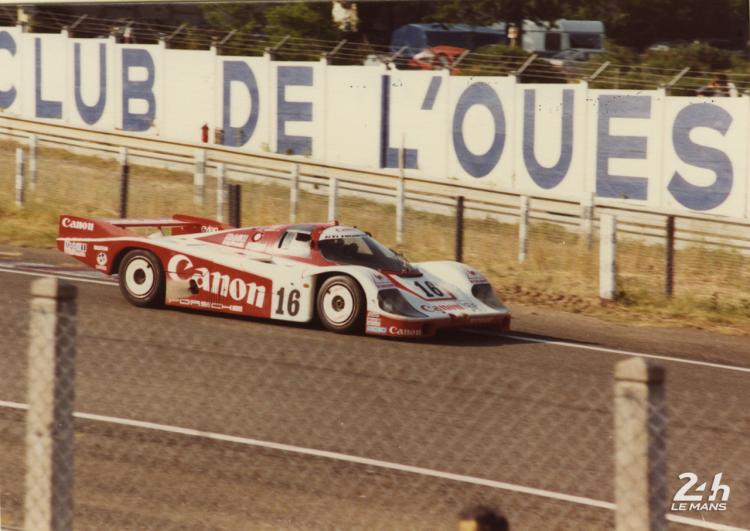

Centenaire des 24 Heures – La musique live fournit une bande-son pour la course