Economy

Johnny Ronan Group reports a loss of 30.34 million euros after writing off its assets

One of the main holdings in the property group owned by developer Johnny Ronan last year posted a pre-tax loss of 30.34 million euros.

According to the calculations provided by Ardquade Ltd, the company recorded the loss mainly as a result of a non-cash write-off of €25.48 million in the value of the Group’s investment property portfolio along with exceptional costs of €4. 9 million.

The pre-tax loss of €30.34 million followed a pre-tax profit of €1.8 million in 2019.

Revenues

The company’s revenue increased last year by 6 percent from 21 million euros to 22.3 million euros.

Ardquade revenue consists of €11.9 million from rent, €6.2 million management fees, €2.73 million other revenue and €1 million recharge of development costs.

Last year, the group posted an operating loss of 15.68 million euros and net interest payments of 16.46 million euros contributed to a pre-tax loss of 30.34 million euros.

The Directors state that Covid-19 has not had any material impact on the operating activities of the Group.

The Board of Directors states that the Group continues to collect rental and management fee income in full and service interest on all Group facilities.

Directors expect this to continue into the next year.

They state that they are optimistic that after the lifting of restrictions and a concomitant rise in economic activity, retail property values will rebound, and managers will continue to grow the business in the year ahead.

Pay for managers

The salary of directors last year more than doubled from 598,221 euros to 1.35 million euros consisting of salaries of 1.3 million euros and pension contributions of 51,337 euros.

The group, which owns the personal business interests of Mr. Ronan and his family members, had net assets on its balance sheet of 7.3 million euros at the end of last December.

Ardquade’s investment properties were valued on its books at €203.5 million.

The company owes 191.9 million euros to credit institutions that have a term of up to January 2022 and attract interest and owes 14.36 million euros to directors who are not attracting any interest.

A note addressing the going concern status of the Company indicates that the indicative terms relating to the refinancing of the Company’s major and minor lending facilities have been received.

Managers state that they expect new lending facilities to be in place for the coming year.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Propriété de Mount Juliet en vente pour 45 millions d'euros en tant qu'hôtel et complexe de golf – The Irish Times

:quality(70):focal(683x341:693x351)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/OQLZ3WLOR46YUKFNSBHLSDHAXA.jpg)

Tetrarch Capital est sur le point de réaliser un retour sur investissement significatif dans la propriété Mount Juliet à Kilkenny. Après avoir déboursé 15 millions d'euros pour s'assurer la propriété de l'hôtel cinq étoiles et du golf resort en 2014, la société et l'homme d'affaires Emmett O'Neill, copropriétaire de Mount Juliet, l'ont mis en vente au prix indicatif de 45 millions d'euros. .

Dans une lettre envoyée vendredi soir aux membres de Mount Juliet, le directeur de Mount Juliet, Damien Gaffney, a déclaré que les consultants en immobilier commercial JLL Ireland avaient été nommés pour « explorer le marché et gérer la vente ».

Commentant la gestion par Tetrarch de l'hôtel de 125 chambres, du restaurant étoilé Michelin Lady Helen, du parcours Jack Nicklaus Signature Design et du domaine plus vaste de 500 acres, il a déclaré que la société avait « investi très financièrement » dans le complexe et qu'elle était « très fière ». . Il a supervisé une transformation si majeure.

M. Gaffney a déclaré que les propriétaires actuels sont « ravis d’organiser deux Irish Open consécutifs en 2021 et 2022 sur notre parcours de golf emblématique Jack Nicklaus pour la première fois depuis le milieu des années 1990 – respectant la promesse que nous avons faite aux membres lors de notre acquisition. le domaine à l’été 2014. »

M. Gaffney a conclu la lettre en disant que même si le processus de vente commencerait immédiatement, « toutes les activités et opérations liées au golf se poursuivront comme d'habitude et les emplois de tous nos employés resteront sûrs et inchangés ».

Le moment de la vente pourrait être opportun car elle intervient dans la mesure où les revenus de la station ont presque doublé pour atteindre 17,6 millions d'euros en 2022, dernière année pour laquelle des comptes consolidés ont été déposés. L'opérateur de la propriété, MJBE Investments 1 Ltd, a renoué avec les bénéfices d'exploitation issus de ces revenus pour enregistrer un bénéfice d'exploitation de 699 520 €, l'organisation de l'Irish Open jouant un rôle important pour attirer des affaires.

Ce bénéfice d'exploitation fait suite à une modeste perte d'exploitation de 10 302 € en 2021, lorsque le site avait également accueilli l'Irish Open 2021.

[ Mount Juliet narrows pretax losses amid Covid closures ]

Les comptes montrent que l'encours des prêts bancaires à fin 2022 s'élevait au total à 13,65 millions d'euros, alors qu'il restait un encours supplémentaire de 24,2 millions d'euros au titre d'un prêt d'actionnaire.

En plus de souligner le retour à la rentabilité et l'organisation de l'Irish Open, les propriétaires de Mount Juliet pourraient également espérer capitaliser sur la publicité positive entourant la récente décision de la BCE d'accueillir une réunion de son conseil d'administration composé de 26 membres. Conseil là-bas en mai.

Contactée pour commentaires, une porte-parole des propriétaires de Mount Juliet a confirmé qu'ils avaient chargé JLL d'envisager de vendre la propriété pour un prix indicatif de 45 millions d'euros. La porte-parole a déclaré que la décision avait été prise après « un certain nombre de communications indésirables récentes » concernant la propriété.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Un homme qui n'a pas droit à un allègement fiscal pour la location d'une maison qu'il a quittée à cause de harcèlement raciste – The Irish Times

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/OAM557WQURAFZEKSBP6MYXLHWI.jpg)

La Cour suprême a statué contre un Pakistanais qui tentait de faire valoir son droit à un allègement fiscal pour la location de la maison que lui et sa famille avaient quittée en raison d'allégations de harcèlement raciste de la part de certains résidents locaux.

Cependant, Adnan Ahmed Siddiqui a obtenu partiellement gain de cause devant le tribunal, le juge Oisin Quinn étant d'accord avec lui sur le fait que le commissaire aux appels fiscaux (TAC) avait commis une erreur dans la façon dont il avait considéré un paiement de 85 000 € de son ancien employeur.

Le juge a déclaré que le paiement avait été effectué alors que Siddiqui était en congé de stress et qu'il faisait partie d'un accord de règlement en mars 2014 visant à retirer sa plainte auprès du Tribunal pour l'égalité pour discrimination raciale présumée.

Le Tax Appeals Commissioner (TAC) a demandé au tribunal de déterminer s'il avait raison de confirmer la décision du Commissioner of Revenue sur trois questions juridiques en vertu de la Tax Consolidation Act 1997.

Dans sa décision, le juge a déclaré que Siddiqui, qui vit et travaille en Irlande depuis 2000, a affirmé qu'il devrait être autorisé à déduire le loyer qu'il a payé pour sa nouvelle résidence des revenus locatifs qu'il a reçus des locataires qui ont emménagé dans son ancien logement. Le juge a déclaré que ses allégations de « graves incidents de harcèlement » étaient étayées par des documents fournis à la police.

Dans un discours prononcé à Dublin 14, M. Siddiqi a déclaré que sa décision en 2014 était nécessaire en raison de l'incapacité présumée de la police à lutter contre le harcèlement. Le loyer de sa nouvelle maison était plus élevé que les revenus locatifs qu'il recevait de son ancienne maison et, comme il ne voulait pas déménager, il affirmait qu'il existait un lien entre les deux paiements, de sorte que son impôt à payer devrait être réduit à zéro entre 2014 et 2017, a indiqué le juge.

Le juge Quinn était convaincu que le TAC avait raison dans ses conclusions concernant les impôts sur les revenus locatifs.

Même s’il était « profondément insatisfaisant » que M. Siddiqui et sa famille aient été expulsés en raison de harcèlement raciste, cela ne change rien à la question juridique. « Le code des impôts n’a pas de justice », a déclaré le juge, et « le coût de l’installation d’un toit n’est pas une dépense déductible ».

Par ailleurs, le Revenu a déduit 21 872 € d'impôts sur le montant à titre gracieux de 84 903 €, que M. Siddiqui a reçu en plus de sa quittance statutaire. La juge a déclaré qu'elle avait traité l'affaire comme étant liée à la cessation de son emploi de comptable financier dans une société de location de voitures, car l'accord de règlement pertinent décrivait expressément cela comme une indemnité de départ.

M. Siddiqui, qui se représente lui-même, a déclaré qu'il s'agissait essentiellement d'un règlement de sa plainte en cours devant le Tribunal pour l'égalité et d'une éventuelle plainte pour préjudice à sa santé mentale résultant de la discrimination alléguée. Le juge a déclaré que les sommes versées pour régler ces réclamations ne seraient pas imposables.

Le ministère des Finances a confirmé que TAC avait raison de considérer que le paiement était imposable et a souligné l'accord de règlement qui stipulait que M. Siddiqui devait recevoir une somme nette de 65 000 €, ce qu'il a fait. Elle a déclaré que l'accord lui-même proposait ce type de traitement fiscal et que Siddiqui avait conclu cet accord en bénéficiant des conseils juridiques d'avocats experts en droit du travail.

Le juge Quinn n'était pas d'accord, estimant que le ministère des Finances était tenu de procéder à une analyse objective de la « matrice de vérité » entourant le paiement. Il a déclaré que la correspondance de 2018 et 2019 aurait dû être considérée comme pertinente car elle indiquait le contexte du règlement.

Il a souligné que le règlement aboutissait au retrait de la demande d’égalité et prévoyait le paiement de 10 000 euros plus taxe sur la valeur ajoutée pour les frais juridiques de M. Siddiqui. Le juge a estimé qu'une fois versée l'indemnité légale de licenciement, on aurait dû se poser une « vraie question » de savoir pourquoi 85 000 € supplémentaires avaient été accordés à un salarié avec un salaire annuel de 57 000 € qui n'avait travaillé dans l'entreprise que trois fois. années. .

Le juge a déclaré que le « contexte factuel global » associé aux dispositions statutaires de l’article 192A de la loi de 1997 exigeait que l’affirmation de M. Siddiqi selon laquelle le montant avait été payé en règlement d’une réclamation soit examinée plus en détail.

Il a soutenu que le TAC avait eu tort dans son interprétation de l'entente de règlement et dans sa conclusion que le montant n'était pas celui offert pour régler la réclamation.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

La gare de Bray obtient un investissement de 3,5 millions d’euros dans un centre de voyage – The Irish Times

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/JWUFXT6XEJNKHEQOTLBQE6XG3U.jpg)

Le ministre des Transports, Eamonn Ryan, a transformé le terrain en un projet de plaque tournante des transports pour la gare de Bray dans le comté de Wicklow.

D'un coût de 3,5 millions d'euros, le projet réorganisera les services de bus à la gare de Brays Daly, modernisera les installations piétonnes et cyclables avec de nouveaux sentiers et passages à niveau élargis, introduira de nouvelles aires de repos et plantera des arbres.

Le projet, soutenu par Irish Rail, a été conçu par le cabinet de conseil Atkins Realis, avec les entrepreneurs David Walsh Civil Engineering pour la réalisation des travaux.

Le Taoiseach Simon Harris, un TD de Wicklow, a déclaré dans un communiqué qu'il était ravi du projet, qui « devrait avoir un impact significatif sur les habitants de tout le comté en fournissant des espaces publics de haute qualité pour accompagner nos bâtiments de gare historiques ». Vraiment chanceux de t’avoir.

« Nous verrons un regain d'énergie et d'activité dans la région, ce que les petites entreprises apprécieront sans aucun doute », a déclaré le Taoiseach.

S'exprimant lors du redressement, M. Ryan a déclaré : « Le nouveau pôle de transport transformera la zone autour de la gare de Bray et encouragera davantage de personnes à choisir les transports publics. Nous constatons dans tout le pays que lorsque nous améliorons les infrastructures et les installations de transport, les gens réagissent de manière très positive. » .

« Bray est une ville fantastique et prospère et elle est sur le point de s'améliorer encore grâce à ce nouveau plan du conseil du comté de Wicklow, pour les résidents locaux et les navetteurs d'abord, mais aussi pour les nombreuses personnes qui visitent. »

Le directeur général adjoint du conseil du comté de Wicklow, Michael Nicholson, a déclaré que le projet de voyage actif était « l'un des nombreux » projets déployés dans tout le comté.

« À terme, le projet bénéficiera aux principaux modes de transport tels que la marche, le vélo, les taxis, les bus et le train à la gare, et encouragera un changement de paradigme des véhicules privés vers des modes de transport plus durables », a-t-il déclaré.

Les travaux seront réalisés par étapes, en conservant partout l'accès aux commerces, aux résidences, aux transports en commun et aux commodités. Les voies d'accès alternatives requises pendant la construction seront mises en évidence à l'avance.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

-

entertainment2 ans ago

Découvrez les tendances homme de l’été 2022

-

Top News2 ans ago

Festival international du film de Melbourne 2022

-

Tech1 an ago

Voici comment Microsoft espère injecter ChatGPT dans toutes vos applications et bots via Azure • The Register

-

science2 ans ago

Les météorites qui composent la Terre se sont peut-être formées dans le système solaire externe

-

science3 ans ago

Écoutez le « son » d’un vaisseau spatial survolant Vénus

-

Tech2 ans ago

F-Zero X arrive sur Nintendo Switch Online avec le multijoueur en ligne • Eurogamer.net

-

entertainment1 an ago

Seven révèle son premier aperçu du 1% Club

-

entertainment1 an ago

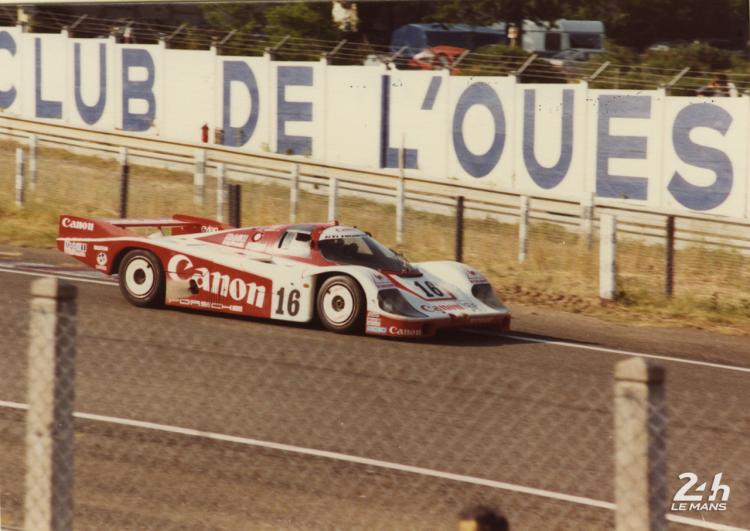

Centenaire des 24 Heures – La musique live fournit une bande-son pour la course