Economy

KBC accounts to move to Bank of Ireland by end of 2022

KBC clients are likely to see the mortgage transfer to the Bank of Ireland in late 2022 with the process complete by December next year.

Les Plachik, chief executive of the Irish arm of the Belgian banking group, told the Oireachtas committee that the transfer should take place in the fourth quarter of 2022, pending the expected completion of the CCP investigation in the first half of next year.

Notice to the mortgage borrower will be given at least 60 days before the transfer is made, but KBC checking account holders will have to make the transfer themselves, if they wish.

All account holders will need to download and register with the Bank of Ireland app themselves.

KBC – which confirmed in October it would sell the €8.8bn lead mortgage book and hand over €4.4bn in deposits to the Bank of Ireland – said it would not complete its exit from the market until all the tracked mortgage cases pending in the courts were resolved.

« Any exit will be carried out in an orderly and responsible manner, with full respect for all of our commitments, » Mr. Blajic told TDs and senators on Wednesday.

“We will not leave until we have settled all the obligations related to the tracked mortgages that we have. We will honor all our obligations. We will fulfill our obligations until the last minute.”

A record 18 million euros fine was imposed on KBC last year for what the Central Bank of Ireland described as « serious failures » of 3,741 tracked mortgage clients, including a « significant price increase » and the recall of 66 properties.

Blaczek, who took over as CEO earlier this year, said the scandal was a « very unfortunate event » and he again apologized for the bank’s actions.

He told Oireachtas’ joint financing committee that the bank will settle 27 mortgage cases pending in the courts before fully exiting the market.

« Our exit from the Irish market will not be considered complete until we do it right by all of them, » he said.

The bank has already corrected the accounts of about 3,785 clients, according to the head of risk management, Barry Darcy.

Blažek TDs warned that other banks are unlikely to enter the market here in their wake.

KBC has faced « very significant challenges » in making profits in Ireland due to high capital requirements, small market size and the global trend away from retail banks towards fintech companies.

It is driven by a number of factors. It’s competition in the Irish market. They are also some of the aspects of the higher capital requirements for the assets we have to hold in Ireland. But it’s also, as I mentioned, indicative of the structural changes that are taking place in other markets and in Ireland as well. »

Mr Blažek insisted that customers in Ireland had « an abundance of options » due to fintech applications and other non-banking products.

KBC also signed a deal this summer to sell nearly €1.1 billion of Irish non-performing loans to US-based CarVal Investors.

Mr Plachik said he had « no reason to believe that customers in general would be in a worse situation than they are » with KBC.

Meanwhile, the Financial Services Federation (FSU) responded to comments made by Mr Blajek saying that it would prefer to deal directly with bank employees rather than unions, the Labor Relations Commission (WRC) and the labor court.

“If the current system had been so beneficial to employees, hundreds of KBC employees would not have joined FSU,” said FSU Secretary General John O’Connell.

KBC has refused to attend both the WRC and the Labor Court in the past. I hope the new CEO will stick to his word that employee welfare and representation are important and agree to attend labor court if asked. »

KBC Group, the parent company of the bank, announced a profit of 601 million euros for the third quarter of this year, including a loss of 319 million euros on its Irish arm due to the sale of the Bank of Ireland.

The group said in a statement on its third-quarter results, that the loss includes a one-time impairment charge of 170 million euros and 81 million euros in staff costs, in addition to a one-time loss of 13 million euros related to the mortgage review.

The group expects to recoup around €200 million of its Irish losses once the Bank of Ireland deals close.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Le gouvernement irlandais s'attend à un excédent budgétaire de plus de 8 milliards d'euros

- auteur, John Campbell

- Rôle, BBC News NI Éditeur d'économie et d'affaires

Le gouvernement irlandais a déclaré qu’il s’attend à réaliser un excédent budgétaire de plus de 8 milliards d’euros (6,8 milliards de livres sterling) en 2024.

Cela équivaut à environ 3% du revenu national.

C’est la troisième année consécutive que le gouvernement reçoit plus d’impôts qu’il n’en dépense.

L'Irlande se trouve dans une situation inhabituelle : elle peut générer des excédents grâce à une manne exceptionnelle de recettes provenant de l'impôt sur les sociétés.

Le processus de création d’un fonds souverain utilisant certaines recettes fiscales exceptionnelles a commencé.

L’objectif est de créer un fonds doté d’actifs de 100 milliards d’euros (86 milliards de livres sterling) d’ici le milieu des années 2030.

Le ministre irlandais des Finances, Michael McGrath, a déclaré que le gouvernement espérait réaliser un excédent global de 8,6 milliards d'euros (7,4 milliards de livres sterling) pour cette année.

« Cela se base sur l'hypothèse que les recettes fiscales s'élèvent à environ 92,1 milliards d'euros, avec un taux de croissance de 4,6% », a-t-il précisé.

« Toutefois, je tiens à souligner que cet excédent dépend fortement des recettes volatiles de l’impôt sur les sociétés, qui sont passées de 4 milliards d’euros à 24 milliards d’euros en l’espace d’une décennie. »

Son ministère s'attend également à ce que l'économie intérieure irlandaise croisse de 1,9 % cette année et de 2,3 % l'année prochaine.

« Plutôt en bonne forme »

Les prévisions de cette année ont été légèrement révisées à la baisse depuis le budget d'octobre.

Le PIB irlandais est estimé à l’aide d’une mesure appelée demande intérieure modifiée (MDD).

Il exclut les effets de distorsion des multinationales sur la mesure du PIB en Irlande.

Le MDD a connu une croissance rapide après la pandémie, mais la croissance a ralenti à seulement 0,5 % l’année dernière, l’inflation et la hausse des taux d’intérêt ayant frappé le revenu disponible.

McGrath a déclaré que les éléments de preuve suggèrent que l’économie est « en assez bonne forme » et que certaines pressions inflationnistes devraient continuer à s’atténuer et « soutenir une reprise de l’activité économique ».

Il a ajouté que le « point économique le plus brillant » est le marché du travail, le pays devant rester au plein emploi technique dans un avenir prévisible.

Malgré de solides résultats économiques, la coalition au pouvoir en Irlande est en difficulté dans les sondages, car la hausse des coûts du logement et les services publics mis à rude épreuve signifient que de nombreuses personnes ont le sentiment de ne pas partager la prospérité du pays.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Éteindre une seule chose dans votre voiture peut « doubler la durée de vie » de votre moteur, explique le mécanicien

Un expert en conduite automobile possédant des décennies d'expérience a révélé une astuce simple qui pourrait doubler la durée de vie du moteur de votre voiture.

Avec près de 50 ans d'expérience en tant que mécanicien, Scotty Kilmer a appris une chose ou deux sur le fonctionnement des voitures et est impatient de transmettre sa sagesse. Ce technicien automobile chevronné partage un trait commun qui peut nuire aux performances d'un véhicule.

Dans une vidéo sur sa populaire chaîne YouTube, Kilmer a conseillé aux conducteurs de désactiver le démarrage/arrêt automatique de leur voiture, ce qu'utilisent de nombreuses voitures modernes.

Lire la suite : Les automobilistes irlandais paient toujours plus pour le carburant que l’été dernier, malgré quatre mois de baisse des prix

Bien que ces fonctionnalités aient gagné en popularité ces dernières années en raison de leur capacité à réduire les émissions tout en augmentant l'économie de carburant, Kilmer n'en est pas si sûr, expliquant que la technologie pourrait simplement entraîner une usure plus rapide du moteur.

Il a déclaré: « [Turning it off] C'est une chose intelligente à faire. La technologie marche/arrêt est la chose la plus stupide qui ait été introduite depuis des années. 97 % de l'usure se produit lorsque vous démarrez votre voiture, alors souhaitez-vous continuer à la démarrer et à l'éteindre ? Pas si vous voulez que votre voiture dure plus longtemps.

Heureusement, la fonction stop/start peut être facilement désactivée à l'aide d'un interrupteur à bascule que l'on trouve généralement sur le tableau de bord, souvent marqué de la lettre A entourée d'une flèche circulaire. Une petite lumière indique généralement lorsque le paramètre est désactivé.

Les conseils du mécanicien ont choqué les utilisateurs des réseaux sociaux, car de nombreux propriétaires de voitures ont afflué vers les commentaires pour le remercier de ses conseils.

L'un d'eux a commenté : « Je conduisais récemment une voiture de location dotée de cette fonctionnalité, et après avoir réalisé que la voiture ne s'arrêtait pas à chaque feu rouge, j'ai réalisé ce qui se passait. Je pensais que c'était… pire pour le moteur que de simplement tourner au ralenti. »

Un autre a déclaré : « J’ai déjà testé une voiture avec cette fonction et j’ai trouvé cela ennuyeux. »

Rejoignez le service d'actualités de l'Irish Mirror sur WhatsApp. Cliquez sur ce lien Recevez les dernières nouvelles et les derniers titres directement sur votre téléphone. Nous proposons également aux membres de notre communauté des offres spéciales, des promotions et des publicités de notre part et de celles de nos partenaires. Si vous n'aimez pas notre communauté, vous pouvez la consulter à tout moment. Si vous êtes curieux, vous pouvez lire notre site internet Avis de confidentialité.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Excédent budgétaire prévu de 8,6 milliards d’euros malgré une « perte de dynamique économique » – Irish Times

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/FAS6WGTVVNEWNLBVB36VW5U5VA.JPG)

Le gouvernement espère réaliser un excédent budgétaire de 8,6 milliards d'euros cette année et des excédents cumulés de 38 milliards d'euros au cours des quatre prochaines années grâce à des recettes inattendues de l'impôt sur les sociétés.

Les dernières prévisions contenues dans la mise à jour du programme de stabilisation du gouvernement, soumise annuellement à la Commission européenne, s'accompagnent d'un avertissement concernant une perte de dynamique économique au cours des derniers mois, alors que l'inflation et les taux d'intérêt continuent de peser sur les dépenses de consommation et les investissements.

L'excédent budgétaire attendu de 8,6 milliards d'euros équivaut à 2,8 pour cent du revenu national et fait suite à un excédent de 8,3 milliards d'euros l'année dernière.

Le ministre des Finances, Michael McGrath, a déclaré qu'une grande partie de la générosité du budget était due aux recettes fiscales potentiellement volatiles des entreprises du secteur multinational. Il a souligné qu'en supprimant ces recettes, on enregistrerait un déficit de 2,7 milliards d'euros cette année et de 1,8 milliard d'euros l'année prochaine.

Les recettes annuelles de l’impôt sur les sociétés sont passées de 4 milliards d’euros à 24 milliards d’euros en une décennie. Cependant, McGrath a averti que l’ère de la surperformance en matière d’impôt sur les sociétés « touche désormais à sa fin ».

« On ne peut pas compter sur ces recettes : nous avons constaté un ralentissement significatif de l’impôt sur les sociétés au cours de l’année écoulée, mettant en évidence la volatilité de cette source de revenus », a-t-il déclaré.

La solide position fiscale du gouvernement, qui reflète également la croissance annuelle des recettes de l'impôt sur le revenu et de la TVA, verra 6 milliards d'euros de ressources budgétaires transférées vers un nouveau fonds de richesse et un plus petit fonds pour les infrastructures et le climat, créé pour servir de réserves tampons. Contre les contractions futures.

Les nouvelles projections permettront également de nouvelles dépenses et mesures fiscales agressives dans le budget 2025, le dernier avant les élections. Cependant, le ministre McGrath et le ministre des Dépenses publiques Paschal Donohoe ont refusé de dire si le budget respecterait la règle de dépenses de 5 pour cent que le gouvernement s'est imposée, qui vise à limiter les augmentations annuelles des dépenses à un plafond de 5 pour cent.

Le gouvernement a violé cette règle dans chacun de ses deux derniers budgets. M. Donohoe a souligné que que les dépenses augmentent l'année prochaine de 5, 5,5 ou 6 pour cent, « cette décision concerne des centaines de millions » alors que le gouvernement économisait 6 milliards d'euros « pour assurer un avenir meilleur à ce pays ».

« Pour évaluer la prudence et le soin apportés à la stratégie budgétaire, 6 milliards d'euros par an constituent un élément crucial », a-t-il déclaré.

Le document du gouvernement SPU prévoit que l'économie nationale connaîtra une croissance modeste de 1,9% cette année, en baisse par rapport aux prévisions précédentes de 2,2%, et de 2,4% en 2025.

Le rapport prévient que l'économie irlandaise a été confrontée à plusieurs vents contraires ces dernières années, avec une perte de dynamique évidente dans les données des derniers trimestres.

Un troisième terminal à l’aéroport de Dublin : nécessité urgente ou tarte en l’air ?

« Cela est dû en grande partie à deux facteurs contraires, à savoir les récents taux d'inflation élevés, qui ont affecté les salaires réels et les dépenses de consommation, et le resserrement monétaire, qui a fait grimper le coût du capital », a-t-il ajouté.

Cependant, le ministre des Finances Michael McGrath a insisté sur le fait que l'économie restait dans une « forme raisonnablement bonne », avec une baisse des prix de l'énergie et une baisse de l'inflation qui en découlerait susceptible de soutenir « une amélioration des salaires réels et du pouvoir d'achat des ménages ».

Il a noté que le taux d'inflation global de cette année devrait désormais être de 2,1 pour cent, inférieur aux prévisions du jour du budget de 2,9 pour cent.

[ €6bn has been removed from the budget day pot. Politically, this could get interesting ]

« Le point économique le plus brillant est sans aucun doute le marché du travail, qui est resté résilient tout au long de cette période de forte inflation et de taux d'intérêt élevés », a-t-il déclaré, notant qu'il y a désormais plus de 2,7 millions de personnes ayant un emploi.

Les prévisions macroéconomiques qui sous-tendent le SPU ont été approuvées par le Conseil des Finances le 2 avril, une obligation légale en vertu de la réglementation européenne.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

-

entertainment2 ans ago

Découvrez les tendances homme de l’été 2022

-

Top News2 ans ago

Festival international du film de Melbourne 2022

-

Tech1 an ago

Voici comment Microsoft espère injecter ChatGPT dans toutes vos applications et bots via Azure • The Register

-

science2 ans ago

Les météorites qui composent la Terre se sont peut-être formées dans le système solaire externe

-

science3 ans ago

Écoutez le « son » d’un vaisseau spatial survolant Vénus

-

Tech2 ans ago

F-Zero X arrive sur Nintendo Switch Online avec le multijoueur en ligne • Eurogamer.net

-

entertainment1 an ago

Seven révèle son premier aperçu du 1% Club

-

entertainment1 an ago

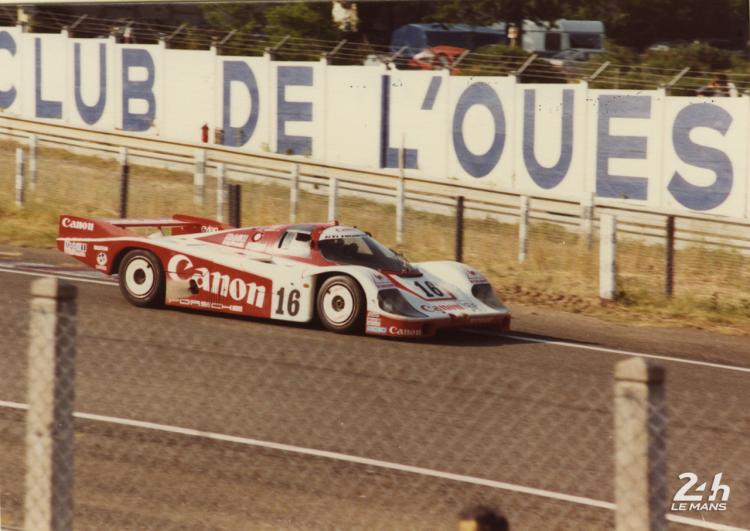

Centenaire des 24 Heures – La musique live fournit une bande-son pour la course