Economy

More than 5 billion euros wiped out the value of three Irish companies due to the new strain of Covid

Investors wiped more than 5 billion euros off the value of three leading Irish companies as news of the latest outbreak of Covid sparked panic in the stock market.

Stocks around the world fell on Friday after countries moved to impose new travel restrictions to stem the spread of a new strain of the Covid virus in South Africa that is feared to spread more easily than current variables.

The Iseq Index of the Irish Stock Exchange, which tracks all shares traded in the Dublin market, fell 4.48 percent to close at 7,834.61 on Friday.

Ryanair Holdings lost more than 2 billion euros in value as investors sold shares in travel and leisure companies, which are seen as most at risk if countries bring back lockdowns or restrictions.

Shares in Europe’s largest airline fell more than 12 per cent to trade at €14.035 as Dublin closed.

Ryanair’s price has already recovered to nearly €16 on Thursday after losing ground earlier in the week when tension from renewed travel restrictions hit markets for the first time.

Building materials giant CRH, another Irish market strike, saw its value drop by 1.5 billion euros, as the sell-off sent its stock down 4 per cent to 43.70 euros.

Paddy Power’s owner, Flutter Entertainment, whose global sports betting business could suffer if these events were hit by shutdowns, has wiped about 1.6 billion euros from its total value. Its stock fell 7 percent in Dublin to 120.15 euros.

In London, shares in the international airline group that owns Aer Lingus fell 14.6 per cent to 131.76 pence.

Back in Dublin, Dalata Hotel Group, owner of the Clayton and Maldron chains, fell 7.88 percent to 3.39 euros.

AIB fell 8.64 percent to close at 1.9185 euros, while the Bank of Ireland lost 7.17 percent to 4.716 euros.

Few stocks escaped defeat. Homebuilders Cairn Homes and Glenveagh Properties lost out, as did packaging giant Smurfit, office developer Hibernia Reit and Irish owner Residential Properties.

European and American stock markets

European stock markets fell 3 percent to 5 percent. On Wall Street, which closed early this Thanksgiving weekend, the benchmark S&P 500 index fell 2.3 percent while the Nasdaq, home to many tech companies, fell 2.2 percent.

Scientists have not yet decided whether the latest Covid-19 strain actually transmits faster than others or if it can evade vaccines or immunity more easily.

However, stock market watchers have been pointing to a months-long rally in the stock’s value.

Kiran Ganesh, strategist at UBS Global Wealth Management, agreed that it was too early to judge the impact of the South African dynasty.

« Where the market is getting so oversold is a product of, ‘Yeah, that’s bad news,’ but also the fact that we’ve had a very strong performance with relatively low volatility for a while, » he explained.

Meanwhile, oil prices suffered their biggest one-day drops ever, crashing more than 11 percent as news of the new virus strain raised fears that the renewed shutdown would hurt global demand. The collapse, the seventh largest for Brent crude, the global oil standard, may prompt OPEC + to reconsider its policy when it meets next week, as the group is increasingly inclined towards halting its production increases temporarily.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Un café de Kinsale présente un délicieux étalage pendant que la propriétaire de Food U raccroche son tablier

KINSALE et la bonne nourriture vont de pair, donc quiconque cherche à gérer sa propre entreprise alimentaire dans la ville balnéaire pourrait être intéressé par la location d'un café établi.

Food U, géré par l'entreprise de restauration professionnelle Úna Crosbie depuis 10 ans, est l'endroit idéal pour profiter de la fréquentation du parc Kinsale. De plus, il est situé face au vénérable yacht club, et est idéalement placé pour satisfaire les marins assoiffés (et insipides) et grincheux.

Mme Crosby, qui dirigeait auparavant le restaurant Glassyalleys dans la ville de Cork, travaille dans la restauration depuis 2002 et prend sa retraite de son entreprise à Kinsale. Le résultat est que l'entreprise est à vendre. Les acheteurs intéressés peuvent prendre possession du bail – un nouveau bail de trois ans a été récemment signé – pour 150 000 €.

«Je gère toujours le café moi-même, et les choses passent très vite, mais je veux ralentir un peu, alors je vends sur le bail», a déclaré Mme Crosbie.

Elle a ajouté : « J'adore ce travail, c'est une super petite entreprise, mais je sers de la nourriture depuis l'âge de 16 ans. » Mme Crosby le dirigeait six jours par semaine.

Représenté par Ray Sweetnam de Casey & Kingston, il affirme que le café a réalisé « des marges bénéficiaires et un chiffre d'affaires constamment élevés au cours des cinq dernières années ».

L'unité est située au 1 Pier Road, Kinsale, au cœur de la ville, surplombant le port de Kinsale, et à seulement 15 minutes du Old Head of Kinsale, qui abrite l'un des clubs de golf les plus exclusifs du pays, ainsi qu'un important site touristique. centre. la gravité.

Le bail comprend un bâtiment de 360 pieds carrés (33,5 m²) au rez-de-chaussée, avec des agencements et des sièges intérieurs et extérieurs. Les prix sont de 700 euros.

Le site, proche de l'hôtel Acton, « bénéficie clairement du yachting et d'un tourisme de haut niveau », a déclaré Swetnam.

Kinsale est idéalement relié par plusieurs lignes de bus et se trouve à seulement 20 minutes en voiture de l'aéroport de Cork. C'est une ville riche avec plus que sa part de foyers valant plusieurs millions d'euros.

Ray Sweetnam Tél. : 021 42711277 E-mail : [email protected]

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Un employé d'un restaurant de restauration rapide de Cork reçoit une indemnisation après un licenciement abusif

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Le programme de conduite autonome de Tesla est une déception perpétuelle en termes de revenus

(Bloomberg) – L’écart entre ce que dit Elon Musk à propos de la commercialisation de la technologie de conduite autonome et ce que Tesla dira plus tard dans les documents réglementaires n’a jamais été aussi large.

Tesla a publié mercredi son rapport trimestriel 10-Q qui fournit un aperçu plus détaillé de la santé financière de l'entreprise. Pendant plusieurs années consécutives, Tesla a fourni des mises à jour régulières de ces données sur le montant des revenus qu'elle a reçus des clients et qui n'ont pas encore été entièrement reconnus. Une partie de ces revenus différés est liée à un produit en préparation : la conduite entièrement autonome, ou FSD, en abrégé.

Les revenus reportés des véhicules de Tesla s'élevaient à 3,5 milliards de dollars au 31 mars, soit peu de changement par rapport à la fin de l'année dernière. Sur ce montant, Tesla s'attend à reconnaître 848 millions de dollars au cours des 12 prochains mois, ce qui signifie qu'une grande partie des obligations de performance associées à ce qu'elle facture aux clients pour le FSD ne seront toujours pas satisfaisantes dans un an.

La société ne donne pas de détails sur ses performances médiocres, même si le titre du programme est connu pour être un abus de langage. FSD est un système d'aide à la conduite qui ne rend pas les voitures de l'entreprise autonomes ; Cela nécessite que les conducteurs vigilants gardent les mains sur le volant.

Dans ces documents, Tesla a également indiqué le montant des revenus différés réellement comptabilisés – et la société basée à Austin n’a toujours pas répondu à ses attentes. Il a reconnu 494 millions de dollars de revenus différés au cours des 12 derniers mois, soit moins que les 679 millions de dollars prévus il y a un an.

Ces chiffres ont pris encore plus d’importance à la lumière du ralentissement de l’activité automobile de Tesla et de l’accent mis par Musk sur le FSD. Le PDG a mis en place une exigence à la fin du premier trimestre, selon laquelle les employés devaient installer et démontrer un FSD à chaque client en Amérique du Nord avant de livrer le véhicule.

En fait, lors de la conférence téléphonique sur les résultats du premier trimestre de Tesla mardi, Musk a tracé une nouvelle ligne dans le sable : « Si quelqu'un ne pense pas que Tesla va résoudre le problème de l'autonomie, alors je pense qu'il ne devrait pas investir dans le secteur. entreprise. » « Nous le ferons, et nous le ferons », a déclaré l’exécutif.

Alors que Tesla a bénéficié au premier trimestre de la hausse des revenus FSD par rapport à l'année dernière, en raison de la sortie d'une fonctionnalité en Amérique du Nord appelée Autopark, les revenus totaux ont chuté de 8,7 % à 21,3 milliards de dollars. Il s'agit de la première baisse d'une année sur l'autre de l'entreprise en quatre ans et de la plus forte baisse en pourcentage depuis 2012.

Musk a donné le coup d'envoi de l'appel aux résultats de Tesla en qualifiant la dernière version de FSD de « profonde » et s'améliorant rapidement. La société a réduit le prix d’achat de la fonctionnalité ou d’abonnement pour l’utiliser sur une base mensuelle et propose également des essais gratuits. Le PDG a déclaré que la société avait eu des discussions avec un grand constructeur automobile au sujet d'une licence FSD.

« Encore une fois, je recommanderais fortement à tous ceux qui, je pense, envisagent des actions Tesla, de vraiment conduire FSD », a déclaré Musk à la fin de l'appel. « Il est impossible de comprendre l’entreprise si on ne la comprend pas. »

D'autres histoires comme celle-ci sont disponibles sur bloomberg.com

©2024 Bloomberg LP

Ouvrez un monde d'avantages ! Des newsletters utiles au suivi des stocks en temps réel, en passant par les dernières nouvelles et un fil d'actualité personnalisé, tout est là, en un seul clic ! Connecte-toi maintenant!

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

-

entertainment2 ans ago

Découvrez les tendances homme de l’été 2022

-

Top News2 ans ago

Festival international du film de Melbourne 2022

-

Tech1 an ago

Voici comment Microsoft espère injecter ChatGPT dans toutes vos applications et bots via Azure • The Register

-

science2 ans ago

Les météorites qui composent la Terre se sont peut-être formées dans le système solaire externe

-

science3 ans ago

Écoutez le « son » d’un vaisseau spatial survolant Vénus

-

Tech2 ans ago

F-Zero X arrive sur Nintendo Switch Online avec le multijoueur en ligne • Eurogamer.net

-

entertainment1 an ago

Seven révèle son premier aperçu du 1% Club

-

entertainment1 an ago

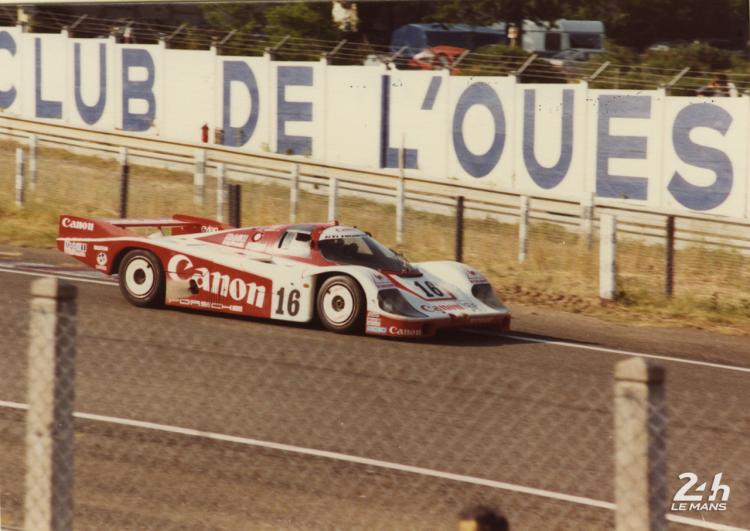

Centenaire des 24 Heures – La musique live fournit une bande-son pour la course