Economy

Official recipient files £1 billion claim against auditor of collapsed construction firm Carillion | Business News

The official recipient is filing a legal claim against the auditors of Carillion, the collapsed construction giant, which could target up to £1 billion in damages.

Sky News understands that liquidators from the former component of the FTSE-100 index filed a claim form against KPMG on Friday – a move that gives the plaintiff four months to provide more details of his case.

City sources said the measure could become one of Britain’s largest against an accounting firm.

Official details of the claim document are not expected to be provided by the OR for several weeks.

It is understood OR is tracking £230m of losses in the form of dividends which it argues should never have been paid by Carillion as it was headed for disaster.

It also wants to recover the £20m in consultancy fees which it is expected to claim could have been avoided.

However, the claim could ultimately be much greater if the OR succeeds arguing that it must also be compensated for trading losses in the run-up to Carillion’s demise.

People close to the case say the total damages sought by liquidators could be around £1 billion.

Earlier this year, OR struck a deal with Litigation Capital Management, a publicly listed company, to fund the claim.

The insider says the action against KPMG was prompted by the legal duty of liquidators to maximize refunds to Carillion creditors.

The construction group, which was involved in building and maintaining hospitals and roads, and providing millions of school meals, went bankrupt in January 2018 due to nearly £7 billion.

Thousands of jobs were lost as a result.

Earlier this year, Kwasi Quarting, the business secretary, authorized the insolvency service to prosecute former Carillion board members including Philip Green, its chairman, with the aim of removing them from serving as directors of the company.

The legal action is expected to allege that KPMG failed in its duties as an auditor to monitor misstatements in the accounts of the outsourcing group.

KPMG’s work for Carillion is investigated separately by the Financial Reporting Council (FRC), the accounting regulator.

In September, the FRC alleged that KPMG and a number of employees had provided it with false or misleading information in connection with the Carillion audit.

Carillion’s demise has become one of the main catalysts for reforming Britain’s audit sector, with far-reaching consequences including the creation of a new watchdog, and requirements for the Big Four – Deloitte and EY too – to ‘operational separation’. Their arms are in auditing and consulting.

At the time of its collapse, Carillion held approximately 450 construction and service contracts across the government.

It employed more than 43,000 people, including 18,000 in the UK.

In a scathing report on the company’s governance, the Business, Energy and Industrial Strategy Selection Committee in General said: « As a large company and a competitive bidder, Carillion has been well positioned to win contracts.

« Its failures to manage it later to turn a profit were masked for a long time by a constant flow of new work and … accounting practices that prevented an accurate assessment of the status of contracts. »

KPMG has served as Carillion’s auditor for nearly two decades, and has generated a total of £29 million for the audit work.

OR and KPMG declined to comment.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Le propriétaire irlandais indépendant Mediahuis est en pourparlers pour racheter Journal.ie – The Irish Times

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/LMA2PTBA7JJEAWS6264HMSESLM.jpg)

L'éditeur irlandais indépendant Mediahuis Ireland est en pourparlers pour acquérir le fournisseur d'informations en ligne The Journal ainsi que sa publication sportive et podcast sœur. the42.ieSelon des sources.

La valeur de l’accord potentiel serait de l’ordre de « quelques millions à un chiffre ».

« Mediahuis note des spéculations concernant une éventuelle acquisition », a déclaré une porte-parole de l'éditeur. « Comme toujours, Mediahuis ne souhaite pas commenter de telles spéculations, sinon pour dire que nous continuerons à étudier et à évaluer toutes les opportunités qui se présenteront. »

Journal Media a été fondée en 2010 par les frères Brian et Eamonn Fallon. Les efforts pour obtenir les commentaires de la famille de Fallon ont échoué.

La vente est gérée en interne par Journal Media, la société à l'origine des deux publications. Il semblerait que Business Post, contrôlé par Kilcullen Kapital Partners et l'homme d'affaires de Galway Enda Okoinen, ait fait l'objet d'une offre sous-évaluée pour l'entreprise.

Le42.ie Elle fonctionne sur abonnement, tandis que la revue est ouverte aux contributions des lecteurs. Journal Media a fermé un site d'information sur la culture populaire. DailyEdge.ieen 2019 et au-delà Forums.ie Business News Service l’année suivante. La récente fermeture a été imputée aux mesures de réduction des coûts prises par l’entreprise pendant la pandémie.

Journal Media ne dépose pas d'états financiers séparés auprès du Bureau d'enregistrement des sociétés. Au lieu de cela, les chiffres consolidés sont transmis à la société mère ultime, DML Capital Unlimited.

Eamonn et Brian Fallon ont marqué une première fois le paysage numérique irlandais en créant Putain.ie Le site immobilier en 1997, alors qu'ils avaient respectivement 20 et 15 ans. Ils ont fusionné cette entreprise avec leur société sœur Annonces.ieAvec Schibsted Media Group basé en Norvège DoneDeal.fr En 2015.

La coentreprise qui en résulte, Distilled Ltd, est détenue à 50 pour cent par la famille Fallon, qui détient ses actions via DMG, et à 50 pour cent par Adevinta, une filiale de Schibsted.

Mediahuis Group, basé en Belgique, a acquis Independent News & Media (INM), alors cotée en bourse, en 2019 et l'a ensuite rebaptisé Mediahuis Ireland.

Outre l'Irish Independent, Mediahuis Ireland publie le Sunday Independent, le Sunday World, le Belfast Telegraph, le Sunday Life et neuf titres régionaux.

Le groupe mère est également présent en Belgique, aux Pays-Bas, au Luxembourg et en Allemagne.

Mediahuis Ireland a confirmé la semaine dernière avoir réduit ses effectifs de 50 personnes dans sa division d'édition, ce total incluant un certain nombre de licenciements obligatoires. L’entreprise employait près de 550 personnes début 2024, avant d’annoncer qu’elle cherchait à réduire les effectifs dans sa division d’édition en Irlande.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Comment une fausse publicité pour une célébrité gagnant de l'argent grâce au Bitcoin a coûté près de 10 000 € à un lecteur – The Irish Times

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/TEIYANDAA5GCHPE2TRSWWKJXZQ.jpg)

Fin février, une lectrice que nous appellerons Joan était sur Facebook et est tombée sur un article qui semblait provenir d'une source d'information irlandaise réputée, soulignant comment une personnalité de la télévision irlandaise réputée avait réussi à gagner une grosse somme d'argent après quelques années. des plaisanteries. Investir dans la crypto-monnaie.

L’article regorgeait de citations d’autres célébrités irlandaises qui ont également gagné beaucoup d’argent grâce aux crypto-monnaies.

Vous savez probablement où cela va, n'est-ce pas ?

Mais Joan n'a pas fait ça.

« Il y avait un lien dans le contenu, j'ai cliqué sur le lien et je me suis inscrit pour prendre un appel », a-t-elle écrit. « En moins de cinq minutes, un homme m'a appelé, m'a posé quelques questions sur mon âge et, comme j'avais la cinquantaine, m'a proposé une réduction pour effectuer un dépôt. »

Il lui a dit que la caution était normalement de 250 €, mais il l'avait enregistrée pour 200 €. Je pensais à des jours heureux.

« Je lui ai donné les coordonnées de ma carte de crédit pour effectuer le paiement. Il m'a dit que la plateforme fonctionnait sur l'intelligence artificielle et que je n'avais rien d'autre à faire que de voir mon investissement croître. Il m'a ensuite dit qu'on me désignerait un gestionnaire de compte qui le ferait. contactez-moi le lendemain pour me préparer au trading.

Effectivement, l’appel est arrivé et le « gestionnaire d’investissement » – un homme appelé Max – a demandé à Joan de télécharger une application où elle pouvait voir que 200 € étaient désormais 208 €.

«Max m'a dit qu'il travaillait avec une commission de 10 pour cent de mes bénéfices et qu'il toucherait sa commission à la mi-avril», dit-elle.

« Il m'a demandé combien d'argent je voulais gagner, et je lui ai dit que quelques milliers d'euros seraient bien. Il m'a dit que je ne gagnerais pas ce genre d'argent avec un dépôt de 200 €, alors il m'a donné quelques chiffres de bénéfices si je le faisais. pourrait déposer plus d’argent. Il m’a dit que la valeur du Bitcoin était à son plus haut niveau jamais vu et que le bénéfice « logement » arriverait à la mi-avril 2024, et que plus vous investissez, plus vous pourriez rapporter de bénéfices. lui où se trouvait le siège de cette entreprise et il a déclaré : « Max et moi avions l'habitude de nous parler tous les deux ou trois jours au téléphone, principalement pour me tenir au courant de mes revenus », a écrit Joan.

Puis, deux semaines après le premier contact, Max a envoyé à Joan un message sur Telegram disant : « Son service de conformité a besoin d'une pièce d'identité de ma part pour des raisons de conformité. Je lui ai donc envoyé des photos de mon permis de conduire, recto et verso, et il m'a demandé de lui envoyer des photos de mon permis de conduire. lui aussi des photos. Une photo de moi tenant mon permis de conduire.

Fin mars, Joan avait investi 8 500 €.

« J'ai demandé à Max ce qu'il adviendrait de mon solde de revenus à la mi-avril, et il m'a répondu que je pouvais retirer une partie ou la totalité de mon argent, auquel cas je ne paierais aucun impôt. Il a répondu : « Si je laissais une partie ou la totalité de mon argent. mon argent là-bas, je devrais payer des impôts, mais je ne paierais des impôts que sur mes revenus.

«Il m'a dit que j'obtiendrais une attestation fiscale pour les impôts payés en Suisse et que le taux d'imposition y est compris entre 15 et 20 pour cent. Ce type, Max, m'a envoyé une très belle lettre de Pâques pour moi et ma famille. Parfois, il me demandait si ! J’étais obligé de retirer de l’argent, alors j’ai dit « non » et j’étais heureux de continuer à faire croître mes investissements.

« Je réalise maintenant qu'il me posait cette question parce que si je voulais retirer une partie de mon argent, il m'aurait dit qu'il y aurait des impôts à payer et il m'aurait demandé de lui remettre plus d'argent pour ce retrait. »

Fin mars, elle a parlé à une amie de ses investissements.

« Elle soupçonnait vraiment que j'étais victime d'une arnaque, et lorsque j'ai recherché l'entreprise sur Google, tous les avis disaient qu'il s'agissait d'une arnaque. J'étais vraiment nerveux à l'époque à l'idée d'avoir pu me faire arnaquer. »

« J'ai donc testé Max Man en demandant le retrait de mes fonds le jeudi 4 avril 2024. Il m'a envoyé un 'formulaire de retrait' précisant que je devrais payer un impôt et une commission de 1 800 € pour un retrait de 9 000 €. . Je lui ai dit que je n'avais plus d'argent pour payer la taxe/commission. J'ai dit que j'aimerais retirer mon dépôt, auquel cas je n'aurais pas à payer d'impôts. Je lui ai alors dit que je voulais clôturer mes dépôts (c'est ainsi qu'il désigne mon argent sur le marché des changes) et il m'a dit que je faisais une très grosse erreur et que je perdrais tous mes bénéfices. Je lui ai dit que j'étais en crise financière et que j'avais besoin de l'argent de mon dépôt, qui s'élevait désormais à 8 500 euros.

Max lui a dit qu'elle devrait attendre une semaine pour obtenir l'argent et Joan a remercié Max pour son aide.

« Le lundi 8 avril, j'ai ouvert l'application Telegram pour envoyer à Max un message concernant la récupération de mon argent et j'ai découvert que Max avait supprimé toutes nos discussions Telegram et que la connexion à mon compte d'investissement avait également disparu. »

La triste vérité est que son argent a probablement disparu pour de bon, car elle a clairement été victime d’une arnaque à l’investissement.

Nous avons envoyé les détails à Niamh Davenport de FraudSmart, l'unité de cybercriminalité de la Fédération irlandaise des banques et des paiements.

« Les escroqueries liées aux investissements, y compris les escroqueries liées aux cryptomonnaies, sont en augmentation et deviennent de plus en plus sophistiquées et sophistiquées », dit-elle. « Les fraudeurs se cachent derrière des sites Web qui peuvent sembler légitimes et utilisent les médias sociaux et la publicité en ligne pour cibler leurs victimes en leur promettant des rendements élevés, les incitant souvent à partager des informations personnelles et financières.

« Une fois que la victime accepte de payer et que les fonds arrivent sur le compte de l’escroc, le criminel transfère rapidement les fonds vers plusieurs autres comptes, souvent à l’étranger, où ils sont ensuite encaissés. »

Elle a souligné que quiconque pense avoir été victime d'une fraude doit le signaler le plus rapidement possible à sa banque et à An Garda Síochána. Chaque cas de fraude signalé fait l'objet d'une enquête approfondie et les banques et institutions financières feront de leur mieux pour aider les clients à récupérer leur argent, si possible.

Davenport ajoute que comme les fraudeurs ciblent de plus en plus directement les consommateurs, « il est important que nous sachions tous comment nous protéger. En particulier, le public doit se méfier des publicités en ligne et sur les plateformes de médias sociaux, même s'il s'agit de publicités payantes ou soutenues. en utilisant des marques ou des noms de marque familiers Arrêtez de réfléchir et contactez l'entreprise de manière indépendante pour vérifier les détails.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Découvrez l'intérieur de la nouvelle maison de Mary Kennedy à Dublin

La maison de Mary Kennedy dégage une énergie chaleureuse et accueillante. L'odeur du gâteau au citron fraîchement sorti du four remplit la cuisine, une demande plutôt sophistiquée de son petit-fils Buddy pour son cinquième anniversaire.

Des œuvres d'art et des photos Polaroid de ses petits-enfants bien-aimés (ils sont quatre et un autre ensemble les rejoindra cet été) sont fièrement exposées, tandis que des jouets jonchent le sol, preuve d'un week-end de Pâques chargé en famille.

Dans le nouveau numéro de RSVP à l'appel principalMary partage sa nouvelle demeure, parle de ses éléments non négociables lors du déménagement et de la façon dont elle a fait évoluer son style d'intérieur.

« Ça a été amusant. C'est un plan d'étage ouvert, c'est lumineux, c'est neuf. Cela fait plus d'un an que j'ai emménagé. J'ai réduit les locaux parce que ma maison était devenue trop grande. C'était une décision importante à prendre », mais là Il y avait quelques éléments sur lesquels j'ai insisté dans la nouvelle maison : l'un d'eux était un jardin orienté au sud, et j'ai dû avoir quatre chambres parce que ma fille vit à Limerick et qu'elle avait besoin d'un endroit où rester.

« C'est aussi dans la même paroisse, donc j'ai toujours les mêmes amis et quelques nouveaux, ce qui est vraiment important. Même église, mêmes supermarchés, même centre communautaire, toutes ces choses sont toujours les mêmes, ce qui est vraiment sympa. Je ne le fais pas. je sais si je pouvais « En quittant la région, vous êtes en quelque sorte propriétaire de vos racines. »

Lisez l'interview complète de Mary et découvrez-en davantage dans le nouveau numéro de RSVP Home, disponible dès maintenant.

Photographie de Philipp Lauterbach

Coiffure et maquillage : Lauren Edgerton @lorringerton / @makemeblush.ie

Conception : Gilly, Drogheda. @magénérationvêtementsstore Tél : 041-9818695

Le salon de Maryam

Cet ensemble de meubles a plus de 40 ans et est toujours aussi solide

Le nouveau jardin de Mary a une magnifique cour

Mary a préparé un gâteau au citron pour le 5e anniversaire de son petit-fils Paddy – son préféré

Cuisine ouverte avec salle à manger

Ce buffet était un cadeau de mariage offert aux parents de Mary en 1953.

RSVP, avril 2024

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

-

entertainment2 ans ago

Découvrez les tendances homme de l’été 2022

-

Top News2 ans ago

Festival international du film de Melbourne 2022

-

Tech1 an ago

Voici comment Microsoft espère injecter ChatGPT dans toutes vos applications et bots via Azure • The Register

-

science2 ans ago

Les météorites qui composent la Terre se sont peut-être formées dans le système solaire externe

-

science3 ans ago

Écoutez le « son » d’un vaisseau spatial survolant Vénus

-

Tech2 ans ago

F-Zero X arrive sur Nintendo Switch Online avec le multijoueur en ligne • Eurogamer.net

-

entertainment1 an ago

Seven révèle son premier aperçu du 1% Club

-

entertainment1 an ago

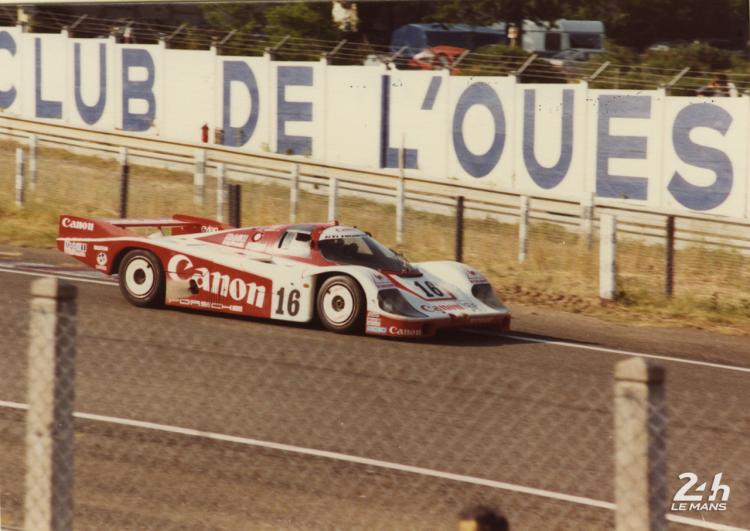

Centenaire des 24 Heures – La musique live fournit une bande-son pour la course