Economy

Ratings agency Fitch upgrades Ireland’s credit rating

Ratings agency Fitch has upgraded Ireland’s sovereign credit rating to AA-.

It is the first time that Fitch has raised its opinion on Ireland since 2017 and returns it to an AA level that was last seen in 2010, as the financial crisis was unfolding.

In its decision, Fitch referred to the continued improvement in Ireland’s tax revenues and the extent of the strong economic recovery from the pandemic.

It also cited its expectation that Ireland’s debt to GDP and debt to national income ratios will enter a firm downward trajectory.

« This is Ireland’s second upgrade by a major ratings agency in 2022, following DBRS Morningstar’s upgrade earlier this month, » said Frank O’Connor, NTMA Director of Funding and Debt Management.

« It is welcome news as it reflects Ireland’s strong economic progress and is consistent with international investor sentiment, which remains very positive. »

The verdict that credit rating agencies like Fitch give on Ireland’s economic situation and outlook can have an important bearing on the state’s cost of borrowing and the appetite for Irish debt among international investors.

“The ongoing trend of improvements in Ireland’s credit ratings is for our ability to continue broadening our investor base, which ultimately increases demand for Irish Government bonds and enhances liquidity in our debt issuance,” said Mr O’Connor.

Ireland is now rated in the AA or equivalent category by three of the four major global ratings agencies – Standard & Poor, Fitch and DBRS Morningstar.

Fitch also declared the outlook on Ireland’s rating to be stable.

In its statement, it said it expects a continued improvement in Ireland’s fiscal metrics, supported by strong revenue performance.

It also said its expectation of a firm downward debt to GDP trajectory is reinforced by the Government’s new medium-term fiscal framework.

« According to a new fiscal rule introduced last September, the permanent increase in Exchequer current spending should be limited to 5% annually, whichs to the economy’s growth potential in nominal terms, » it said.

“In our view, the rule has the potential to serve as an effective tool, limiting growth in current spending and channeling the windfall CIT revenues towards investments and debt repayment.

« However, the rule has not been codified into law, which increases the risk of non-compliance. »

It also referred to how Irish banks have weathered the pandemic and that all rated banks have stable outlooks.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

La gare de Bray obtient un investissement de 3,5 millions d’euros dans un centre de voyage – The Irish Times

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/JWUFXT6XEJNKHEQOTLBQE6XG3U.jpg)

Le ministre des Transports, Eamonn Ryan, a transformé le terrain en un projet de plaque tournante des transports pour la gare de Bray dans le comté de Wicklow.

D'un coût de 3,5 millions d'euros, le projet réorganisera les services de bus à la gare de Brays Daly, modernisera les installations piétonnes et cyclables avec de nouveaux sentiers et passages à niveau élargis, introduira de nouvelles aires de repos et plantera des arbres.

Le projet, soutenu par Irish Rail, a été conçu par le cabinet de conseil Atkins Realis, avec les entrepreneurs David Walsh Civil Engineering pour la réalisation des travaux.

Le Taoiseach Simon Harris, un TD de Wicklow, a déclaré dans un communiqué qu'il était ravi du projet, qui « devrait avoir un impact significatif sur les habitants de tout le comté en fournissant des espaces publics de haute qualité pour accompagner nos bâtiments de gare historiques ». Vraiment chanceux de t’avoir.

« Nous verrons un regain d'énergie et d'activité dans la région, ce que les petites entreprises apprécieront sans aucun doute », a déclaré le Taoiseach.

S'exprimant lors du redressement, M. Ryan a déclaré : « Le nouveau pôle de transport transformera la zone autour de la gare de Bray et encouragera davantage de personnes à choisir les transports publics. Nous constatons dans tout le pays que lorsque nous améliorons les infrastructures et les installations de transport, les gens réagissent de manière très positive. » .

« Bray est une ville fantastique et prospère et elle est sur le point de s'améliorer encore grâce à ce nouveau plan du conseil du comté de Wicklow, pour les résidents locaux et les navetteurs d'abord, mais aussi pour les nombreuses personnes qui visitent. »

Le directeur général adjoint du conseil du comté de Wicklow, Michael Nicholson, a déclaré que le projet de voyage actif était « l'un des nombreux » projets déployés dans tout le comté.

« À terme, le projet bénéficiera aux principaux modes de transport tels que la marche, le vélo, les taxis, les bus et le train à la gare, et encouragera un changement de paradigme des véhicules privés vers des modes de transport plus durables », a-t-il déclaré.

Les travaux seront réalisés par étapes, en conservant partout l'accès aux commerces, aux résidences, aux transports en commun et aux commodités. Les voies d'accès alternatives requises pendant la construction seront mises en évidence à l'avance.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

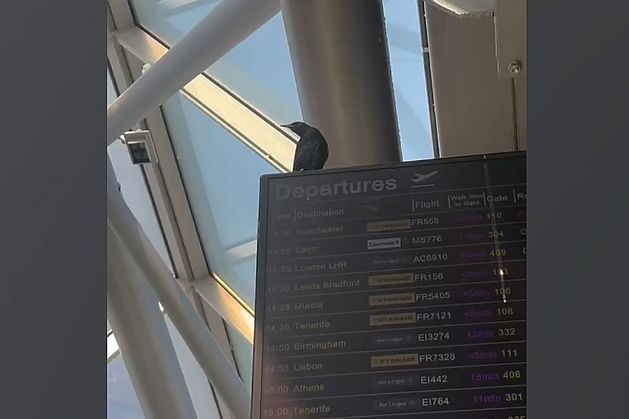

Un oiseau piégé dans le terminal de l'aéroport de Dublin « erre dans la confusion pendant plus de 40 jours » car son élimination « n'est pas une tâche facile »

Un militant des droits des animaux a déclaré que l’oiseau « errait confusément, à la recherche de restes de nourriture pendant plus de 40 jours.

« Nous notons des inquiétudes concernant l'oiseau vivant actuellement dans le terminal 1 de l'aéroport de Dublin », avait précédemment déclaré l'aéroport de Dublin sur Twitter.

« Aider un petit (et très rapide !) oiseau à sortir d'un bâtiment aussi immense et bondé n'est pas une tâche facile. Mais l'équipe de l'aéroport se saisit du dossier et, en consultation avec des experts de la faune et des oiseaux, mène une opération qui aura l'oiseau reprendra son chemin en toute sécurité très bientôt.

« En attendant, le public peut être assuré que l'oiseau reçoit suffisamment de nourriture et de boisson et qu'il est en bonne santé. Le retour en toute sécurité de l'oiseau dans la nature est une priorité absolue et nous remercions le public d'avoir confié son sauvetage au public. professionnels. »

Le militant Caoimhe Laird Phelan lance un appel pour sauver l'oiseau, une espèce d'étourneau sansonnet, qui serait là depuis plus de 40 jours.

« C'est la saison de reproduction, c'est le printemps, ils devraient voler d'arbre en arbre pour collecter du matériel de nidification afin de pouvoir avoir des bébés, sans errer confusément dans la station à la recherche de restes », a-t-elle déclaré.

« Être piégé à l’intérieur sans nulle part où s’échapper est très stressant pour un oiseau sauvage. Il est déjà dans un état de panique alors qu’il vole constamment vers les fenêtres du ciel pour trouver une issue.

Les étourneaux seraient piégés dans le terminal 1 de l'aéroport de Dublin depuis le 8 mars.

« Il ne sait pas que le hall des arrivées dans lequel il se trouve est au troisième étage et que pour sortir du bâtiment, il devra descendre deux volées d'escaliers pour atteindre une porte à la porte d'embarquement.

« C'est quelque chose qu'il n'a jamais pu comprendre car ces portes sont ouvertes par intermittence dans le seul but de permettre aux passagers de monter à bord de l'avion.

« Les aéroports ne sont pas leur habitat naturel et ne produisent pas de vers ni d’insectes à manger. Les étourneaux ne trouveront pas la nourriture et l’eau dont ils ont besoin.

«J'étais en voyage vendredi dernier et j'ai remarqué un étourneau maigre faisant des cercles autour du terminal 1. J'ai demandé à quelques membres du personnel, et personne ne semblait trop dérangé par sa présence ou par le début des secours.

«J'avais le sentiment qu'il était là depuis un moment, alors j'ai filmé quelques clips et réalisé une vidéo racontant son histoire et je l'ai mise en ligne.

« Cela a pris de l'ampleur et j'ai appris qu'il y avait été aperçu pour la première fois le 8 mars. À partir d'aujourd'hui, cela signifie qu'il est là depuis 42 jours », a-t-elle déclaré.

Caoimhi espère que l'aéroport de Dublin « assumera la responsabilité de mettre en place des procédures appropriées lorsque la faune est piégée entre ses murs ».

Kildare Wildlife Rescue a déclaré avoir reçu plusieurs demandes de renseignements concernant l'oiseau piégé.

« Nous avons reçu plusieurs rapports de personnes ayant vu une vidéo de cet étourneau en ligne », a-t-elle déclaré.

« L'aéroport n'a pas été en contact avec nous, mais même s'il l'était, nous ne pouvons malheureusement pas faire grand-chose pour aider dans cette situation.

« Puisque les étourneaux peuvent voler dans un grand espace ouvert avec de hauts plafonds, il ne serait pas possible de les attraper avec un filet.

« Le conseil habituel pour les oiseaux piégés dans les bâtiments est d’éteindre toutes les lumières et d’ouvrir toutes les fenêtres/sorties. Cela doit être fait pendant la journée afin que l’oiseau ne s’envole pas dans l’obscurité.

«Nous ne pouvons que supposer que l'aéroport ne sera pas en mesure de suivre ces conseils pour des raisons de sécurité et de logistique.

« Comme il est là depuis des semaines, nous pouvons au moins être assurés qu'il trouve de la nourriture et de l'eau quelque part – soit il est intentionnellement nourri par le personnel ou les voyageurs, soit il est capable de trouver de la nourriture et de l'eau par lui-même.

«Nous contactons nous-mêmes l'aéroport de Dublin et serions heureux de leur parler plus en détail et d'envisager des options potentielles s'ils nous répondent.

« La situation est loin d'être idéale ; « Nous espérons que tôt ou tard, il pourra s'en sortir », a-t-il ajouté.

Gillian Baird de la DSPCA a ajouté qu'il pourrait être difficile de faire sortir l'oiseau de l'aéroport.

« Le problème avec les étourneaux est qu'ils ont tendance à trouver leur chemin, quelle que soit la direction qu'ils prennent », a-t-elle déclaré. « À l'heure actuelle, ce qui se serait passé, c'est que l'oiseau aurait pu construire un nid et pondre des œufs », a-t-elle déclaré.

« Certains poussins pourraient bientôt éclore, c'est donc très difficile.

« Ce que nous disons à quelqu'un qui a un oiseau coincé dans son bâtiment, c'est d'éteindre toutes les lumières, d'ouvrir les portes, de mettre des graines à l'extérieur et de laisser l'oiseau tranquille.

« Mais ce que je vois, c'est que l'oiseau est piégé dans un bâtiment aéroportuaire doté de nombreux plafonniers. Il serait donc impossible d'éteindre les lumières car c'est une zone très fréquentée. L'oiseau ne sera jamais laissé seul. »

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Le propriétaire irlandais indépendant Mediahuis est en pourparlers pour racheter Journal.ie – The Irish Times

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/LMA2PTBA7JJEAWS6264HMSESLM.jpg)

L'éditeur irlandais indépendant Mediahuis Ireland est en pourparlers pour acquérir le fournisseur d'informations en ligne The Journal ainsi que sa publication sportive et podcast sœur. the42.ieSelon des sources.

La valeur de l’accord potentiel serait de l’ordre de « quelques millions à un chiffre ».

« Mediahuis note des spéculations concernant une éventuelle acquisition », a déclaré une porte-parole de l'éditeur. « Comme toujours, Mediahuis ne souhaite pas commenter de telles spéculations, sinon pour dire que nous continuerons à étudier et à évaluer toutes les opportunités qui se présenteront. »

Journal Media a été fondée en 2010 par les frères Brian et Eamonn Fallon. Les efforts pour obtenir les commentaires de la famille de Fallon ont échoué.

La vente est gérée en interne par Journal Media, la société à l'origine des deux publications. Il semblerait que Business Post, contrôlé par Kilcullen Kapital Partners et l'homme d'affaires de Galway Enda Okoinen, ait fait l'objet d'une offre sous-évaluée pour l'entreprise.

Le42.ie Elle fonctionne sur abonnement, tandis que la revue est ouverte aux contributions des lecteurs. Journal Media a fermé un site d'information sur la culture populaire. DailyEdge.ieen 2019 et au-delà Forums.ie Business News Service l’année suivante. La récente fermeture a été imputée aux mesures de réduction des coûts prises par l’entreprise pendant la pandémie.

Journal Media ne dépose pas d'états financiers séparés auprès du Bureau d'enregistrement des sociétés. Au lieu de cela, les chiffres consolidés sont transmis à la société mère ultime, DML Capital Unlimited.

Eamonn et Brian Fallon ont marqué une première fois le paysage numérique irlandais en créant Putain.ie Le site immobilier en 1997, alors qu'ils avaient respectivement 20 et 15 ans. Ils ont fusionné cette entreprise avec leur société sœur Annonces.ieAvec Schibsted Media Group basé en Norvège DoneDeal.fr En 2015.

La coentreprise qui en résulte, Distilled Ltd, est détenue à 50 pour cent par la famille Fallon, qui détient ses actions via DMG, et à 50 pour cent par Adevinta, une filiale de Schibsted.

Mediahuis Group, basé en Belgique, a acquis Independent News & Media (INM), alors cotée en bourse, en 2019 et l'a ensuite rebaptisé Mediahuis Ireland.

Outre l'Irish Independent, Mediahuis Ireland publie le Sunday Independent, le Sunday World, le Belfast Telegraph, le Sunday Life et neuf titres régionaux.

Le groupe mère est également présent en Belgique, aux Pays-Bas, au Luxembourg et en Allemagne.

Mediahuis Ireland a confirmé la semaine dernière avoir réduit ses effectifs de 50 personnes dans sa division d'édition, ce total incluant un certain nombre de licenciements obligatoires. L’entreprise employait près de 550 personnes début 2024, avant d’annoncer qu’elle cherchait à réduire les effectifs dans sa division d’édition en Irlande.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

-

entertainment2 ans ago

Découvrez les tendances homme de l’été 2022

-

Top News2 ans ago

Festival international du film de Melbourne 2022

-

Tech1 an ago

Voici comment Microsoft espère injecter ChatGPT dans toutes vos applications et bots via Azure • The Register

-

science2 ans ago

Les météorites qui composent la Terre se sont peut-être formées dans le système solaire externe

-

science3 ans ago

Écoutez le « son » d’un vaisseau spatial survolant Vénus

-

Tech2 ans ago

F-Zero X arrive sur Nintendo Switch Online avec le multijoueur en ligne • Eurogamer.net

-

entertainment1 an ago

Seven révèle son premier aperçu du 1% Club

-

entertainment1 an ago

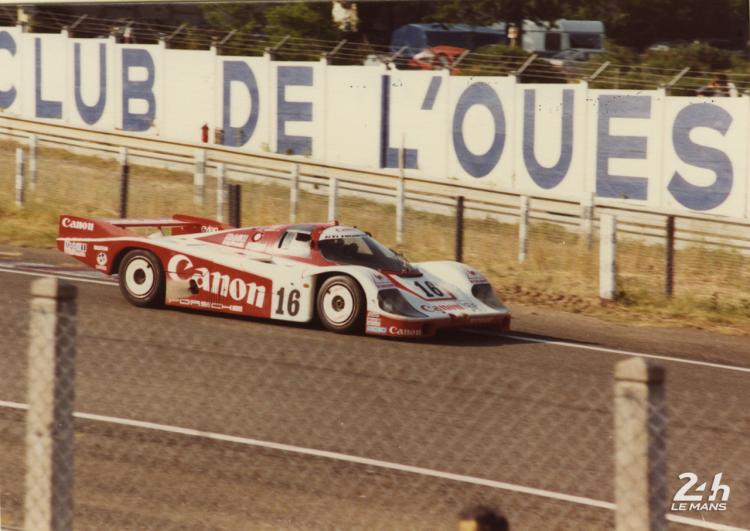

Centenaire des 24 Heures – La musique live fournit une bande-son pour la course