Economy

Supreme Court rejects Meath Hotel’s appeal against Zurich’s refusal to pay damages for business interruption due to the pandemic

The Supreme Court has rejected an appeal by a Co Meath hotel against the Zurich insurer’s refusal to pay a claim for business disruption due to the Covid-19 pandemic.

The lawsuit was filed by the four-star, 260-bedroom Headfort Arms Hotel, Kells Co Meath, which claimed to have entered into an insurance policy with Zurich in October 2019.

Zurich opposed the measure, saying the hotel’s policy did not cover a claim to disrupt business due to the pandemic.

In his ruling, Judge Dennis MacDonald said he was satisfied that the claim made by the hotel did not fall within the coverage available under the Zurich policy.

The family-owned hotel claimed that under its policy with Zurich, it was entitled to compensation for the disruption to its business, including forced closures, caused by the pandemic.

In the lawsuit, the hotel sought various injunctions against Zurich, including damages for breach of contract, willful interference with economic interests, and a declaration that it was entitled to compensation from the insurance company.

The hotel also requested orders asking the Zurich company to compensate the hotel for the losses it had incurred.

Zurich Insurance Plc disputed the lawsuit and said the policy does not cover losses incurred due to Covid-19 and only works in the event of damage to hotel premises.

It also argued that the hotel did not require coverage under any of the related business interruption extensions introduced by Zurich that specifically provided cover for business interruptions caused by reported illnesses.

Zurich added that at the time the policy was put in place, there were a number of competing policies available in the market that provided cover for business interruptions due to illness.

In his decision, Justice MacDonald said the case brought by the hotel included a tense and unnatural reading of the policy clauses.

The judge added that there was nothing in the relevant factual or legal background to support the explanation given by the hotel regarding the policy.

The judge said that under the terms of the policy he entered into with Zurich, the hotel was not entitled to compensation for temporary deprivation of property.

It has failed to show that its inability to operate its business during the shutdown can be defined as « damage » in the policy.

He added that the hotel could, but did not seek, a policy that explicitly covers business disruption.

Accordingly, the judge said that the only order the court could issue was to dismiss the hotel’s claim.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Un homme qui n'a pas droit à un allègement fiscal pour la location d'une maison qu'il a quittée à cause de harcèlement raciste – The Irish Times

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/OAM557WQURAFZEKSBP6MYXLHWI.jpg)

La Cour suprême a statué contre un Pakistanais qui tentait de faire valoir son droit à un allègement fiscal pour la location de la maison que lui et sa famille avaient quittée en raison d'allégations de harcèlement raciste de la part de certains résidents locaux.

Cependant, Adnan Ahmed Siddiqui a obtenu partiellement gain de cause devant le tribunal, le juge Oisin Quinn étant d'accord avec lui sur le fait que le commissaire aux appels fiscaux (TAC) avait commis une erreur dans la façon dont il avait considéré un paiement de 85 000 € de son ancien employeur.

Le juge a déclaré que le paiement avait été effectué alors que Siddiqui était en congé de stress et qu'il faisait partie d'un accord de règlement en mars 2014 visant à retirer sa plainte auprès du Tribunal pour l'égalité pour discrimination raciale présumée.

Le Tax Appeals Commissioner (TAC) a demandé au tribunal de déterminer s'il avait raison de confirmer la décision du Commissioner of Revenue sur trois questions juridiques en vertu de la Tax Consolidation Act 1997.

Dans sa décision, le juge a déclaré que Siddiqui, qui vit et travaille en Irlande depuis 2000, a affirmé qu'il devrait être autorisé à déduire le loyer qu'il a payé pour sa nouvelle résidence des revenus locatifs qu'il a reçus des locataires qui ont emménagé dans son ancien logement. Le juge a déclaré que ses allégations de « graves incidents de harcèlement » étaient étayées par des documents fournis à la police.

Dans un discours prononcé à Dublin 14, M. Siddiqi a déclaré que sa décision en 2014 était nécessaire en raison de l'incapacité présumée de la police à lutter contre le harcèlement. Le loyer de sa nouvelle maison était plus élevé que les revenus locatifs qu'il recevait de son ancienne maison et, comme il ne voulait pas déménager, il affirmait qu'il existait un lien entre les deux paiements, de sorte que son impôt à payer devrait être réduit à zéro entre 2014 et 2017, a indiqué le juge.

Le juge Quinn était convaincu que le TAC avait raison dans ses conclusions concernant les impôts sur les revenus locatifs.

Même s’il était « profondément insatisfaisant » que M. Siddiqui et sa famille aient été expulsés en raison de harcèlement raciste, cela ne change rien à la question juridique. « Le code des impôts n’a pas de justice », a déclaré le juge, et « le coût de l’installation d’un toit n’est pas une dépense déductible ».

Par ailleurs, le Revenu a déduit 21 872 € d'impôts sur le montant à titre gracieux de 84 903 €, que M. Siddiqui a reçu en plus de sa quittance statutaire. La juge a déclaré qu'elle avait traité l'affaire comme étant liée à la cessation de son emploi de comptable financier dans une société de location de voitures, car l'accord de règlement pertinent décrivait expressément cela comme une indemnité de départ.

M. Siddiqui, qui se représente lui-même, a déclaré qu'il s'agissait essentiellement d'un règlement de sa plainte en cours devant le Tribunal pour l'égalité et d'une éventuelle plainte pour préjudice à sa santé mentale résultant de la discrimination alléguée. Le juge a déclaré que les sommes versées pour régler ces réclamations ne seraient pas imposables.

Le ministère des Finances a confirmé que TAC avait raison de considérer que le paiement était imposable et a souligné l'accord de règlement qui stipulait que M. Siddiqui devait recevoir une somme nette de 65 000 €, ce qu'il a fait. Elle a déclaré que l'accord lui-même proposait ce type de traitement fiscal et que Siddiqui avait conclu cet accord en bénéficiant des conseils juridiques d'avocats experts en droit du travail.

Le juge Quinn n'était pas d'accord, estimant que le ministère des Finances était tenu de procéder à une analyse objective de la « matrice de vérité » entourant le paiement. Il a déclaré que la correspondance de 2018 et 2019 aurait dû être considérée comme pertinente car elle indiquait le contexte du règlement.

Il a souligné que le règlement aboutissait au retrait de la demande d’égalité et prévoyait le paiement de 10 000 euros plus taxe sur la valeur ajoutée pour les frais juridiques de M. Siddiqui. Le juge a estimé qu'une fois versée l'indemnité légale de licenciement, on aurait dû se poser une « vraie question » de savoir pourquoi 85 000 € supplémentaires avaient été accordés à un salarié avec un salaire annuel de 57 000 € qui n'avait travaillé dans l'entreprise que trois fois. années. .

Le juge a déclaré que le « contexte factuel global » associé aux dispositions statutaires de l’article 192A de la loi de 1997 exigeait que l’affirmation de M. Siddiqi selon laquelle le montant avait été payé en règlement d’une réclamation soit examinée plus en détail.

Il a soutenu que le TAC avait eu tort dans son interprétation de l'entente de règlement et dans sa conclusion que le montant n'était pas celui offert pour régler la réclamation.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

La gare de Bray obtient un investissement de 3,5 millions d’euros dans un centre de voyage – The Irish Times

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/JWUFXT6XEJNKHEQOTLBQE6XG3U.jpg)

Le ministre des Transports, Eamonn Ryan, a transformé le terrain en un projet de plaque tournante des transports pour la gare de Bray dans le comté de Wicklow.

D'un coût de 3,5 millions d'euros, le projet réorganisera les services de bus à la gare de Brays Daly, modernisera les installations piétonnes et cyclables avec de nouveaux sentiers et passages à niveau élargis, introduira de nouvelles aires de repos et plantera des arbres.

Le projet, soutenu par Irish Rail, a été conçu par le cabinet de conseil Atkins Realis, avec les entrepreneurs David Walsh Civil Engineering pour la réalisation des travaux.

Le Taoiseach Simon Harris, un TD de Wicklow, a déclaré dans un communiqué qu'il était ravi du projet, qui « devrait avoir un impact significatif sur les habitants de tout le comté en fournissant des espaces publics de haute qualité pour accompagner nos bâtiments de gare historiques ». Vraiment chanceux de t’avoir.

« Nous verrons un regain d'énergie et d'activité dans la région, ce que les petites entreprises apprécieront sans aucun doute », a déclaré le Taoiseach.

S'exprimant lors du redressement, M. Ryan a déclaré : « Le nouveau pôle de transport transformera la zone autour de la gare de Bray et encouragera davantage de personnes à choisir les transports publics. Nous constatons dans tout le pays que lorsque nous améliorons les infrastructures et les installations de transport, les gens réagissent de manière très positive. » .

« Bray est une ville fantastique et prospère et elle est sur le point de s'améliorer encore grâce à ce nouveau plan du conseil du comté de Wicklow, pour les résidents locaux et les navetteurs d'abord, mais aussi pour les nombreuses personnes qui visitent. »

Le directeur général adjoint du conseil du comté de Wicklow, Michael Nicholson, a déclaré que le projet de voyage actif était « l'un des nombreux » projets déployés dans tout le comté.

« À terme, le projet bénéficiera aux principaux modes de transport tels que la marche, le vélo, les taxis, les bus et le train à la gare, et encouragera un changement de paradigme des véhicules privés vers des modes de transport plus durables », a-t-il déclaré.

Les travaux seront réalisés par étapes, en conservant partout l'accès aux commerces, aux résidences, aux transports en commun et aux commodités. Les voies d'accès alternatives requises pendant la construction seront mises en évidence à l'avance.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

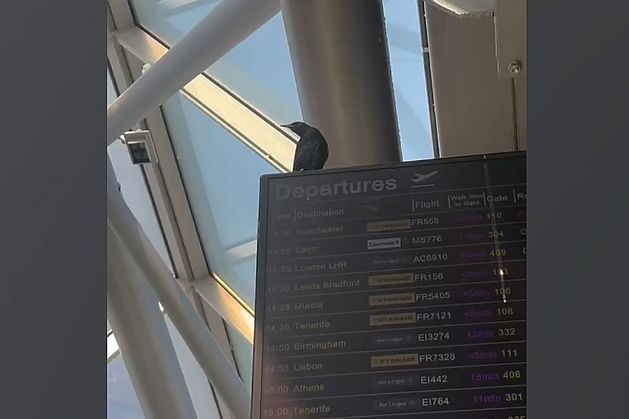

Un oiseau piégé dans le terminal de l'aéroport de Dublin « erre dans la confusion pendant plus de 40 jours » car son élimination « n'est pas une tâche facile »

Un militant des droits des animaux a déclaré que l’oiseau « errait confusément, à la recherche de restes de nourriture pendant plus de 40 jours.

« Nous notons des inquiétudes concernant l'oiseau vivant actuellement dans le terminal 1 de l'aéroport de Dublin », avait précédemment déclaré l'aéroport de Dublin sur Twitter.

« Aider un petit (et très rapide !) oiseau à sortir d'un bâtiment aussi immense et bondé n'est pas une tâche facile. Mais l'équipe de l'aéroport se saisit du dossier et, en consultation avec des experts de la faune et des oiseaux, mène une opération qui aura l'oiseau reprendra son chemin en toute sécurité très bientôt.

« En attendant, le public peut être assuré que l'oiseau reçoit suffisamment de nourriture et de boisson et qu'il est en bonne santé. Le retour en toute sécurité de l'oiseau dans la nature est une priorité absolue et nous remercions le public d'avoir confié son sauvetage au public. professionnels. »

Le militant Caoimhe Laird Phelan lance un appel pour sauver l'oiseau, une espèce d'étourneau sansonnet, qui serait là depuis plus de 40 jours.

« C'est la saison de reproduction, c'est le printemps, ils devraient voler d'arbre en arbre pour collecter du matériel de nidification afin de pouvoir avoir des bébés, sans errer confusément dans la station à la recherche de restes », a-t-elle déclaré.

« Être piégé à l’intérieur sans nulle part où s’échapper est très stressant pour un oiseau sauvage. Il est déjà dans un état de panique alors qu’il vole constamment vers les fenêtres du ciel pour trouver une issue.

Les étourneaux seraient piégés dans le terminal 1 de l'aéroport de Dublin depuis le 8 mars.

« Il ne sait pas que le hall des arrivées dans lequel il se trouve est au troisième étage et que pour sortir du bâtiment, il devra descendre deux volées d'escaliers pour atteindre une porte à la porte d'embarquement.

« C'est quelque chose qu'il n'a jamais pu comprendre car ces portes sont ouvertes par intermittence dans le seul but de permettre aux passagers de monter à bord de l'avion.

« Les aéroports ne sont pas leur habitat naturel et ne produisent pas de vers ni d’insectes à manger. Les étourneaux ne trouveront pas la nourriture et l’eau dont ils ont besoin.

«J'étais en voyage vendredi dernier et j'ai remarqué un étourneau maigre faisant des cercles autour du terminal 1. J'ai demandé à quelques membres du personnel, et personne ne semblait trop dérangé par sa présence ou par le début des secours.

«J'avais le sentiment qu'il était là depuis un moment, alors j'ai filmé quelques clips et réalisé une vidéo racontant son histoire et je l'ai mise en ligne.

« Cela a pris de l'ampleur et j'ai appris qu'il y avait été aperçu pour la première fois le 8 mars. À partir d'aujourd'hui, cela signifie qu'il est là depuis 42 jours », a-t-elle déclaré.

Caoimhi espère que l'aéroport de Dublin « assumera la responsabilité de mettre en place des procédures appropriées lorsque la faune est piégée entre ses murs ».

Kildare Wildlife Rescue a déclaré avoir reçu plusieurs demandes de renseignements concernant l'oiseau piégé.

« Nous avons reçu plusieurs rapports de personnes ayant vu une vidéo de cet étourneau en ligne », a-t-elle déclaré.

« L'aéroport n'a pas été en contact avec nous, mais même s'il l'était, nous ne pouvons malheureusement pas faire grand-chose pour aider dans cette situation.

« Puisque les étourneaux peuvent voler dans un grand espace ouvert avec de hauts plafonds, il ne serait pas possible de les attraper avec un filet.

« Le conseil habituel pour les oiseaux piégés dans les bâtiments est d’éteindre toutes les lumières et d’ouvrir toutes les fenêtres/sorties. Cela doit être fait pendant la journée afin que l’oiseau ne s’envole pas dans l’obscurité.

«Nous ne pouvons que supposer que l'aéroport ne sera pas en mesure de suivre ces conseils pour des raisons de sécurité et de logistique.

« Comme il est là depuis des semaines, nous pouvons au moins être assurés qu'il trouve de la nourriture et de l'eau quelque part – soit il est intentionnellement nourri par le personnel ou les voyageurs, soit il est capable de trouver de la nourriture et de l'eau par lui-même.

«Nous contactons nous-mêmes l'aéroport de Dublin et serions heureux de leur parler plus en détail et d'envisager des options potentielles s'ils nous répondent.

« La situation est loin d'être idéale ; « Nous espérons que tôt ou tard, il pourra s'en sortir », a-t-il ajouté.

Gillian Baird de la DSPCA a ajouté qu'il pourrait être difficile de faire sortir l'oiseau de l'aéroport.

« Le problème avec les étourneaux est qu'ils ont tendance à trouver leur chemin, quelle que soit la direction qu'ils prennent », a-t-elle déclaré. « À l'heure actuelle, ce qui se serait passé, c'est que l'oiseau aurait pu construire un nid et pondre des œufs », a-t-elle déclaré.

« Certains poussins pourraient bientôt éclore, c'est donc très difficile.

« Ce que nous disons à quelqu'un qui a un oiseau coincé dans son bâtiment, c'est d'éteindre toutes les lumières, d'ouvrir les portes, de mettre des graines à l'extérieur et de laisser l'oiseau tranquille.

« Mais ce que je vois, c'est que l'oiseau est piégé dans un bâtiment aéroportuaire doté de nombreux plafonniers. Il serait donc impossible d'éteindre les lumières car c'est une zone très fréquentée. L'oiseau ne sera jamais laissé seul. »

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

-

entertainment2 ans ago

Découvrez les tendances homme de l’été 2022

-

Top News2 ans ago

Festival international du film de Melbourne 2022

-

Tech1 an ago

Voici comment Microsoft espère injecter ChatGPT dans toutes vos applications et bots via Azure • The Register

-

science2 ans ago

Les météorites qui composent la Terre se sont peut-être formées dans le système solaire externe

-

science3 ans ago

Écoutez le « son » d’un vaisseau spatial survolant Vénus

-

Tech2 ans ago

F-Zero X arrive sur Nintendo Switch Online avec le multijoueur en ligne • Eurogamer.net

-

entertainment1 an ago

Seven révèle son premier aperçu du 1% Club

-

entertainment1 an ago

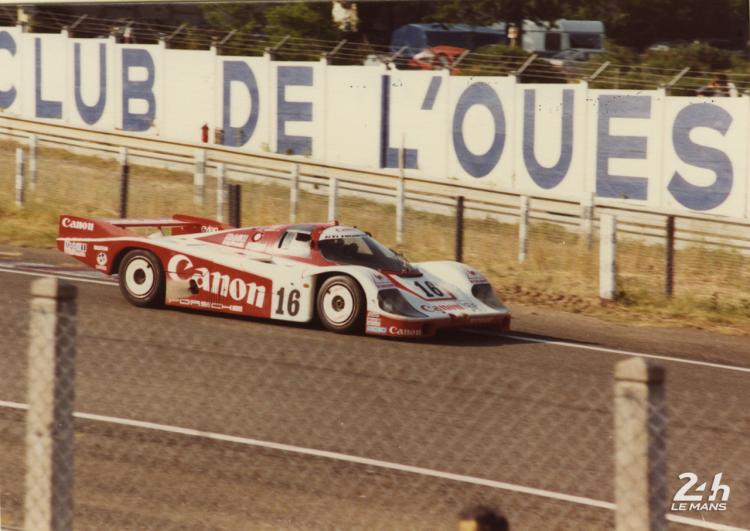

Centenaire des 24 Heures – La musique live fournit une bande-son pour la course