Economy

Bond yields rise after eurozone inflation surprise

Eurozone bond yields rose on Tuesday after the bloc’s August inflation reading came in well above expectations.

First estimate data showed inflation rose to 3% on an annual basis in August, the highest level in a decade, and well above the European Central Bank’s 2% target and 2.7% forecast in a Reuters poll.

Core inflation, a narrower reading that strips out volatile food and energy costs, also rose to 1.6%, compared to expectations for a rise to 1.4%.

Although bond markets are closely focused on inflation readings this year, price action after the data has been marginal.

By mid-morning, the 10-year yield in Germany, the main benchmark for the eurozone, rose 2 basis points to -0.42%, but remained below last week’s high of -0.401pc.

The Italian 10-year bond yield rose 3 basis points to 0.64%, keeping the closely watched gap with German 10-year bond yields at 105 basis points.

Inflation came above the ECB’s target for the second month in a row and is expected to rise further in the remainder of this year. But this is largely seen as a temporary increase driven by transitional factors, and policymakers argue that it will remain well below the bank’s target for years to come.

Ludovic Colin, portfolio manager at Vontobel Asset Management, said the European Central Bank’s new 2% symmetric inflation target, which allows for temporary excesses, is keeping markets calm.

« The market is saying we may see 2 per cent inflation, but we will never see an average of 2 per cent over a long period of time in Europe, » he said.

« That’s why, even if you get strong inflation numbers in Europe, the chance that it will lead to a massive rise in yield in Europe is very low. »

Data earlier on Tuesday already showed that French inflation came in higher than expected at 2.4 percent on an annual basis, while Spanish inflation exceeded expectations on Monday.

On Monday, data showing German inflation at a 13-year high, in line with expectations, failed to stimulate price action.

In the primary market, the release is rising this week after the summer lull. Commerzbank expects a €29.5 billion issuance in its busiest week since mid-July, although coupon payments and redemptions will offset the show.

On Tuesday, Italy raised 7.75 billion euros from reopening five- and 10-year bonds, along with seven-year floating-rate bonds, with five-year bonds issued at a record low yield of -0.01%.

The Netherlands was to raise up to €2.5 billion from reopening four-year bonds.

Greece has hired a syndicate of banks to reopen the five- and 30-year bonds. The sale is « expected in the near future, » a phrase that debt management offices usually use the day before the sale.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Ryanair remporte le procès contre son programme d’aide à une compagnie aérienne concurrente – Irish Times

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/J2QXIH7IDKQ7V3EHGKIYYDMNQQ.jpg)

Un tribunal de l’UE a fait droit à une plainte formelle déposée par Ryanair contre la décision de la Commission européenne de donner son feu vert à un programme d’aide allemand d’une valeur de plus de 300 millions d’euros en faveur de la compagnie aérienne Condor basée à Francfort.

L’Allemagne a demandé une aide de 321 millions d’euros pour aider la compagnie charter Condor à se restructurer après qu’elle se soit retrouvée en difficulté financière suite à l’effondrement de son groupe mère.

Il a également prévu 200 millions d’euros pour soutenir l’entreprise pendant la pandémie de Covid-19.

La Commission a décidé en juillet 2021 que le soutien de l’Allemagne à la compagnie aérienne ne violait pas les règles de l’UE en matière d’aides d’État. Condor faisait partie du groupe Thomas Cook, qui s’est effondré en 2019, obligeant la compagnie aérienne à déposer le bilan, après quoi le gouvernement allemand est intervenu pour soutenir l’entreprise.

Ryanair a fait appel de la décision concernant le soutien à la restructuration de 321 millions d’euros, dans le cadre d’une plainte déposée par la compagnie aérienne irlandaise auprès du Tribunal général de l’Union européenne. La commission, l’Allemagne et Condor ont soutenu que les poursuites judiciaires devaient être abandonnées.

Dans une décision rendue mercredi, le tribunal luxembourgeois s’est rangé du côté de Ryanair, annulant la décision de la Commission d’approuver l’aide. « La Commission n’aurait pas dû approuver l’aide à la restructuration en question sans ouvrir une enquête formelle », a déclaré le tribunal dans un communiqué.

Elle a déclaré : « L’objectif de l’aide est de soutenir la restructuration et la poursuite des opérations de Condor et de résoudre les difficultés rencontrées en raison de la faillite de son ancienne société mère, Thomas Cook 1. »

Elle a ajouté que Ryanair avait prouvé « suffisamment » que la Commission aurait dû avoir des doutes quant à l’acceptation d’une aide.

Cependant, la décision indique que Ryanair n’a pas démontré que l’aide était susceptible d’avoir un « effet négatif important » sur la position concurrentielle du transporteur irlandais sur le marché.

Le tribunal de l’UE avait initialement suspendu l’aide d’État à la compagnie aérienne allemande peu après que la Commission l’ait approuvée en 2021, dans l’attente d’une décision complète. La décision de cette semaine sur un point juridique peut faire l’objet d’un recours devant la Cour de justice européenne.

Ryanair a déclaré dans un communiqué que l’approbation par la Commission de l’aide à Condor était « contraire aux principes fondamentaux du droit de l’UE » et que la décision du tribunal était une « victoire pour une concurrence loyale ». Ryanair a critiqué le fait que la Commission n’ait pas pris de mesures pour restaurer « des milliards d’euros d’aides gouvernementales » accordées à d’autres compagnies aériennes.

Il y a un an, Ryanair a remporté une autre affaire devant le Tribunal européen contre une aide d’État de 130 millions d’euros en faveur des compagnies aériennes mise en place par le gouvernement italien pendant la pandémie de Covid-19. De même, la Cour a annulé une décision de la Commission européenne autorisant la mesure d’aide.

Ryanair a pris bon nombre de ces mesures pour contester les subventions accordées aux compagnies aériennes concurrentes pendant la pandémie. Même si des jugements ont parfois été défavorables à Ryanair, elle a réussi à lutter contre un plan d’aide gouvernementale de 6 milliards d’euros en faveur de la compagnie aérienne allemande Lufthansa.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Les énergies renouvelables atteignent un niveau record de 30% de l’électricité mondiale | L’actualité climatique

Cependant, Imber a déclaré que la poursuite de la croissance des secteurs solaire et éolien l’année dernière, menée par des pays comme la Chine et le Brésil, a marqué une « étape importante » dans la transition mondiale vers une énergie propre. Il existe aujourd’hui tellement d’énergie propre que la production mondiale d’énergie fossile est sur le point de décliner, tout comme ses émissions.

par Victoria Seabrook, correspondante climat @SeabrookClimate

Mercredi 8 mai 2024 à 01h00, Royaume-Uni

Les experts ont salué un « tournant critique » alors que les énergies renouvelables ont généré l’année dernière un record de 30 % de l’électricité mondiale, selon de nouvelles données.

Cela laisse espérer qu’un pic des émissions mondiales de gaz à effet de serre se profile à l’horizon.

Mais on craint que de nombreux pays échouent dans leur transition vers une énergie propre parce qu’ils ne peuvent pas obtenir l’argent nécessaire pour la financer.

La « percée » des énergies renouvelables de l’année dernière a été motivée par une autre année en plein essor pour l’éolien et surtout le solaire.

La Chine, le Brésil et les Pays-Bas ont ouvert la voie en termes de mise en œuvre rapide, a déclaré Ember Research dans son rapport annuel sur l’électrification mondiale.

La Chine représente à elle seule 51 % de la nouvelle production d’énergie solaire et 60 % de la nouvelle énergie éolienne. Il a également continué à construire des quantités massives de nouvelle énergie au charbon..

Christiana Figueres, ancienne des Nations Unies climat Le président a décrit 2023 comme un « tournant critique ».

Elle a déclaré que les combustibles fossiles « obsolètes » ne pouvaient désormais plus rivaliser avec « l’innovation massive et la baisse des coûts dans les énergies renouvelables et le stockage ».

« L’humanité entière et la planète dont nous dépendons s’en porteront mieux », a-t-elle ajouté.

Au cours des deux dernières décennies, les énergies solaire et éolienne ont défié les attentes et ont connu une croissance beaucoup plus rapide que prévu, passant de seulement 0,2 % de la production mondiale d’électricité en 2000 à 13,4 % en 2023.

Dave Jones, responsable des connaissances mondiales chez Ember, a déclaré que la croissance explosive était due à des politiques et des technologies « matures » et à des coûts inférieurs.

Le coût de l’énergie solaire a diminué de moitié l’année dernière malgré une demande accrue, grâce à une explosion des capacités de production.

Dans le même temps, les problèmes qui ont freiné l’énergie éolienne – tels que les coûts inflationnistes – commencent à se résoudre, ouvrant ainsi la voie à davantage de projets.

La Chine augmente son énergie au charbon malgré sa promesse de la contrôler

Objectif « vraiment ambitieux » en matière d’énergies renouvelables.

Lors du sommet sur le climat COP28 à Dubaï l’année dernière, les dirigeants se sont engagés à tripler la capacité des énergies renouvelables d’ici 2030.

Cet objectif « véritablement ambitieux » montre que les dirigeants soutiennent les énergies renouvelables, qui sont « les outils clés dont nous disposons aujourd’hui pour parvenir aux réductions importantes des émissions dont nous avons besoin », plutôt que des technologies plus risquées, telles que celles utilisées pour éliminer le dioxyde de carbone de l’atmosphère. dit M. Jones.

Imber note que la consommation mondiale de combustibles fossiles dans le secteur de l’énergie pourrait avoir culminé en 2023 et commencera à diminuer cette année, parallèlement à la pollution et aux émissions qu’elle entraîne.

Étant donné que le secteur de l’énergie représente la plus grande part des émissions mondiales, cela signifie que les émissions mondiales pourraient également bientôt commencer à diminuer.

C’est une bonne nouvelle pour limiter le changement climatique, même si les scientifiques ont averti à plusieurs reprises que les émissions ne diminuent pas assez rapidement pour limiter le réchauffement climatique à des niveaux plus sûrs convenus.

Le rythme de la baisse des émissions « dépend de la rapidité avec laquelle la révolution des énergies renouvelables se poursuit », a déclaré Jones.

La mise en œuvre serait « beaucoup plus rapide avec un investissement adéquat » dans les pays africains, qui sont souvent confrontés à des coûts d’emprunt beaucoup plus élevés que d’autres pays, a déclaré Juab Okanda, conseiller principal de Christian Aid, basé au Kenya.

Hanan Morsi, secrétaire exécutif adjoint et économiste en chef à la Commission économique des Nations Unies pour l’Afrique, a déclaré que le continent disposait d’un « potentiel important en matière d’énergies renouvelables ».

« Cependant, une très petite part de moins de 2 % des investissements mondiaux dans les énergies renouvelables est réalisée sur le continent. Le continent ne peut pas se développer davantage sans accès à l’énergie. »

Il a appelé à des réformes financières pour introduire de nouveaux types de financement abordables.

Le financement de la transition propre dans les pays en développement, qui contribuent généralement moins au changement climatique, sera une question clé lors du sommet des Nations Unies sur le climat, la COP29, en Azerbaïdjan.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

La Haute Cour annule un contrat de 23,5 millions d’euros pour moderniser l’éclairage public dans le Nord-Ouest

La Haute Cour a annulé l’attribution d’un contrat de 23,5 millions d’euros visant à moderniser environ 45 000 lampadaires dans le Nord-Ouest afin de les rendre plus économes en énergie.

Le juge Michael Quinn a rendu des ordonnances annulant la décision de mars 2023 du conseil du comté de Mayo, qui était l’autorité principale de sept conseils sur le projet de rénovation, d’attribuer le contrat à BAM KLS JV.

Le défi a été lancé par l’un des soumissionnaires non retenus, White Mountain Quarries Ltd, opérant sous le nom de Breedon, du comté d’Antrim.

Le deuxième défi, lancé par un consortium d’entreprises basé en République d’Irlande, appelé Le Chéile, qui était également un soumissionnaire non retenu, a été retiré.

White Mountain a affirmé qu’en attribuant le contrat, le conseil n’avait pas respecté un certain nombre de réglementations européennes en matière de marchés publics.

Il a également été allégué, entre autres choses, qu’en plus de ne pas avoir déterminé que l’offre de BAM KLS JV semblait anormalement basse, le Conseil n’avait pas non plus fourni de raisons suffisantes pour justifier sa décision.

Le conseil du comté de Mayo a nié ces allégations.

Dans sa décision, le juge Quinn a déclaré qu’il proposait de rendre un certain nombre d’ordonnances, notamment l’annulation de la décision d’attribuer le contrat à BAM KLS JV.

Il publiera également des déclarations selon lesquelles le conseil n’a pas réussi à déterminer que l’offre du soumissionnaire retenu « était suspecte et semblait donc anormalement basse » sur la base du non-respect des réglementations pertinentes, y compris des obligations applicables en matière de droit du travail.

Il déclarerait également que le conseil était obligé de ne pas exiger du soumissionnaire retenu qu’il explique les prix et les coûts dans son offre et qu’il violait le règlement sur les marchés publics.

Il entendra plus tard les parties sur la forme des ordonnances à prendre.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

-

entertainment2 ans ago

Découvrez les tendances homme de l’été 2022

-

Top News2 ans ago

Festival international du film de Melbourne 2022

-

Tech1 an ago

Voici comment Microsoft espère injecter ChatGPT dans toutes vos applications et bots via Azure • The Register

-

science2 ans ago

Les météorites qui composent la Terre se sont peut-être formées dans le système solaire externe

-

science3 ans ago

Écoutez le « son » d’un vaisseau spatial survolant Vénus

-

Tech2 ans ago

F-Zero X arrive sur Nintendo Switch Online avec le multijoueur en ligne • Eurogamer.net

-

entertainment1 an ago

Seven révèle son premier aperçu du 1% Club

-

entertainment1 an ago

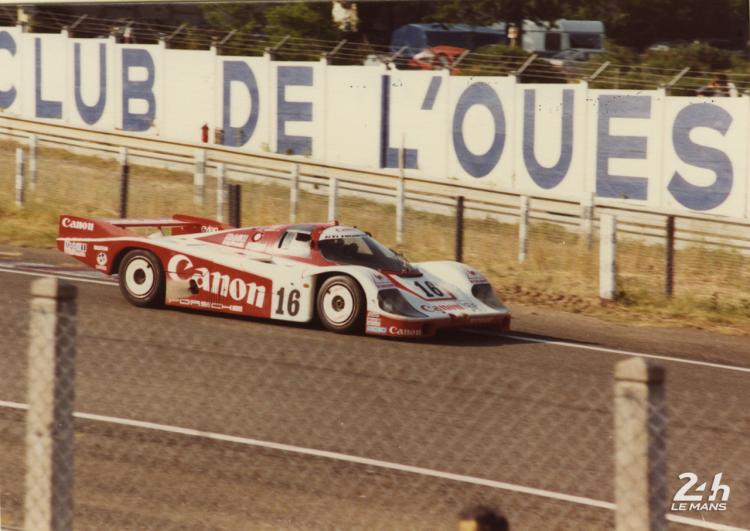

Centenaire des 24 Heures – La musique live fournit une bande-son pour la course