Economy

How to achieve your financial goals for 2022

While the « New Year, I’m New » approach isn’t for everyone, many people will be looking to iron out their finances for 2022.

This task may seem daunting, but there are some simple steps you can take to help manage your day-to-day finances and achieve your long-term goals.

We asked Susan Cashin, financial planner at Brewin Dolphin Wealth Manager, for some advice.

where do I start?

It’s common to procrastinate when it comes to confronting your spending habits, Ms. Cashin said.

But once you start the process, she said you might be surprised at how many quick saves you can make with a few small tweaks.

“For example, if you like a daily cappuccino at a cost of €3.50 per day during the work week, assuming you do that 50 weeks out of the year, you spend €875 on your daily treatment,” said Ms.

“Maybe this is a very nice vacation cost, or if you are a really sane person you can use it to create an AVC for your pension.

« If you do this, you can get a tax break of up to 350 euros on this payment, » she explained.

How do I create a realistic budget?

Before you start creating your budget, you’ll need to determine your net income, and note how much money you’re getting from all sources.

Once you do, Ms. Kashin suggests following the next five steps.

1 Track your spending.

Look at all your basic expenses first because it’s the easiest – so make a note of the mortgage, rent, childcare, heating, energy, insurance, etc.

To keep track of non-essentials, like cappuccinos or discretionary clothes and hair, keep a notebook or note on your phone about everything you spend.

Double-check this against your Revolut or your bank statement to make sure you don’t miss out on these easy click expenses.

2 Define your goals and objectives

Jot down what you would like to achieve in 2022 and beyond.

For example, are you looking to secure a happy retirement, buy a house or go on vacation.

Remember that Rome was not built in a day, so make sure that the goal is realistic, as if it is out of reach you will not stick to it, and then you will return to bad habits.

3 plans for how to achieve your goals

Find out how you will achieve these savings or goals.

For example, check all utility providers to see if savings can be made here.

Many people do not change providers and lose hundreds of euros in savings as a result.

Also check if you can save by switching insurance providers.

4 Adjust your bad habits

This is the hardest step because it involves some sacrifice, but keeping track of your end goal and monitoring your progress towards it will ease the pain of giving up a cappuccino, blowdry or takeaway.

When considering a purchase, back it up.

For example, if the new dress is €100, consider that you have to earn approximately €190 from work to save that €100 net – this can be a really good way to cut down on unnecessary spending.

5 Reconsider your plan

The most successful plans are those that we constantly reconsider.

Don’t increase the budget in January and then don’t revise it until December.

Keep checking in, and as you see your goal become more achievable, this will motivate you to make more adjustments.

Should I set long and short term goals?

Yes, setting long- and short-term goals is the key to success, according to Ms. Kashin.

« Initial, short-term goals build the building blocks for achieving longer goals, » she said.

Research shows that it takes an average of 18 to 270 days to break bad habits or modify our behaviors.

Therefore, Ms. Kashin said setting achievable short-term goals will ultimately help you succeed in achieving your long-term goals.

« For example, setting an initial goal in the first quarter of reducing your spending by 20% and achieving it, will instill the belief that you can reach those long-term financial goals, » she explained.

Can I Save Too Much Tax Credit?

Most people use the PAYE system, so taxes are deducted at the source.

But you’ll still need to check benefits, tax schedules, and ranges, which you can do in Revenue’s online system.

Medical expenses qualify for a 20% relief, but Ms. Kachin said many people lose or forget their receipts.

« A simple step like scanning it on your phone or even storing it in an envelope means you won’t miss it, » she said.

Ms. Cashin said she would encourage everyone to make sure they claim all of their allowances for 2022.

What about pension planning?

Ms. Kashin said if she had not already done so, she would suggest starting a personal contribution to a pension.

« For many people in our 30s, this may seem like a very long-term goal, but the truth is that most of us will now live well into our 90s, » she said.

« If you plan to retire at age 65, the pension amount must last at least 25 years, » she added.

For those who already have a pension, Ms. Cashin said she would advise you to review it once a year.

She explained that most pensions are invested with some degree of equity investment, and values can go down as well as up.

She said the initial assumptions would be illustrative, so knowing how the fund is performing is very important.

« It’s also a good idea to ask about fees and costs and to make sure you get your annual benefit statement, » she said.

Ms. Kashin said that when she meets a new client, she will often ask them three questions — “How much is your pension worth?”, “How much is your fee?” and “How did it perform last year?”

She said that the majority of people cannot answer these questions.

“So I turn the question around and ask if you have an apartment, will you be able to answer the same questions about them?

« In short, for many people their pension is likely to be the next most valuable asset after their home, so it should be given the same importance and respect, » she said.

Another important factor, Ms. Kashin said, is researching any old pensions you may have from previous jobs.

“Keep your address up to date on these and see where you can arrange access online.

« Organize a review of it where it may be invested in strategies that don’t match your investment goals, or have very high fees, » she said.

Ms. Kachin said that many pensions and personal investments with life companies are not claimed every year.

« So keep a note of it with your will and other asset schedule, » she said.

Should I consider investing?

With the current negative interest rate environment, many people will be looking to invest for the first time in 2022.

But Ms. Kashin cautioned that for some the risk might not be appropriate, or really appropriate, for their financial goals.

« All decisions, including investments, are about assessing the potential benefits and seeing if they outweigh the risks, » she said.

“In the current environment, it is possible that your money in the bank will not get any interest or you may lose money because of negative interest rates,” she explained.

Before investing, Ms. Cashin said you will need to check if the money you plan to invest is needed in the short term.

« Ask if you have debt to pay off before you invest and be sure to keep a rainy day fund, » Ms. Cashin suggested.

She said they recommend clients keep enough cash to cover basic living expenses for at least 6-12 months, as well as cash to cover any unexpected expenses.

« Do your research again and if you can, talk to a professional counselor to explore all of your options, » she said.

If you can take a long-term view of investing, Ms. Cashin said investing money in your pension fund where it gets tax-free growth might be a better option.

But, before making any decision, read the lowercase letters.

“Check all fees and costs and make sure you get them in writing.

“Ask what happens if you need access to your money early, and get the answer in writing,” she said.

And as a final word of warning, Kachin said that if an investment sounds too good to be true, it generally does.

“Investments promising huge high returns tend to be high risk as well, anything promising or claiming unrealistic returns should be avoided at all costs.”

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Un café de Kinsale présente un délicieux étalage pendant que la propriétaire de Food U raccroche son tablier

KINSALE et la bonne nourriture vont de pair, donc quiconque cherche à gérer sa propre entreprise alimentaire dans la ville balnéaire pourrait être intéressé par la location d'un café établi.

Food U, géré par l'entreprise de restauration professionnelle Úna Crosbie depuis 10 ans, est l'endroit idéal pour profiter de la fréquentation du parc Kinsale. De plus, il est situé face au vénérable yacht club, et est idéalement placé pour satisfaire les marins assoiffés (et insipides) et grincheux.

Mme Crosby, qui dirigeait auparavant le restaurant Glassyalleys dans la ville de Cork, travaille dans la restauration depuis 2002 et prend sa retraite de son entreprise à Kinsale. Le résultat est que l'entreprise est à vendre. Les acheteurs intéressés peuvent prendre possession du bail – un nouveau bail de trois ans a été récemment signé – pour 150 000 €.

«Je gère toujours le café moi-même, et les choses passent très vite, mais je veux ralentir un peu, alors je vends sur le bail», a déclaré Mme Crosbie.

Elle a ajouté : « J'adore ce travail, c'est une super petite entreprise, mais je sers de la nourriture depuis l'âge de 16 ans. » Mme Crosby le dirigeait six jours par semaine.

Représenté par Ray Sweetnam de Casey & Kingston, il affirme que le café a réalisé « des marges bénéficiaires et un chiffre d'affaires constamment élevés au cours des cinq dernières années ».

L'unité est située au 1 Pier Road, Kinsale, au cœur de la ville, surplombant le port de Kinsale, et à seulement 15 minutes du Old Head of Kinsale, qui abrite l'un des clubs de golf les plus exclusifs du pays, ainsi qu'un important site touristique. centre. la gravité.

Le bail comprend un bâtiment de 360 pieds carrés (33,5 m²) au rez-de-chaussée, avec des agencements et des sièges intérieurs et extérieurs. Les prix sont de 700 euros.

Le site, proche de l'hôtel Acton, « bénéficie clairement du yachting et d'un tourisme de haut niveau », a déclaré Swetnam.

Kinsale est idéalement relié par plusieurs lignes de bus et se trouve à seulement 20 minutes en voiture de l'aéroport de Cork. C'est une ville riche avec plus que sa part de foyers valant plusieurs millions d'euros.

Ray Sweetnam Tél. : 021 42711277 E-mail : [email protected]

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Un employé d'un restaurant de restauration rapide de Cork reçoit une indemnisation après un licenciement abusif

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Le programme de conduite autonome de Tesla est une déception perpétuelle en termes de revenus

(Bloomberg) – L’écart entre ce que dit Elon Musk à propos de la commercialisation de la technologie de conduite autonome et ce que Tesla dira plus tard dans les documents réglementaires n’a jamais été aussi large.

Tesla a publié mercredi son rapport trimestriel 10-Q qui fournit un aperçu plus détaillé de la santé financière de l'entreprise. Pendant plusieurs années consécutives, Tesla a fourni des mises à jour régulières de ces données sur le montant des revenus qu'elle a reçus des clients et qui n'ont pas encore été entièrement reconnus. Une partie de ces revenus différés est liée à un produit en préparation : la conduite entièrement autonome, ou FSD, en abrégé.

Les revenus reportés des véhicules de Tesla s'élevaient à 3,5 milliards de dollars au 31 mars, soit peu de changement par rapport à la fin de l'année dernière. Sur ce montant, Tesla s'attend à reconnaître 848 millions de dollars au cours des 12 prochains mois, ce qui signifie qu'une grande partie des obligations de performance associées à ce qu'elle facture aux clients pour le FSD ne seront toujours pas satisfaisantes dans un an.

La société ne donne pas de détails sur ses performances médiocres, même si le titre du programme est connu pour être un abus de langage. FSD est un système d'aide à la conduite qui ne rend pas les voitures de l'entreprise autonomes ; Cela nécessite que les conducteurs vigilants gardent les mains sur le volant.

Dans ces documents, Tesla a également indiqué le montant des revenus différés réellement comptabilisés – et la société basée à Austin n’a toujours pas répondu à ses attentes. Il a reconnu 494 millions de dollars de revenus différés au cours des 12 derniers mois, soit moins que les 679 millions de dollars prévus il y a un an.

Ces chiffres ont pris encore plus d’importance à la lumière du ralentissement de l’activité automobile de Tesla et de l’accent mis par Musk sur le FSD. Le PDG a mis en place une exigence à la fin du premier trimestre, selon laquelle les employés devaient installer et démontrer un FSD à chaque client en Amérique du Nord avant de livrer le véhicule.

En fait, lors de la conférence téléphonique sur les résultats du premier trimestre de Tesla mardi, Musk a tracé une nouvelle ligne dans le sable : « Si quelqu'un ne pense pas que Tesla va résoudre le problème de l'autonomie, alors je pense qu'il ne devrait pas investir dans le secteur. entreprise. » « Nous le ferons, et nous le ferons », a déclaré l’exécutif.

Alors que Tesla a bénéficié au premier trimestre de la hausse des revenus FSD par rapport à l'année dernière, en raison de la sortie d'une fonctionnalité en Amérique du Nord appelée Autopark, les revenus totaux ont chuté de 8,7 % à 21,3 milliards de dollars. Il s'agit de la première baisse d'une année sur l'autre de l'entreprise en quatre ans et de la plus forte baisse en pourcentage depuis 2012.

Musk a donné le coup d'envoi de l'appel aux résultats de Tesla en qualifiant la dernière version de FSD de « profonde » et s'améliorant rapidement. La société a réduit le prix d’achat de la fonctionnalité ou d’abonnement pour l’utiliser sur une base mensuelle et propose également des essais gratuits. Le PDG a déclaré que la société avait eu des discussions avec un grand constructeur automobile au sujet d'une licence FSD.

« Encore une fois, je recommanderais fortement à tous ceux qui, je pense, envisagent des actions Tesla, de vraiment conduire FSD », a déclaré Musk à la fin de l'appel. « Il est impossible de comprendre l’entreprise si on ne la comprend pas. »

D'autres histoires comme celle-ci sont disponibles sur bloomberg.com

©2024 Bloomberg LP

Ouvrez un monde d'avantages ! Des newsletters utiles au suivi des stocks en temps réel, en passant par les dernières nouvelles et un fil d'actualité personnalisé, tout est là, en un seul clic ! Connecte-toi maintenant!

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

-

entertainment2 ans ago

Découvrez les tendances homme de l’été 2022

-

Top News2 ans ago

Festival international du film de Melbourne 2022

-

Tech1 an ago

Voici comment Microsoft espère injecter ChatGPT dans toutes vos applications et bots via Azure • The Register

-

science2 ans ago

Les météorites qui composent la Terre se sont peut-être formées dans le système solaire externe

-

science3 ans ago

Écoutez le « son » d’un vaisseau spatial survolant Vénus

-

Tech2 ans ago

F-Zero X arrive sur Nintendo Switch Online avec le multijoueur en ligne • Eurogamer.net

-

entertainment1 an ago

Seven révèle son premier aperçu du 1% Club

-

entertainment1 an ago

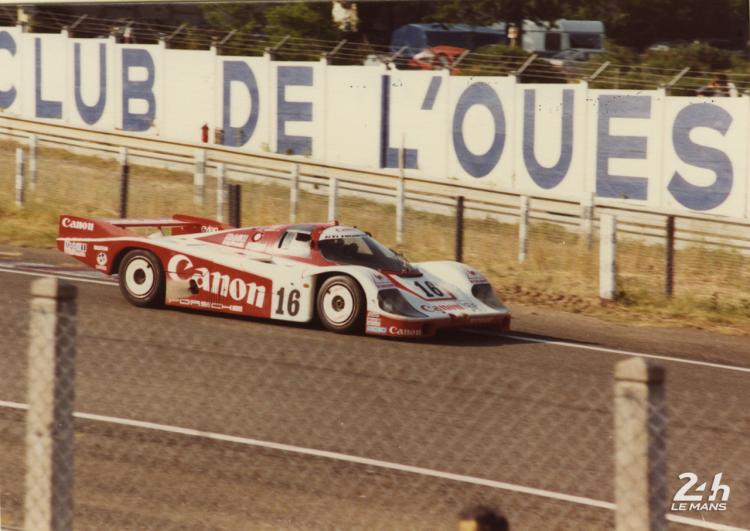

Centenaire des 24 Heures – La musique live fournit une bande-son pour la course