Economy

Is it time for Ulster Bank and KBC customers to switch?

If you are a client of Ulster Bank or KBC, you may want to start thinking about which bank to move to when they pull out of the Irish market.

While both banks say no action is required at the moment, it is worth preparing well in advance of closing.

Ulster Bank said it will contact customers directly early next year, and plans to give checking and deposit account holders six months’ notice to close their accounts and switch.

Meanwhile, KBC said it will give customers at least 60 days’ notice.

From bank fees to online capabilities, there are a number of things to consider before deciding which bank is best for you.

How many banks are there to choose from?

Once Ulster Bank and KBC withdraw from the Irish market, there will be eight providers offering checking account services here.

These are AIB, An Post, Bank of Ireland, The Credit Union, EBS, N26, Permanent TSB, and Revolut.

We asked Daragh Cassidy of comparison site Bonkers.ie to identify the main differences between the checking account services offered by the remaining bank.

What banks have the most branches?

If you are someone who likes to walk into the bank every week to deposit a check or withdraw cash, then you should make sure you choose a provider with a nearby branch.

AIB and Bank of Ireland both have a similar sized branch network, which is the largest in the country.

AIB has 170 branches, while the Bank of Ireland has 169 branches.

The permanent TSB has a much smaller presence with 76 branches, although Cassidy said it is set to acquire 25 Ulster Bank branches over the next few years.

An Post has more than 900 post offices across the country and it allows AIB and Bank of Ireland clients to do their day to day banking at its offices.

Meanwhile, Revolut and N26 have no physical banks, as they are only real online banks.

If you’ve never put food inside a bank and prefer to do online banking – physical presence may not be something you need to consider when choosing a new provider.

What are the best banks for cash users?

If you prefer to use cash for credit or debit cards, online banks are probably not the best option for you.

Cassidy said cash users may want to avoid N26 and Revolut.

« Because they both have no bank branches, you won’t be able to deposit any cash – and withdrawing cash can cost you dearly as well, » he said.

Cassidy said people should be aware that the N26 allows three no-fee ATM withdrawals per month – but then a fee of €2 per withdrawal applies.

Revolut allows you to withdraw a maximum of €200 per month without fees and you are only allowed five free withdrawals per month.

After you reach either limit, you are charged €1 or 2% for each withdrawal, whichever is higher.

Meanwhile, AIB will charge 35 cents for each withdrawal.

While that may not sound like much, Cassidy cautioned that these fees can add up quickly.

The Bank of Ireland and the permanent TSB do not charge anything extra for cash withdrawals and both have a prominent presence.

« These can be good options for those who use cash a lot, » Cassidy said.

On the other hand, he noted that the PTSB pays you 10 cents every time you use your card in the store or online, up to a maximum of 5 euros per month.

« This could make it a good option for those who use their card a lot, » he added.

Which banks have the best online services?

The capabilities of each online provider vary greatly, so if you plan to do most of your banking online, choose carefully.

“N26 and Revolut lead the pack here and have nearly revolutionized what you can do on your phone with your money,” said Mr. Cassidy.

He noted that EBS on the other hand doesn’t even have a mobile app – although it does have online banking that you can access from a laptop or desktop.

Cassidy said the PTSB app is « completely basic » and does not yet provide fingerprint or face login, for example.

Meanwhile, AIB requires a card reader for some online transactions, which means you could be caught if you don’t have the device on hand.

If you want to tap and pay using your phone or watch, you should take into consideration the mobile payments offered by the different banks.

« Most providers now at least offer either Apple Pay and Google Pay, but FitBit and Garmin Pay are not widely available, » Cassidy said.

However, he noted that the EBS account does not offer any mobile payments at all.

What banks have the highest fees and charges?

It can be difficult to keep track of banking fees and costs.

While some banks charge a flat monthly fee, others charge a fee per transaction.

The credit union charges a monthly fee of €4, €5, €6 PTSB and €6 from the Bank of Ireland.

After that, most of your daily banking is free with all these providers.

However, Mr. Cassidy said An Post will charge you 50 cents for every cash or check deposit, and 60 cents for every ATM withdrawal.

« Although that’s down to 50 cents at a post office, and you get one free withdrawal per week, » he added.

With a credit union, you get five ATM withdrawals with no fees per month – then a fee of 50 cents applies.

EBS, N26, and Revolut do not charge a monthly fee.

However, as mentioned earlier, hefty fees can apply when withdrawing cash only from online banks.

Meanwhile, AIB charges fees for nearly every type of transaction, and Cassidy said this can be too expensive for people with medium to heavy accounts.

But if you are a student, graduate, or over 66 years old, the good news is that all providers waive most fees.

None of the banks, Cassidy said, charges fees for mobile or contactless transactions — at this time.

What other features are worth considering?

Ulster Bank has a feature that allows you to block or freeze your debit card if you misplace it, then unfreeze it as soon as you find it.

Of the remaining providers, only AIB, An Post, N26, and Revolut currently offer this feature.

“If you are an Ulster Bank customer who has taken advantage of and values this feature before, this is something to consider,” Cassidy said.

It’s also important to note, he said, that N26 will give you a German IBAN when you open an account, while Revolut will give you a Lithuanian account.

« This can cause problems for people, as some employers and companies cannot recognize non-Irish account numbers, » he warned.

Meanwhile, regarding the overdraft facility, Cassidy said neither An Post, EBS MoneyManager, N26 or Revolut offer overdrafts at this time.

« If you currently have an overdraft or think you might want to have it in the near future, that’s something to consider, » he added.

What is not important when choosing a checking account?

There is a misconception among the Irish people that if you are taking out a mortgage, it will help you with your application if you have your checking account with the respective bank.

But Mr. Cassidy said nothing could be further from the truth.

“Your mortgage application will depend on your income, your ability to pay, and your current job status.

« With who you have your checking account with, it will have no bearing on whether or not your application will be approved, » he said.

Is the conversion process complicated?

While you can open an account with a new online provider, often within minutes, switching from one bank to another is a bit more complicated.

All debits and standing orders must be moved, and Cassidy cautioned that this takes time.

« You can use the central bank’s code of conduct or you can do most of it yourself, » Cassidy explained.

« If you use the Code of Conduct, your old bank should help you transfer direct debts and standing orders, » he explained.

However, he noted that many payments for things like Netflix, Amazon Prime, M50, Spotify, and GoMo are taken from your debit card as recurring payments — they’re not direct debits taken from your account.

« It’s up to you to go online and update all your payment details for these kinds of things yourself, » he said.

You will also need to tell your employer your new account details, as neither your old bank nor your new bank can do this for you.

Finally, you’ll need to sign up and set up your new baking online, download your new bank app and set up Apple or Google Pay on your phone or watch.

Will there be a rush of people looking to change?

Ulster Bank alone has around 500,000 customers in a checking account.

Cassidy noted that a bank of this size had never left Ireland.

“You don’t want to search for a new checking account provider at the same time as more than half a million other people,” he said.

KBC is set to pull out of the Irish market shortly after Ulster Bank, which means there will be a second wave of customers looking to switch.

« There is no need to rush or panic but I advise clients to make the New Year’s resolution for change in January or February perhaps, » he advised.

What is the latest advice from Ulster Bank?

Ulster Bank encourages customers to consider their options, take advantage of support, and prepare to choose a new banking provider.

« Over the coming months, we will be reaching out to customers, including those who may need further support, to help them prepare for the selection of a new provider, with a view to moving and closing their accounts, » the bank said in a statement.

While the bank was quick to point out that customers do not need to take action at the moment, it said customers can switch now if they are willing to do so.

“Ulster Bank encourages our personal ready customers now to call us at 0818210260 to arrange an appointment or call a branch where we will be able to assist customers, who are willing, on an individual and personal basis to get ready to select, transfer and close their checking and deposit accounts.”

She said mortgage clients do not need to take any action at this time.

“We are in discussions with other banking parties in the Irish market to convert these mortgages on their current terms and conditions.

« We will contact customers when there is a further update, » Ulster Bank’s statement said.

Meanwhile, commercial customers willing to transfer their accounts can now contact Ulster Bank at 0818211690 or through their Relationship Manager.

What is the latest advice from KBC?

Unlike Ulster Bank, KBC Bank Ireland does not actively encourage customers to prepare for changes in the road.

When RTÉ business contacted customers for advice, it again said that customers did not need to take any immediate action.

It said the binding agreement with the Bank of Ireland remained subject to all relevant regulatory approvals.

A spokesperson for the bank said: “KBC hubs, call center and digital channels continue to operate as usual and continue to accept new applications for checking accounts, mortgages, deposits, personal loans, life insurance, home and auto insurance and personal credit cards.” And

The spokesperson said KBC will ensure all customers, including checking account customers, receive « plenty of notice » of any changes to their accounts in line with all legal and regulatory protections.

“For example, if customers are required to switch or close their checking accounts, KBC will provide customers with at least 60 days’ notice,” the spokesperson said.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Le yen est tombé au-delà de 158 pour un dollar alors que la Banque du Japon a maintenu son taux d'intérêt directeur inchangé.

(Bloomberg) — Le yen est tombé à son plus bas niveau depuis 34 ans face au dollar après que la Banque du Japon a signalé que sa politique monétaire resterait accommodante, suscitant des spéculations selon lesquelles les autorités pourraient bientôt intervenir sur le marché pour endiguer le déclin de la monnaie.

La monnaie japonaise a chuté jusqu'à 1,8% au cours de la journée et a touché son plus bas niveau de la séance à 158,33 contre dollar, les pertes s'accélérant en fin de séance à New York. Les baisses ont commencé plus tôt dans la journée, après une réunion politique de la Banque du Japon, au cours de laquelle la banque centrale a maintenu son taux d'intérêt directeur inchangé et le gouverneur Kazuo Ueda n'a fait que peu de commentaires pour soutenir le yen lors d'une conférence de presse.

Les pertes se sont creusées même après qu'une mesure de l'inflation sous-jacente aux États-Unis ait correspondu aux attentes, atténuant les craintes que la poursuite des pressions sur les prix puisse retarder la réduction des taux d'intérêt par la Réserve fédérale.

À l'approche de la réunion de la Banque du Japon, les traders ont consolidé leurs positions courtes sur le yen. Les paris combinés des hedge funds et des gestionnaires d'actifs sur la faiblesse des devises ont atteint 184 180 contrats mardi, un record jamais enregistré, selon les données de la Commodity Futures Trading Commission remontant à 2006.

La monnaie japonaise a déjà perdu près de 11 % de sa valeur par rapport au dollar cette année, la moins performante parmi les devises du G10. La dépréciation de la monnaie est due à l'écart toujours plus grand entre les taux d'intérêt aux États-Unis – qui sont à leurs plus hauts niveaux depuis des décennies après le cycle de resserrement agressif de la Fed l'année dernière – et ceux du Japon, où les coûts d'emprunt restent obstinément bas, proches de zéro. .

Lire la suite : La Banque du Japon se positionne sur les taux d'intérêt et les achats d'obligations

« Il s'agit d'une faiblesse incroyable », a déclaré Justin Onwuekosi, directeur des investissements chez St. James's Place Management. « Ce niveau de faiblesse va certainement être préoccupant. Nous pensons que le yen est allé trop loin et, à notre avis, il sera fiable. »

Les décideurs politiques ont averti à plusieurs reprises que la dépréciation de la monnaie ne serait pas tolérée si elle allait trop loin et trop rapidement. Le ministre des Finances Shunichi Suzuki a confirmé après la réunion de la Banque du Japon que le gouvernement réagirait de manière appropriée aux mouvements de change.

L'indice boursier Topix a augmenté de 0,9% après la décision de la Banque du Japon, les sociétés immobilières augmentant leurs gains. Le rendement de l'obligation de référence à 10 ans est tombé à 0,925% contre 0,93% plus tôt dans la journée.

« Une fois de plus, la BoJ a prouvé qu'elle pouvait surprendre même les prévisionnistes les plus pessimistes », a déclaré Charu Chanana, stratège chez Saxo Capital Markets. « Mais toute intervention, si elle n'est pas coordonnée et sans le soutien de messages politiques durs, restera inutile », a-t-elle ajouté.

Dans une déclaration trilatérale publiée la semaine dernière, les États-Unis, le Japon et la Corée du Sud ont déclaré qu'ils continueraient à se consulter étroitement sur l'évolution du marché des changes, tout en reconnaissant les sérieuses inquiétudes exprimées par le Japon et la Corée concernant la récente forte baisse de la valeur de leurs monnaies. .

D'après l'analyse des commentaires de Masato Kanda, haut responsable des changes au ministère des Finances, le niveau de 157,60 par rapport au dollar est l'un des niveaux clés à surveiller. Le ministère publiera le 30 avril les chiffres des interventions pour la période du 28 mars au 25 avril, tandis que les données incluant aujourd'hui seront publiées le 31 mai.

D'autres déclencheurs potentiels sont les jours fériés au Japon lundi et vendredi de la semaine prochaine, qui entraînent un risque de volatilité dans un contexte de négociation tendue.

« Si le yen continue de baisser, comme ce fut le cas après la décision de la Banque du Japon en septembre 2022, la probabilité d'une intervention augmentera », a déclaré Hirofumi Suzuki, stratège en chef des devises chez Sumitomo Mitsui Banking. Cela mènera à l’action.

Le Japon a procédé à sa première intervention d'achat de yen depuis 1998 en septembre 2022, lorsque le gouverneur Haruhiko Kuroda a fait des commentaires pessimistes après une décision politique et la chute de la monnaie. Le Japon est entré sur le marché à trois reprises jusqu'en octobre de la même année, dépensant plus de 9 000 milliards de yens (57 milliards de dollars).

–Avec l'aide de Winnie Hsu, Masaki Kondo, Vassilis Karamanis, Carter Johnson et Constantine Korkoulas.

(Mises à jour sur les mouvements du yen en fin de séance à New York, graphiques)

D'autres histoires comme celle-ci sont disponibles sur bloomberg.com

©2024 Bloomberg LP

Ouvrez un monde d'avantages ! Des newsletters utiles au suivi des stocks en temps réel, en passant par les dernières nouvelles et un fil d'actualité personnalisé, tout est là, en un seul clic ! Connecte-toi maintenant!

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Google investit 75 millions de dollars pour apprendre à 1 million d'Américains à utiliser l'intelligence artificielle

Google a annoncé vendredi le lancement d'une formation visant à apprendre à un million d'Américains à utiliser les outils d'intelligence artificielle.

Dans le cadre de ce déploiement, le géant de la technologie a également annoncé que sa branche philanthropique, Google.org, avait engagé 75 millions de dollars en subventions pour la formation aux compétences en IA des habitants des zones rurales et mal desservies.

Le nouveau cours de compétences en IA sera disponible au prix de 49 $ sur Coursera, un fournisseur de cours en ligne à but lucratif.

Cette annonce intervient après que Google a abandonné ses règles obligeant les fournisseurs et les sociétés de recrutement avec lesquelles il travaille à offrir de bons salaires et avantages sociaux à leurs employés, tout en licenciant des milliers d'employés. employés Malgré des bénéfices records.

Selon la liste des cours, il apprendra aux utilisateurs comment « utiliser des outils d’IA générative pour aider à développer des idées et du contenu, à prendre des décisions plus éclairées et à accélérer les tâches de travail quotidiennes », et ce, de manière responsable.

Le cours promet également que les apprenants « développeront des stratégies pour rester à jour dans le paysage émergent de l’IA ».

Concernant les 75 millions de dollars de subventions de l’AI Opportunity Fund, ces subventions seront versées aux « meilleures organisations de développement de la main-d’œuvre et d’éducation », selon un porte-parole de Google.

Des organisations comme Goodwill Industries International recevront une partie des fonds de formation « pour permettre aux Américains d’exploiter la technologie de l’IA pour améliorer leur productivité et les préparer aux emplois de demain ».

Les programmes d'aide à la carrière de Goodwill ont été salués dans le passé pour avoir aidé les travailleurs à obtenir des postes permanents avec des salaires et des avantages sociaux décents.

Mais l’organisation continue de payer aux employés handicapés un salaire inférieur au salaire minimum sous couvert de formation professionnelle – un programme autorisé par le ministère américain du Travail.

Certains employés handicapés qui travaillent dans le cadre de cette exonération gagnent moins de 1 $ de l'heure.

Il y a à peine une semaine, Google l'annonçait Annuler ses règles Ce qui obligeait ses partenaires commerciaux à fournir à leurs travailleurs un salaire décent.

De 2019 jusqu'à la semaine dernière, Google a exigé que les entreprises avec lesquelles il avait des contrats paient ses employés au moins 15 dollars de l'heure et leur fournissent une assurance maladie et des avantages sociaux.

Mais parce que Google exerçait un certain degré de contrôle sur ces travailleurs, le National Labor Relations Board (NLRB) des États-Unis a déclaré que cela faisait de Google un « employeur conjoint » d’entre eux.

Par conséquent, l’entreprise technologique serait tenue de négocier avec ses syndicats – ce à quoi l’entreprise est connue pour résister à le faire.

Google a refusé de négocier avec des travailleurs syndiqués plus proches de chez lui, y compris YouTube, dont il est propriétaire.

Lorsque les sous-traitants de YouTube ont rejoint à l’unanimité le syndicat Alphabet et ont insisté pour négocier avec Google sur les conditions de travail l’année dernière, le géant de la technologie a refusé.

Ce refus constituait une violation de la loi décidée par le NLRB en janvier de la même année.

Ce ne sont pas non plus des incidents isolés. Google a été accusé d'avoir licencié illégalement des travailleurs à des fins de syndicalisation, d'avoir interféré avec des activités protégées et, de manière générale, d'avoir adopté un comportement illégal pour opprimer ses travailleurs et les empêcher d'exercer leur droit de s'organiser pour de meilleures conditions de travail, selon le British Daily Mail. Institut de politique économique.

Les nouveaux programmes caritatifs annoncés aujourd'hui par Google font également suite à des licenciements très médiatisés.

Google a annoncé avoir réalisé un bénéfice de 20,7 milliards de dollars au quatrième trimestre 2023, soit une augmentation de 52 % par rapport à l'année précédente, mais ses effectifs ont diminué de 4 %.

Kenneth Smith, directeur de l'ingénierie chez Google, a déclaré que la direction l'avait informé par courrier électronique de la suppression de son poste et avait déposé une plainte sur LinkedIn. mail Que l’entreprise n’a pas « reconnu leur humanité ».

« J'ai ressenti beaucoup de colère et de frustration à l'égard des dirigeants de Google à cause de la façon dont ils ont géré le licenciement de douze mille personnes en janvier dernier, et je ne vois pas beaucoup de preuves qu'ils ont appris grand-chose », a-t-il écrit. De cette expérience.

Cette décision est intervenue peu de temps après que Google ait lancé son grand modèle linguistique (LLM) appelé Goose, et après avoir annoncé un investissement majeur dans la startup d'IA.

Le nouveau cours d'IA est adapté à votre rythme et comprend 10 heures de matériel réparties sur cinq modules.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Une guerre des taux hypothécaires éclate lorsqu’un autre prêteur réduit ses taux d’intérêt

Avant Money réduit tous les taux d'intérêt de ses prêts, tandis que la société mère Bankinter est sur le point de mettre en place une opération bancaire complète en Irlande.

La banque espagnole possède le prêteur hypothécaire Avant Money, basé à Leitrim, qui a fait ses preuves au cours des six dernières années de sa détention.

Avant Money, basé à Leitrim, réduit les taux hypothécaires jusqu'à 0,45 point de pourcentage.

Ils proposent également une offre de remise en argent de 1 % sur l'hypothèque retirée pendant une période limitée pour attirer les convertisseurs.

L'incitation s'élèvera à 4 000 € sur un prêt hypothécaire de 400 000 €.

L'actualité du jour en 90 secondes – 26 avril

Cette décision verra son meilleur taux tomber à 3,6 % pour une durée fixe de quatre ans pour ceux qui ont un prêt de 80 % ou moins. C'est moins de 3,8%.

Le taux d'intérêt sur quatre ans est de 3,80 % pour les prêts supérieurs à 80 %.

D’autres taux d’intérêt fixes, notamment un taux fixe unique pour les prêts hypothécaires viagers, sont en cours de réduction.

Brian Land, responsable des prêts hypothécaires d'Avant Money, a déclaré : « Nos taux d'intérêt fixes sont aussi bas que 0,45 point de pourcentage, et nos taux simplifiés offrent une meilleure valeur aux clients sur l'ensemble de notre gamme. »

Le taux fixe sur quatre ans d'Avant Money de 3,6 % est le taux non vert le plus bas du marché et est disponible pour tous les niveaux de prêts hypothécaires, a déclaré Martina Hennessy, directrice générale du courtier hypothécaire Doddl.ie.

Elle a déclaré que la nouvelle proposition de taux et de conversion d'Avant Money serait très attrayante pour des milliers de titulaires de prêts hypothécaires qui bénéficieront de taux fixes au cours des 12 prochains mois.

« Avec des taux d'intérêt sur le marché irlandais compris désormais entre 3,45% et 7,15%, l'époque où il fallait accepter le premier taux qui vous était proposé par votre prêteur actuel est révolue », a-t-elle déclaré.

Mme Hennessy a déclaré qu'il y avait désormais 10 prêteurs sur le marché hypothécaire irlandais et qu'il était essentiel que ceux qui recherchent un nouveau prêt hypothécaire ou une offre à taux fixe fassent leurs recherches ou obtiennent des conseils axés sur le marché auprès d'un courtier.

La décision d'Avant Money de réduire les taux hypothécaires intervient après que le groupe AIB ait réduit les taux hypothécaires « verts » pour les maisons ayant un classement énergétique des bâtiments (BER) de B3 ou mieux.

Plus tôt cette semaine, AIB, EBS et Haven ont également augmenté l'incitation en espèces pour les expéditeurs de fonds de 2 000 € à 3 000 €.

La Bank of Ireland a proposé une gamme de réductions sur ses taux fixes à ceux qui disposent d'un BER de tout type, pas seulement B3 ou mieux. Il a également introduit un nouveau taux variable fixe au lieu d'une gamme de taux variables.

Le PSTB a réduit certains de ses forfaits.

Les mesures visant à réduire les taux d'intérêt hypothécaires précèdent une baisse des taux attendue par la Banque centrale européenne en juin.

Il y aura un ajustement « technique » des taux d'intérêt en septembre pour les détenteurs de trackers, qui verra le taux de refinancement de la BCE réduit de 0,35 point de pourcentage.

La guerre des taux d’intérêt est une excellente nouvelle pour les 70 000 et 80 000 détenteurs de prêts hypothécaires qui ont complété leur période à taux fixe cette année.

Beaucoup sont bloqués avec des taux aussi bas que 2%, mais sont désormais confrontés à un marché où les taux fixes typiques sont au moins le double.

La récente baisse du prix d'Avant Money et la décision du groupe AIB d'augmenter ses incitations pour les expéditeurs de fonds sont le signe que le marché des envois de fonds est sur le point de se réchauffer.

En mai de l’année dernière, Avant Money a réduit les taux qu’il facture à ceux qui choisissent de les fixer pour la durée de leur prêt.

Avant Money a également augmenté certains taux d'intérêt fixes à court terme, mais a réduit les taux hypothécaires à long terme dans le but d'inciter davantage de personnes à changer.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

-

entertainment2 ans ago

Découvrez les tendances homme de l’été 2022

-

Top News2 ans ago

Festival international du film de Melbourne 2022

-

Tech1 an ago

Voici comment Microsoft espère injecter ChatGPT dans toutes vos applications et bots via Azure • The Register

-

science2 ans ago

Les météorites qui composent la Terre se sont peut-être formées dans le système solaire externe

-

science3 ans ago

Écoutez le « son » d’un vaisseau spatial survolant Vénus

-

Tech2 ans ago

F-Zero X arrive sur Nintendo Switch Online avec le multijoueur en ligne • Eurogamer.net

-

entertainment1 an ago

Seven révèle son premier aperçu du 1% Club

-

entertainment1 an ago

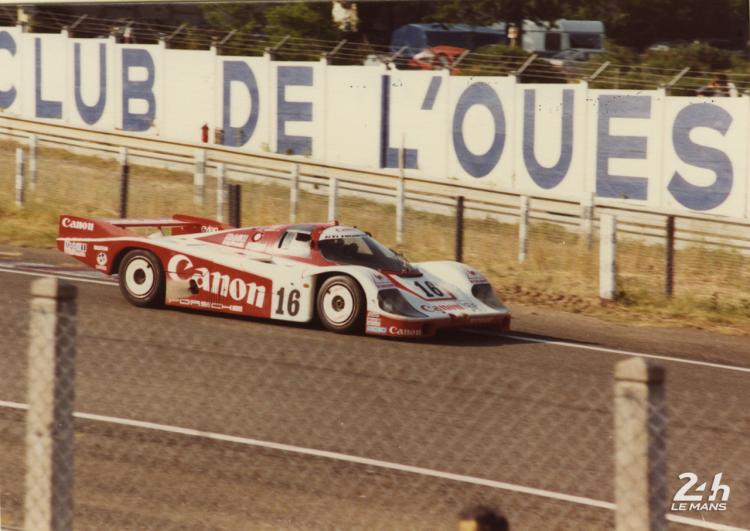

Centenaire des 24 Heures – La musique live fournit une bande-son pour la course