Economy

Home prices are seven times higher as supply dwindles

Wanted property prices rose nearly 10% in 2021, according to an analysis by real estate listing website, myhome.ie.

Asked price inflation came in at 7.4% in the capital, but at 10.6% elsewhere in the country.

Quarterly prices also rose 1.3% nationally in the last three months of the year, with price inflation in Dublin at 1.7%.

It was at 1.1% outside the capital.

The report showed that the adjusted asking price of the property at the national level was 311,000 euros at the end of 2021.

In Dublin, its price reached 421 thousand euros, while in other parts of the country it reached 263 thousand euros.

« The unwelcome message from this quarter’s MyHome report is that there is little sign of conditions easing, » said Kunal McCwell, Davey’s chief economist and author of the myhome.ie report.

He added: « This reflects a tightening of the market, as the stock of homes for sale has fallen to a new record low of just 11,300. In addition, the Irish labor market is doing very well, which is increasing demand for housing. »

He explained that the shortage of inventory for sale or rent is most acute outside the capital, which is also evidenced by a marked decrease in the average agreed-upon selling time of just three months nationwide.

McQuayle said price inflation forecasts for 2021 and 2022 are now likely to be beaten.

“We expected an 11% rise in the Residential Price Index (RPII) through 2021 and 4.5% in 2022. However, the Residential Price Index (RPII) inflation rate rose by 13.5% in October, so overall output is now likely to outpace The past is on our expectations. A prediction of the climate. »

The report comes as the central bank continues to review its lending rules, which are set to expire next month.

Analysis by myhome.ie shows that home prices are now seven times the median income.

“Even so, the Central Bank of Ireland and the Economic and Social Research Institute (ESRI) estimate that mortgage lending rules have stopped home prices from rising an additional 10-25% above current levels,” said Conal McCoyll.

According to estimates, housing completions are expected to reach 22,000 when the 2021 figures are published.

A central bank report published before the onset of the Covid pandemic indicated that about 34,000 homes would have to be built each year over the next decade just to meet demand.

“It is promising to see construction activity increase for seven consecutive months through November, but the stark reality is that we will unfortunately be living with a dysfunctional real estate market for some time,” Angela Keegan, Managing Director of MyHome. ie said.

« We’ve never seen such a shortage of inventory on MyHome.ie, and given the surge in savings among potential homebuyers, it’s doubtful we’ll see a significant drop in demand during 2022, » she added.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Google investit 75 millions de dollars pour apprendre à 1 million d'Américains à utiliser l'intelligence artificielle

Google a annoncé vendredi le lancement d'une formation visant à apprendre à un million d'Américains à utiliser les outils d'intelligence artificielle.

Dans le cadre de ce déploiement, le géant de la technologie a également annoncé que sa branche philanthropique, Google.org, avait engagé 75 millions de dollars en subventions pour la formation aux compétences en IA des habitants des zones rurales et mal desservies.

Le nouveau cours de compétences en IA sera disponible au prix de 49 $ sur Coursera, un fournisseur de cours en ligne à but lucratif.

Cette annonce intervient après que Google a abandonné ses règles obligeant les fournisseurs et les sociétés de recrutement avec lesquelles il travaille à offrir de bons salaires et avantages sociaux à leurs employés, tout en licenciant des milliers d'employés. employés Malgré des bénéfices records.

Selon la liste des cours, il apprendra aux utilisateurs comment « utiliser des outils d’IA générative pour aider à développer des idées et du contenu, à prendre des décisions plus éclairées et à accélérer les tâches de travail quotidiennes », et ce, de manière responsable.

Le cours promet également que les apprenants « développeront des stratégies pour rester à jour dans le paysage émergent de l’IA ».

Concernant les 75 millions de dollars de subventions de l’AI Opportunity Fund, ces subventions seront versées aux « meilleures organisations de développement de la main-d’œuvre et d’éducation », selon un porte-parole de Google.

Des organisations comme Goodwill Industries International recevront une partie des fonds de formation « pour permettre aux Américains d’exploiter la technologie de l’IA pour améliorer leur productivité et les préparer aux emplois de demain ».

Les programmes d'aide à la carrière de Goodwill ont été salués dans le passé pour avoir aidé les travailleurs à obtenir des postes permanents avec des salaires et des avantages sociaux décents.

Mais l’organisation continue de payer aux employés handicapés un salaire inférieur au salaire minimum sous couvert de formation professionnelle – un programme autorisé par le ministère américain du Travail.

Certains employés handicapés qui travaillent dans le cadre de cette exonération gagnent moins de 1 $ de l'heure.

Il y a à peine une semaine, Google l'annonçait Annuler ses règles Ce qui obligeait ses partenaires commerciaux à fournir à leurs travailleurs un salaire décent.

De 2019 jusqu'à la semaine dernière, Google a exigé que les entreprises avec lesquelles il avait des contrats paient ses employés au moins 15 dollars de l'heure et leur fournissent une assurance maladie et des avantages sociaux.

Mais parce que Google exerçait un certain degré de contrôle sur ces travailleurs, le National Labor Relations Board (NLRB) des États-Unis a déclaré que cela faisait de Google un « employeur conjoint » d’entre eux.

Par conséquent, l’entreprise technologique serait tenue de négocier avec ses syndicats – ce à quoi l’entreprise est connue pour résister à le faire.

Google a refusé de négocier avec des travailleurs syndiqués plus proches de chez lui, y compris YouTube, dont il est propriétaire.

Lorsque les sous-traitants de YouTube ont rejoint à l’unanimité le syndicat Alphabet et ont insisté pour négocier avec Google sur les conditions de travail l’année dernière, le géant de la technologie a refusé.

Ce refus constituait une violation de la loi décidée par le NLRB en janvier de la même année.

Ce ne sont pas non plus des incidents isolés. Google a été accusé d'avoir licencié illégalement des travailleurs à des fins de syndicalisation, d'avoir interféré avec des activités protégées et, de manière générale, d'avoir adopté un comportement illégal pour opprimer ses travailleurs et les empêcher d'exercer leur droit de s'organiser pour de meilleures conditions de travail, selon le British Daily Mail. Institut de politique économique.

Les nouveaux programmes caritatifs annoncés aujourd'hui par Google font également suite à des licenciements très médiatisés.

Google a annoncé avoir réalisé un bénéfice de 20,7 milliards de dollars au quatrième trimestre 2023, soit une augmentation de 52 % par rapport à l'année précédente, mais ses effectifs ont diminué de 4 %.

Kenneth Smith, directeur de l'ingénierie chez Google, a déclaré que la direction l'avait informé par courrier électronique de la suppression de son poste et avait déposé une plainte sur LinkedIn. mail Que l’entreprise n’a pas « reconnu leur humanité ».

« J'ai ressenti beaucoup de colère et de frustration à l'égard des dirigeants de Google à cause de la façon dont ils ont géré le licenciement de douze mille personnes en janvier dernier, et je ne vois pas beaucoup de preuves qu'ils ont appris grand-chose », a-t-il écrit. De cette expérience.

Cette décision est intervenue peu de temps après que Google ait lancé son grand modèle linguistique (LLM) appelé Goose, et après avoir annoncé un investissement majeur dans la startup d'IA.

Le nouveau cours d'IA est adapté à votre rythme et comprend 10 heures de matériel réparties sur cinq modules.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

Une guerre des taux hypothécaires éclate lorsqu’un autre prêteur réduit ses taux d’intérêt

Avant Money réduit tous les taux d'intérêt de ses prêts, tandis que la société mère Bankinter est sur le point de mettre en place une opération bancaire complète en Irlande.

La banque espagnole possède le prêteur hypothécaire Avant Money, basé à Leitrim, qui a fait ses preuves au cours des six dernières années de sa détention.

Avant Money, basé à Leitrim, réduit les taux hypothécaires jusqu'à 0,45 point de pourcentage.

Ils proposent également une offre de remise en argent de 1 % sur l'hypothèque retirée pendant une période limitée pour attirer les convertisseurs.

L'incitation s'élèvera à 4 000 € sur un prêt hypothécaire de 400 000 €.

L'actualité du jour en 90 secondes – 26 avril

Cette décision verra son meilleur taux tomber à 3,6 % pour une durée fixe de quatre ans pour ceux qui ont un prêt de 80 % ou moins. C'est moins de 3,8%.

Le taux d'intérêt sur quatre ans est de 3,80 % pour les prêts supérieurs à 80 %.

D’autres taux d’intérêt fixes, notamment un taux fixe unique pour les prêts hypothécaires viagers, sont en cours de réduction.

Brian Land, responsable des prêts hypothécaires d'Avant Money, a déclaré : « Nos taux d'intérêt fixes sont aussi bas que 0,45 point de pourcentage, et nos taux simplifiés offrent une meilleure valeur aux clients sur l'ensemble de notre gamme. »

Le taux fixe sur quatre ans d'Avant Money de 3,6 % est le taux non vert le plus bas du marché et est disponible pour tous les niveaux de prêts hypothécaires, a déclaré Martina Hennessy, directrice générale du courtier hypothécaire Doddl.ie.

Elle a déclaré que la nouvelle proposition de taux et de conversion d'Avant Money serait très attrayante pour des milliers de titulaires de prêts hypothécaires qui bénéficieront de taux fixes au cours des 12 prochains mois.

« Avec des taux d'intérêt sur le marché irlandais compris désormais entre 3,45% et 7,15%, l'époque où il fallait accepter le premier taux qui vous était proposé par votre prêteur actuel est révolue », a-t-elle déclaré.

Mme Hennessy a déclaré qu'il y avait désormais 10 prêteurs sur le marché hypothécaire irlandais et qu'il était essentiel que ceux qui recherchent un nouveau prêt hypothécaire ou une offre à taux fixe fassent leurs recherches ou obtiennent des conseils axés sur le marché auprès d'un courtier.

La décision d'Avant Money de réduire les taux hypothécaires intervient après que le groupe AIB ait réduit les taux hypothécaires « verts » pour les maisons ayant un classement énergétique des bâtiments (BER) de B3 ou mieux.

Plus tôt cette semaine, AIB, EBS et Haven ont également augmenté l'incitation en espèces pour les expéditeurs de fonds de 2 000 € à 3 000 €.

La Bank of Ireland a proposé une gamme de réductions sur ses taux fixes à ceux qui disposent d'un BER de tout type, pas seulement B3 ou mieux. Il a également introduit un nouveau taux variable fixe au lieu d'une gamme de taux variables.

Le PSTB a réduit certains de ses forfaits.

Les mesures visant à réduire les taux d'intérêt hypothécaires précèdent une baisse des taux attendue par la Banque centrale européenne en juin.

Il y aura un ajustement « technique » des taux d'intérêt en septembre pour les détenteurs de trackers, qui verra le taux de refinancement de la BCE réduit de 0,35 point de pourcentage.

La guerre des taux d’intérêt est une excellente nouvelle pour les 70 000 et 80 000 détenteurs de prêts hypothécaires qui ont complété leur période à taux fixe cette année.

Beaucoup sont bloqués avec des taux aussi bas que 2%, mais sont désormais confrontés à un marché où les taux fixes typiques sont au moins le double.

La récente baisse du prix d'Avant Money et la décision du groupe AIB d'augmenter ses incitations pour les expéditeurs de fonds sont le signe que le marché des envois de fonds est sur le point de se réchauffer.

En mai de l’année dernière, Avant Money a réduit les taux qu’il facture à ceux qui choisissent de les fixer pour la durée de leur prêt.

Avant Money a également augmenté certains taux d'intérêt fixes à court terme, mais a réduit les taux hypothécaires à long terme dans le but d'inciter davantage de personnes à changer.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

Economy

X d'Elon Musk dévoile une application TV

X d'Elon Musk a dévoilé cette semaine une application pour les téléviseurs intelligents, intégrant la plate-forme de médias sociaux dans l'espace du streaming.

Mardi, X a révélé des fonctionnalités que les utilisateurs d'autres applications vidéo comme YouTube peuvent découvrir.

Ces fonctionnalités incluent des vidéos tendances, une compatibilité multiplateforme avec les smartphones et des suggestions générées par des algorithmes, selon Temps de Washington.

« Du petit écran au grand écran, X change tout », Linda Yaccarino, PDG de X TV ».

« Ce sera votre compagnon incontournable pour une expérience de divertissement immersive et de haute qualité sur un écran plus grand. »

De plus, le tweet de Yaccarino comprenait un aperçu de l'interface utilisateur de l'application, qui comprenait des vignettes d'un certain nombre de vidéos, telles que la conversation de Tucker Carlson avec le président russe Vladimir Poutine et le lancement d'une fusée SpaceX.

L'application X TV est l'un des éléments de la stratégie de plate-forme permettant de contrôler votre activité de vidéo en ligne.

Selon Musk, le contenu vidéo est l'objectif principal de X, et il a fait appel à plusieurs producteurs de contenu populaires pour télécharger leur travail directement sur X.

En plus d'avoir obtenu un contrat exclusif avec Carlson, Musk a pu organiser l'hébergement de Don Lemon et Tulsi Gabbard. L'émission de Lemon a été annulée par le milliardaire de 52 ans après un premier entretien houleux.

« Spécialiste de la télévision sans vergogne. Pionnier des zombies inconditionnels. Résolveur de problèmes d’une humilité exaspérante. »

-

entertainment2 ans ago

Découvrez les tendances homme de l’été 2022

-

Top News2 ans ago

Festival international du film de Melbourne 2022

-

Tech1 an ago

Voici comment Microsoft espère injecter ChatGPT dans toutes vos applications et bots via Azure • The Register

-

science2 ans ago

Les météorites qui composent la Terre se sont peut-être formées dans le système solaire externe

-

science3 ans ago

Écoutez le « son » d’un vaisseau spatial survolant Vénus

-

Tech2 ans ago

F-Zero X arrive sur Nintendo Switch Online avec le multijoueur en ligne • Eurogamer.net

-

entertainment1 an ago

Seven révèle son premier aperçu du 1% Club

-

entertainment1 an ago

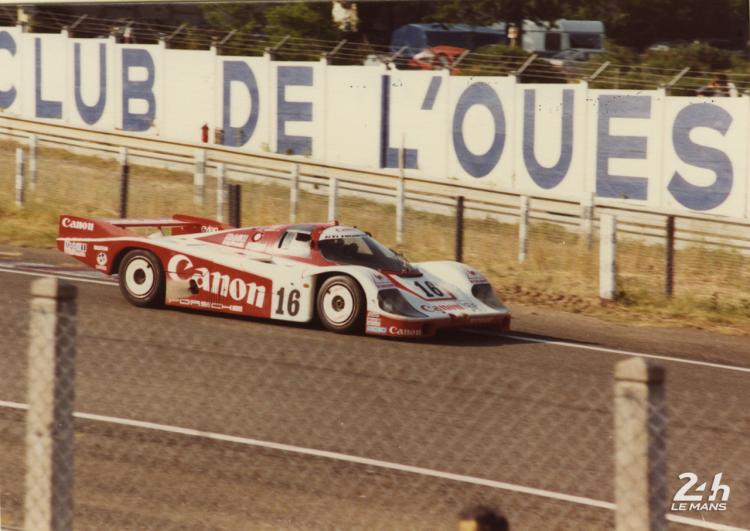

Centenaire des 24 Heures – La musique live fournit une bande-son pour la course